7 1

Grayscale Dismisses Bitcoin 4-Year Cycle, Predicts New Highs in 2026

Despite Bitcoin's price drop to $86,000 and major market liquidations, Grayscale remains optimistic about BTC reaching new all-time highs by 2026. They argue that the four-year cycles are outdated and irrelevant.

Grayscale Dismisses Four-Year Cycle Theory

- Grayscale's report on Dec. 1 suggests that Bitcoin will not follow the traditional four-year cycle.

- The report claims the cycle hasn't shown a parabolic surge typically leading to corrections.

- Institutional capital, mainly through Bitcoin ETFs, is now the main driver of BTC.

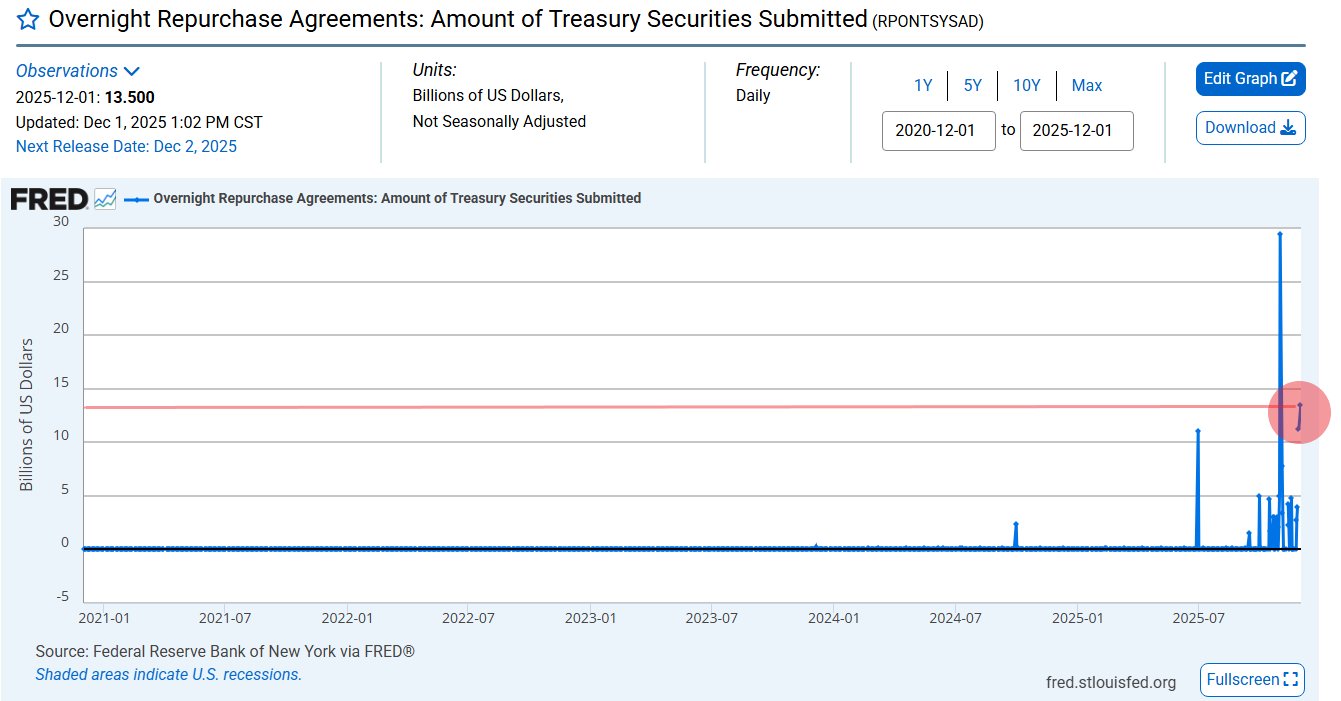

- Supportive macro factors include potential Fed rate cuts and crypto legislation momentum.

- Bitcoin Treasury firms like [Strategy](https://www.coinspeaker.com/saylor-bitcoin-strategy-mstr-1-44b-usd-reserve/) play a significant role.

Tom Lee from BitMine agrees with Grayscale, noting a gap between market fundamentals and asset prices.

Bitcoin's Current Market Situation

- Bitcoin failed to maintain above $90,000, dropping to $86,000.

- Market analyst Ted Pillows states Bitcoin is trading in a neutral zone.

- Pillows notes that BTC needs to reclaim the $88,000 level to regain bullish momentum; otherwise, it risks falling below $80,000.