BULLISH 📈 : Goldman Sachs Adjusts Bitcoin ETF Holdings as New Security Narratives Emerge

- Institutional investors like Goldman Sachs are managing their spot Bitcoin ETF holdings, indicating a shift toward risk management and market maturation.

- The development of quantum computing poses a long-term threat to blockchain security, with potential 'harvest now, decrypt later' attacks on encrypted data.

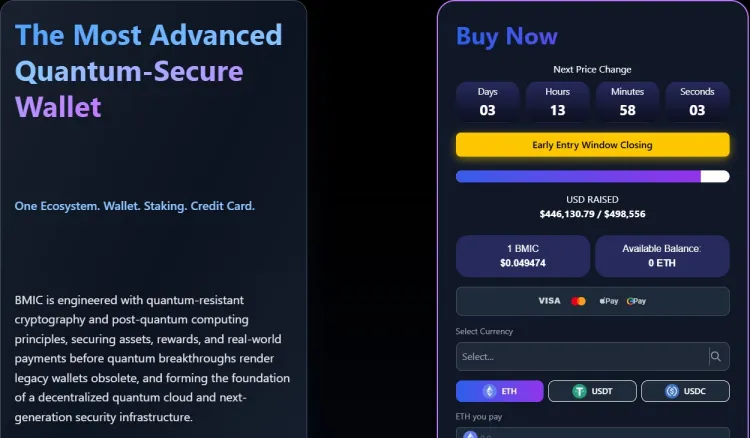

- BMIC is creating a quantum-resistant financial stack using post-quantum cryptography and AI to safeguard digital assets from future threats.

- This transition to quantum-safe cryptography could drive the next cycle of investment in Web3 infrastructure.

Recent SEC filings reveal that major financial institutions such as Goldman Sachs are actively managing their Bitcoin exposure, focusing on sophisticated risk management rather than reducing belief in Bitcoin's value. This marks the beginning of active portfolio management, treating Bitcoin as an asset class similar to equities or bonds.

The primary concern for the future is the threat posed by quantum computing, which could compromise digital security through methods like 'harvest now, decrypt later'. This highlights the need for quantum-resistant solutions.

BMIC ($BMIC) is developing a comprehensive security framework using post-quantum cryptographic standards. The project integrates advanced technologies to prevent public key exposure during transactions, enhancing user asset protection against current and future threats.

The demand for quantum-resistant technology is expected to increase, positioning projects like BMIC at the forefront of future Web3 infrastructure investments. BMIC's presale has already raised $446K, reflecting strong interest and belief in its vision.

While the widespread impact of quantum computing may be years away, early investment in solutions addressing these challenges could yield significant returns over time.