14 0

Bitcoin Hash Ribbons Indicate Miner Capitulation Amidst Price Drop

Recent on-chain data indicates that the Bitcoin Hash Ribbons indicator has signaled miner capitulation, suggesting increased stress among miners.

Key Points

- The Hash Ribbons indicator compares the 30-day and 60-day moving averages (MAs) of Bitcoin's Hashrate, reflecting the total computing power connected to the blockchain.

- A crossover where the 30-day MA falls below the 60-day MA suggests miners are rapidly reducing power, signaling possible capitulation.

- This recent crossover implies miners are currently experiencing stress, historically a potential profitable period for Bitcoin investors.

- Mining capitulation doesn't necessarily mark a market bottom but can lead to short-term bearish trends as miners may sell BTC to cover costs.

- Despite potential long-term opportunities, the duration of these phases varies significantly.

- The current miner stress is attributed to Bitcoin's bearish trend, affecting miners' USD revenue, combined with high network difficulty levels.

BTC Price Update

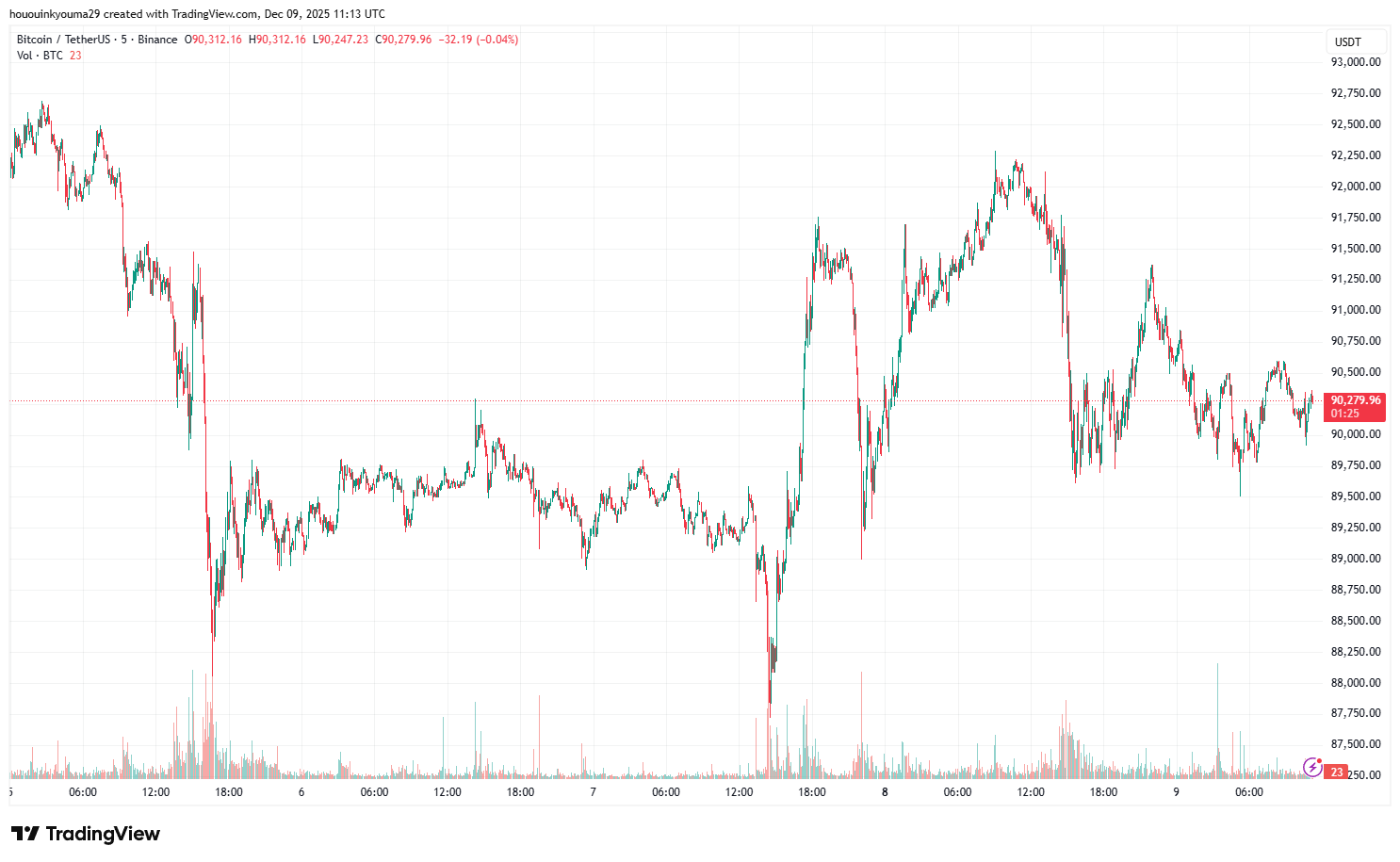

Bitcoin briefly recovered above $92,000 but has since dropped back to $90,300.