8 0

GSR Files for Treasury-Company ETF, Boosts Best Wallet Outlook

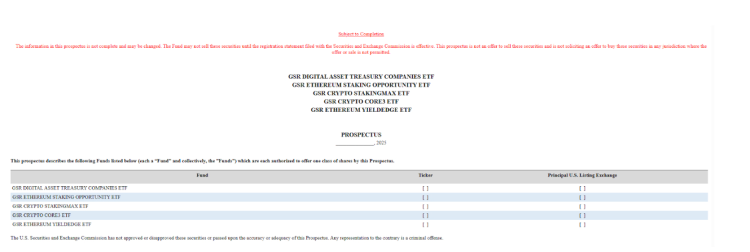

Crypto investing is evolving as companies integrate more equity-backed exposures alongside token-based assets. GSR, a prominent crypto market maker, has filed for an ETF to invest in companies with digital asset holdings in their corporate treasuries.

Key Points

- The proposed ETF will invest at least 80% of its assets in publicly traded companies holding significant digital assets.

- This approach contrasts with traditional methods where companies leverage stock sales to buy crypto and boost stock prices.

- The fund aims to focus on 10 to 15 positions across 5 to 10 issuers, without strict market cap requirements.

- GSR also plans staking-oriented ETFs and a Core3 ETF bundling Bitcoin, Ethereum, and Solana.

- These filings align with the SEC's efforts to expedite crypto ETF approvals, potentially reducing review times.

GSR's ETF could be one of the first to blend equity markets with crypto assets, setting a precedent for hybrid investment options.

The movement by GSR exemplifies the growing trend toward complete integration of crypto within traditional financial systems.