Grayscale Unveils Top 20 Crypto Assets for Q1 2025

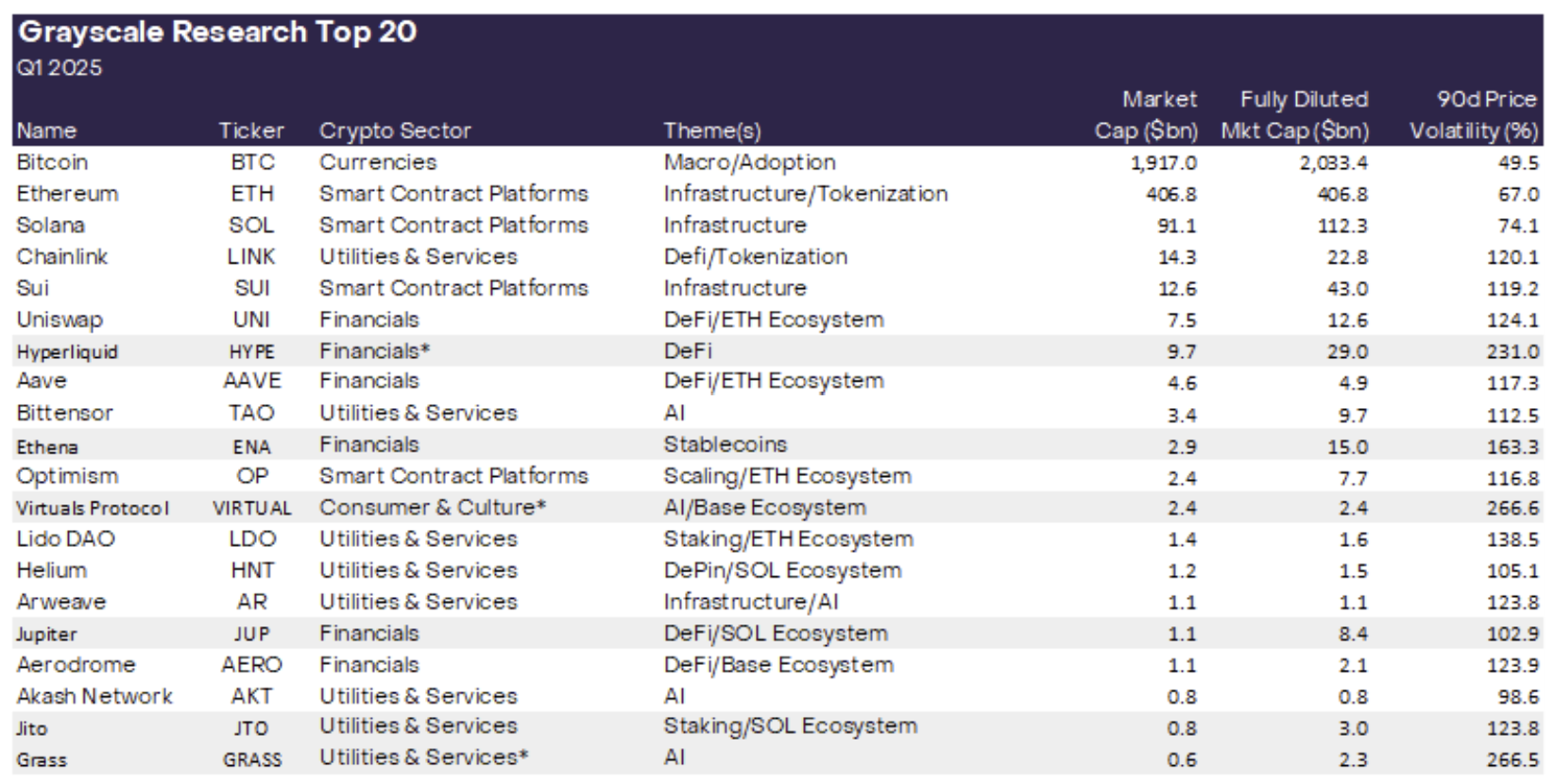

Grayscale Investments has published its quarterly review, detailing its top 20 crypto assets for Q1 2025. The Grayscale Research team evaluates numerous digital assets each quarter to rebalance the FTSE/Grayscale Crypto Sectors family of indexes.

The evaluation considers factors such as network growth, upcoming regulatory implications related to the US election, advancements in decentralized AI, and developments within the Solana ecosystem. Six new altcoins have been added to the list, reflecting alignment with these market themes.

Best (New) Crypto Assets For Q1 2025

Hyperliquid (HYPE): A Layer 1 blockchain focused on on-chain financial applications, Hyperliquid offers a decentralized exchange (DEX) for perpetual futures. It features a fully on-chain order book and has rapidly risen to rank #19 by market cap.

Ethena (ENA): Ethena protocol introduces a stablecoin, USDe, backed by hedged positions in Bitcoin and Ether. The protocol holds long positions in both cryptocurrencies while shorting futures contracts, potentially generating unique yield opportunities through a staked version of the token.

Virtual Protocol (VIRTUAL): Operating on Base, an Ethereum Layer 2 network, Virtual Protocol facilitates the creation of autonomous AI agents that mimic human decision-making. The platform supports co-ownership through tokenization, integrating AI with blockchain.

Jupiter (JUP): As a leading DEX aggregator on Solana, Jupiter has achieved the highest total value locked (TVL) among Solana applications. It is positioned to benefit from increased market activity surrounding memecoins and AI agent tokens.

Jito (JTO): Jito, a liquid staking protocol on Solana, has seen significant adoption and generated over $550 million in fee revenue in 2024, highlighting its strong financial profile.

Grass (GRASS): Grass incentivizes users for sharing unused internet bandwidth via a Chrome extension. The bandwidth is utilized for web scraping, which generates data sold to AI companies, allowing users to earn rewards.

Grayscale maintains interest in previous themes such as Ethereum scaling solutions, tokenization, and decentralized physical infrastructure (DePIN), with projects like Optimism, Chainlink, and Helium continuing to feature in the Top 20 due to their relevance.

Six assets—NEAR, Stacks, Maker, CELO, UMA, and TON—have been removed from the Top 20 this quarter. Grayscale recognizes the ongoing value of these projects within the crypto ecosystem but suggests the revised list may offer better risk-adjusted returns for the upcoming quarter.

At press time, HYPE traded at $29.45.