17 0

Hedera (HBAR) Drops 1.6% Amid ETF Optimism and Global Partnerships

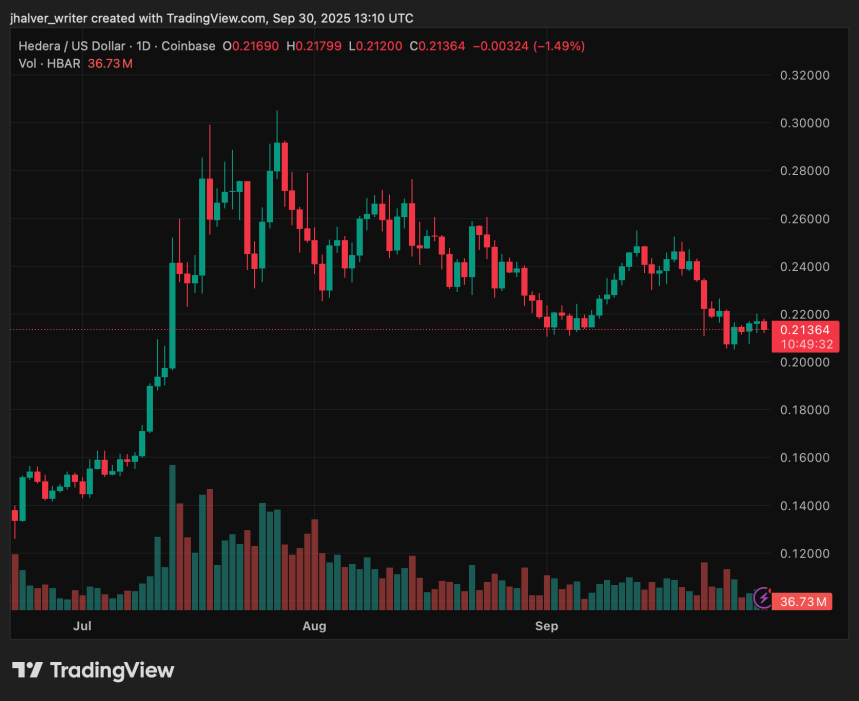

Hedera's HBAR declined by 1.6% to approximately $0.211, yet the outlook for October remains optimistic.

- HBAR gains momentum from ETF optimism and discussions on digital currency interoperability with major financial institutions like SWIFT and Germany’s Bundesbank.

- Wyoming’s Frontier Stablecoin pilot highlights HBAR for low-cost, high-speed settlements.

- The Hedera Governing Council includes major companies such as Google and IBM, emphasizing its enterprise-first approach.

Price Action and Technical Levels

- HBAR is recovering from a two-month low near $0.21, forming a descending wedge pattern.

- Immediate support is between $0.212 and $0.205; breaking below could lead to $0.198.

- Resistance levels are at $0.226–$0.230, with targets at $0.235 and up to $0.285 if buying momentum increases.

Indicators show stabilization: RSI moved from oversold to mid-40s, and Chaikin Money Flow suggests net inflows.

Potential for a death cross exists if the 50-day EMA crosses below the 200-day EMA, with key areas to watch above $0.230 for further gains.