Harris and Trump Expected to Impact Crypto Markets on Election Day

Election Day is tomorrow, and recent polls indicate a tight race between Kamala Harris and Donald Trump. The outcome is expected to influence crypto markets, though the specifics will become clearer in the coming days.

In May, the crypto industry noted significant developments: Trump began accepting crypto donations, while President Biden vetoed a pro-crypto resolution that sought to invalidate the SEC’s SAB 121. Galaxy CEO Mike Novogratz compared opposition to crypto, predominantly from Democrats, to criticizing dogs, referencing the large number of American dog owners.

Trump expressed his support for crypto during a meeting with bitcoin mining executives in June and at the Bitcoin 2024 conference in July, where he promised to fire SEC Chair Gary Gensler and halt government sales of seized bitcoin. The GOP also included a commitment to end the “unlawful” crackdown on crypto in its platform.

Harris has made supportive comments about emerging technologies, including crypto, and pledged to enhance Black men’s rights to invest safely in crypto. However, details remain sparse. Alex Thorn from Galaxy expects her stance to be more favorable than Biden's but less so than Trump's.

Crypto was not addressed in recent debates between Harris and Trump, and there is ambiguity regarding Harris's position on Gensler, which industry participants seek clarity on. Coinbase's Faryar Shirzad acknowledged Harris's engagement with the crypto community but noted Trump’s more extensive remarks.

The latest New York Times poll shows Harris leading Trump 49% to 48%. Meanwhile, Polymarket odds suggest Trump’s lead has decreased recently. Bitcoin traded below $69,000 on Monday, down from over $73,000 last week.

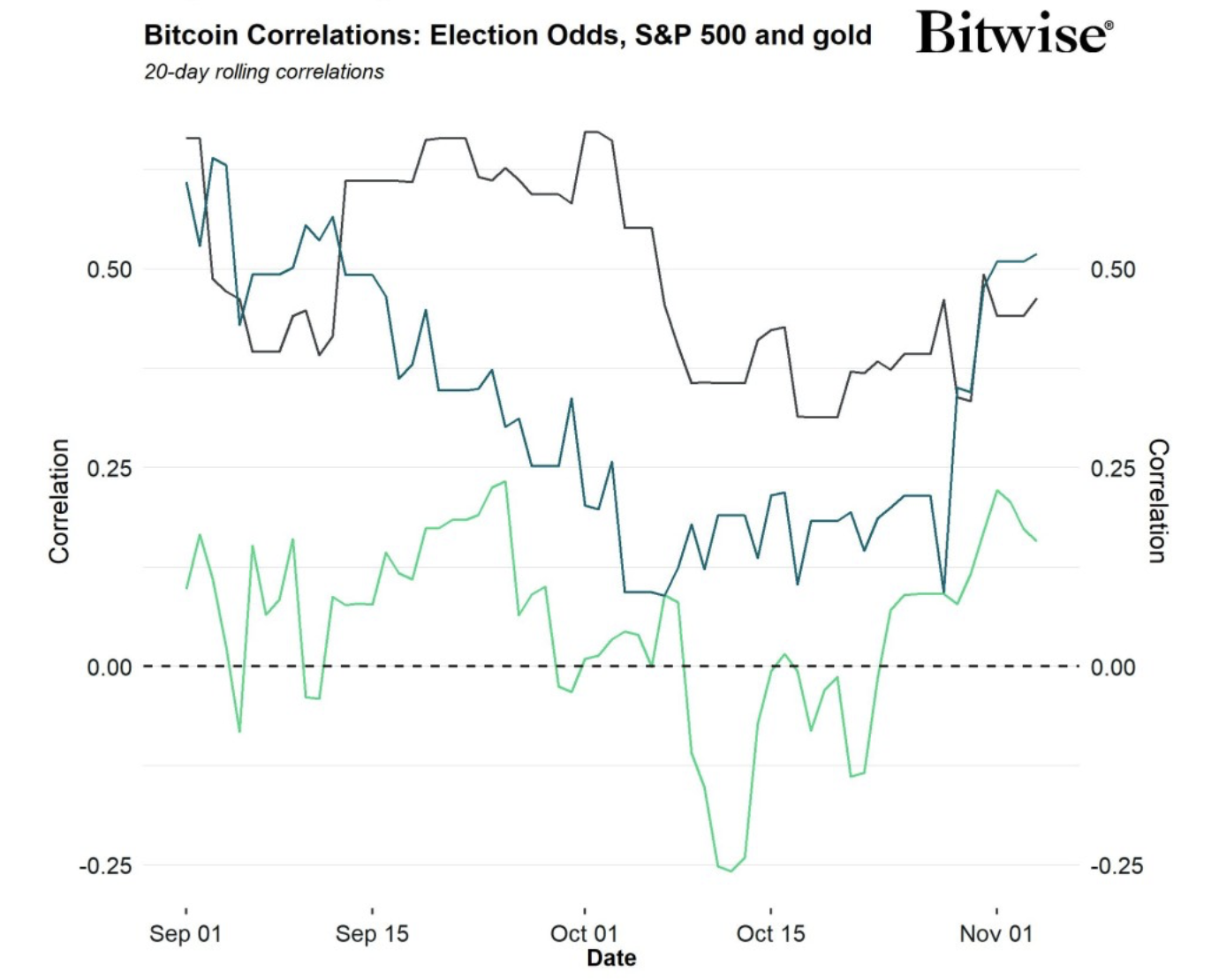

Bitwise's research indicates increased correlation between bitcoin and US presidential election odds, although traditional asset correlations remain higher. They estimate a Trump victory could boost bitcoin by 10.1%, while a Harris win might result in a 9.8% decline.

Swan Bitcoin's John Haar believes the election's impact on crypto markets may be short-lived, asserting that long-term trends supporting bitcoin, such as government deficit spending and ongoing adoption, will prevail. Observers note the discrepancy between political promises and actual actions, suggesting the election results will mark a new chapter rather than conclude the evolving narrative.