17 2

Gold Loses $2.5 Trillion, Exceeding Bitcoin’s Entire Market Cap

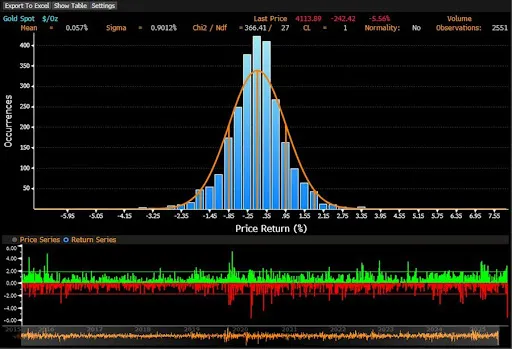

Gold has experienced a significant market capitalization loss of $2.5 trillion, outstripping the entire value of Bitcoin. This shift raises questions about gold's status as a stable investment.

Gold's Impact on Bitcoin's Future Cycle

- A financial analyst, Tom Tucker, noted gold's massive devaluation, suggesting its traditional role as a safe-haven asset is under scrutiny.

- The crypto Fear and Greed Index indicates extreme fear, hinting at potential volatility in digital assets.

- CryptoMichNL observed an 8% drop in gold prices in a single day, coinciding with Bitcoin's temporary surge.

- This gold volatility could lead to capital shifting towards other assets, including cryptocurrencies.

- Upcoming economic indicators like CPI may influence rate cuts and affect Bitcoin's stability.

Bitcoin's Potential Beyond Current Consolidation

- Historically, gold has faced sharp corrections, like the 20% drop following its peak in August 2020.

- During this past volatility, Bitcoin consolidated before reaching new highs fueled by pandemic-era stimulus.

- Currently, Bitcoin remains above $100,000 and might extend further due to parallels with gold's current correction, potential US government shutdown impacts, and AI-driven market changes.