Bitcoin Stock-to-Flow Model Indicates Price Transition Above $100,000

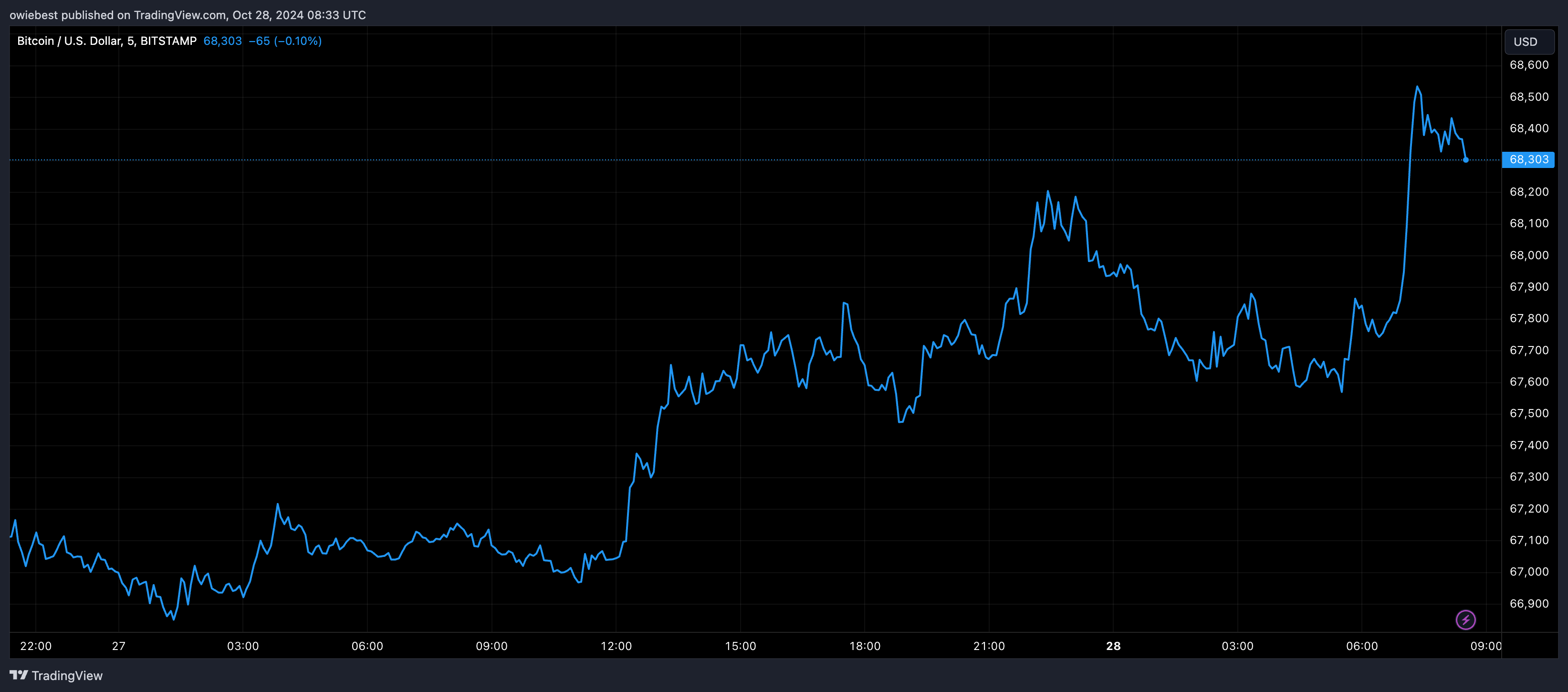

Bitcoin is approaching the $69,000 price level as of October 28, with bullish sentiment aiming for a positive start to the week. A significant breach above this level could initiate a sustained rally.

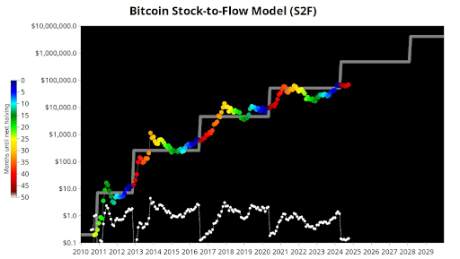

The Bitcoin Stock-to-Flow (S2F) model indicates an upcoming phase transition for Bitcoin, suggesting potential price consolidation above $100,000. Developed for commodities, the S2F model assesses an asset’s supply against new market entries, considering Bitcoin's fixed supply of 21 million and halving events that occur every four years.

BTC Is Ready For Next Phase Transition

The S2F model predicts increased scarcity due to halving events, which historically correlate with price growth. The last halving occurred in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. Historically, halvings have prompted price transitions, with the 2020 halving leading to a rise above $10,000, ultimately reaching approximately $66,000.

With the effects of the April 2024 halving now influencing Bitcoin's supply-demand dynamics, there is optimism for a phase transition exceeding $100,000.

What Does This Mean For Bitcoin Price?

A successful transition above $100,000 would establish this price as a support level, facilitating continued price increases. Historical trends suggest that new peaks typically occur before subsequent halvings, with projections indicating a possible peak near $1,000,000 ahead of the next halving scheduled for 2028.

Currently, Bitcoin is trading at $68,340.