5 0

Bitcoin Weekly SuperTrend Triggers Sell Signal, Raising Bear Market Concerns

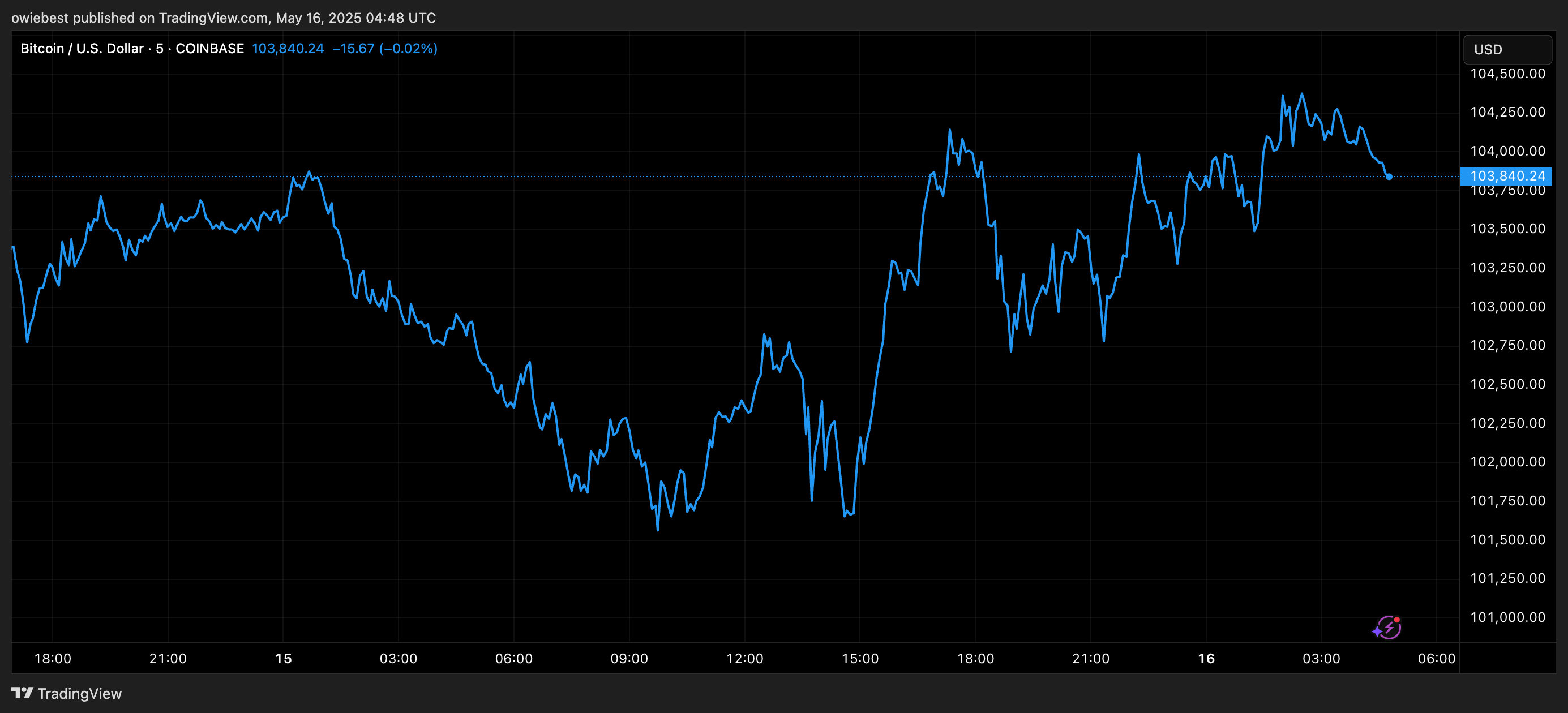

Recent sentiment around Bitcoin has shifted positively, with the price surpassing $100,000. However, a potential sell signal on the weekly chart could indicate an end to this bullish trend.

Sell Signal From 2022 Reappears

- The previous sell-off in 2022 was triggered by the FTX collapse, leading to a over 60% decline in Bitcoin's price.

- A dormant sell signal on the Bitcoin Weekly SuperTrend has returned, activated just below the all-time high of $109,000.

- Analyst Tony Spilotro noted that apparent strength in the BTC/USD pair may be misleading due to a recent weakening of the US dollar.

- The lack of crossover in the BTCEUR pair suggests further caution.

- A new bearish signal could indicate a market top, potentially leading to another prolonged bear market.

- A similar decline could push Bitcoin back below $50,000, adversely affecting the altcoin market.

Bitcoin Needs To Maintain Range Breakout

- Spilotro emphasized that sustaining the current uptrend requires a strong weekly candle closing above the upper Bollinger Band at $108,507.

- With two weeks remaining in May, bulls have time to solidify this breakout; failure to do so may result in a reversal.