8 0

Gold and Silver Hit New Highs, Bitcoin Declines 30% from October Peak

Gold and silver have reached new highs, while US equities are near record levels. In contrast, Bitcoin has been trading sideways after a significant correction.

- Bitcoin is down 30% from its October peak, marking its worst fourth quarter in seven years.

- The current price of Bitcoin is approximately $87,500, with a 2.4% decline today.

- Bitcoin's market cap has decreased by over $700 billion since October, now around $1.74 trillion.

Analysts suggest the correction lacks clear triggers, such as negative news or macroeconomic shocks. Analyst Bull Theory attributes this to "pure market manipulation."

Upcoming US crypto legislation might offer clearer rules, potentially reducing manipulation and allowing Bitcoin to align more closely with stock performance. Analyst Ash Crypto anticipates Bitcoin could rise above $110,000 once regulatory clarity is established.

Risk Curve Analysis

- Market expert Daniel Kostecki notes that high-risk assets like Bitcoin are often sold off first when liquidity falls, benefiting stocks and metals instead.

- According to CryptoQuant analysts, Bitcoin is still viewed as a high-beta asset, not a safe haven.

- Apparent demand for Bitcoin has turned negative, indicating new buyers are scarce.

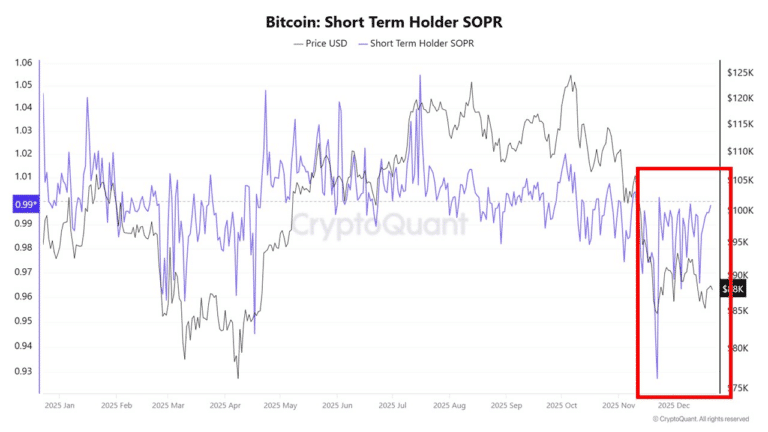

Short-Term Holder SOPR data shows many short-term holders are selling at a loss, which adds pressure on price rebounds.

No Santa Rally?

- QCP Capital highlighted BTC's range-bound state due to thin liquidity before Christmas and year-end institutional deleveraging.

- BTC and ETH perpetual open interest fell by approximately $3 billion and $2 billion, respectively.

- Year-end tax-loss harvesting could introduce short-term volatility for Bitcoin.

- No major Bitcoin price rally is expected before 2026 according to QCP Capital.