8 1

U.S. Trading Volume for Bitcoin, Ether, and Solana Drops Below 45%

The digital asset market has experienced notable shifts in trading activity since April, with Asian trading hours gaining traction while U.S. trading hours decline.

- The U.S. share of global spot volume for bitcoin, ether, and solana fell below 45%, down from over 55% in early 2025.

- Asian trading now represents nearly 30% of global activity, with Europe covering the rest.

- This shift indicates a change in investor dynamics, possibly due to increased non-U.S. portfolio flows.

- Bitcoin rose 40% to $105,000 since early April lows under $75,000.

- Ether and solana increased 87% and 68%, respectively.

Low-volume BTC rally

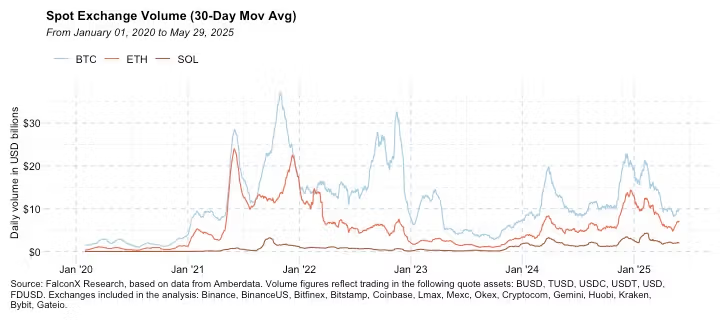

- While bitcoin prices reached new highs, global spot trading volume remains below early 2025 levels, averaging under $10 billion.

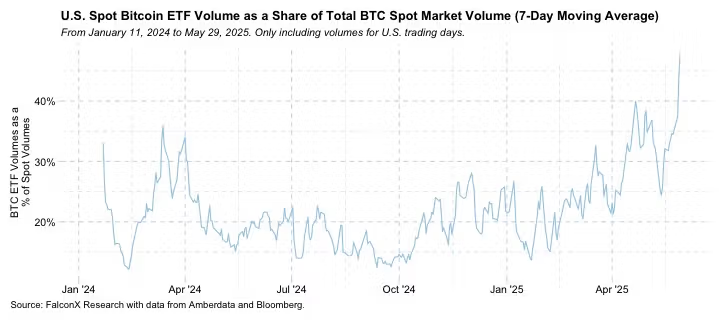

- The rise in ETF popularity may indicate strong institutional demand for BTC.

- U.S.-listed spot bitcoin ETFs captured 45% of global BTC market volume, up from 25% in two months.

- These ETFs have attracted $44 billion in net inflows since January 2024.

- BlackRock's IBIT ETF led with $6.35 billion in May, reflecting growing institutional interest amid economic uncertainties.