1 0

Hong Kong Asset Managers Resist New Crypto Licensing Requirements

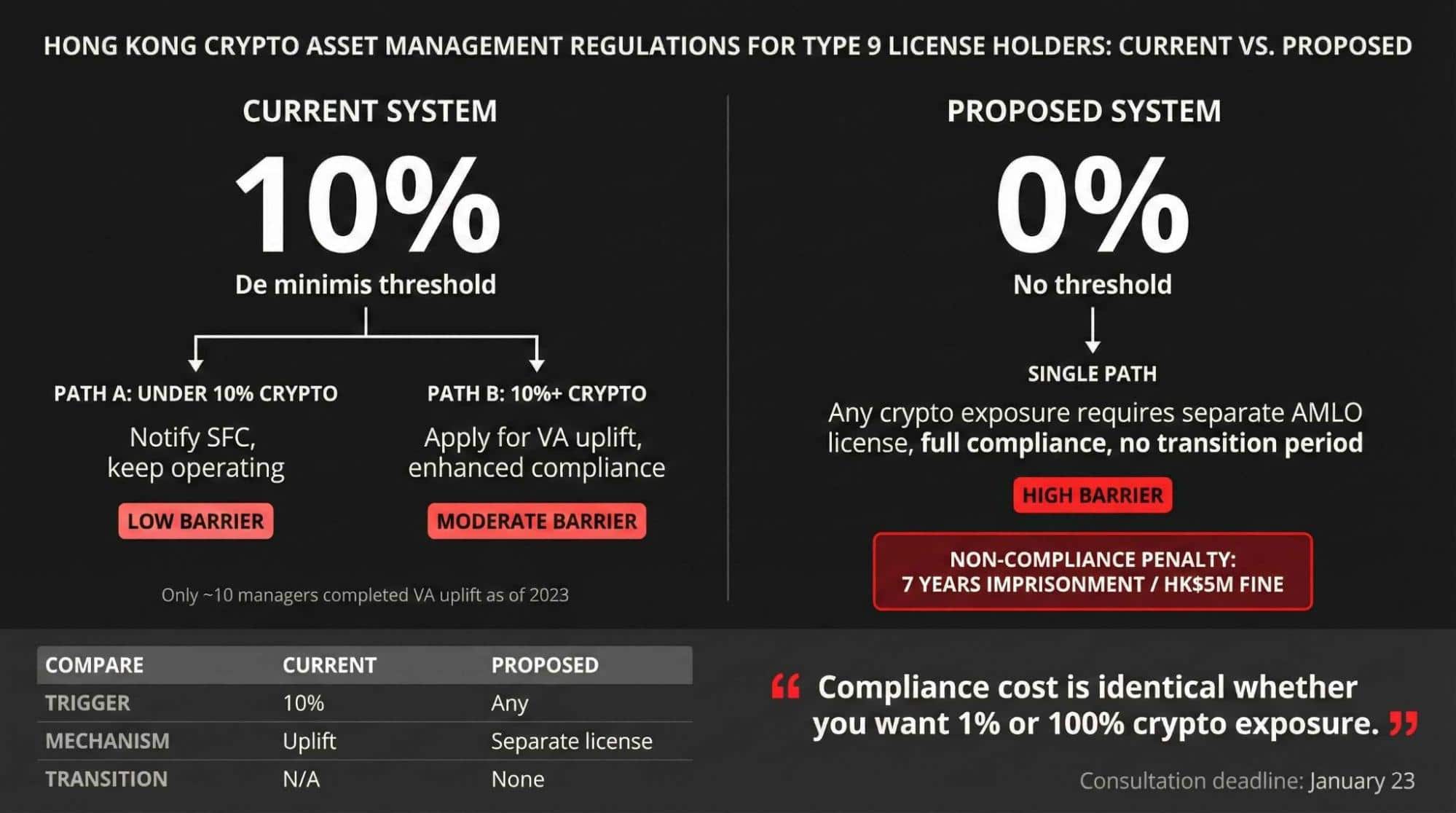

Hong Kong's securities industry is challenging proposed regulatory changes that would require asset managers to obtain full virtual asset licenses even for minimal cryptocurrency exposure.

- The Hong Kong Securities and Futures Professionals Association (HKSFPA) opposes the removal of the existing 10% threshold, which exempts firms from additional licensing if their crypto exposure is below this level.

- Under the new rules, a manager with just 1% allocated to Bitcoin would need a complete virtual asset management license.

- The current framework allows up to 10% crypto investment without extra licensing, requiring only notification to the Securities and Futures Commission (SFC).

- Proposed changes involve a separate licensing regime under the AML and CTF Ordinance, with penalties including imprisonment and fines for non-compliance.

- The SFC defends the removal of the threshold as necessary for consistent investor protection and oversight.

- The HKSFPA argues the custody rules are impractical for funds investing in early-stage tokens.

This proposal is part of Hong Kong's strategy to become a global digital asset hub. The consultation period ends on January 23, aiming for legislative action by 2026. The HKSFPA seeks reinstatement of the threshold exemption and a transitional grace period for current practitioners.