Hot Altcoins Remain Popular as Bitcoin Price Drops Below $93,000

Bitcoin price #BTC has dropped over 5.24% in the last 24 hours, reaching $93,000. Despite this decline, traders are actively discussing "hot altcoins," according to blockchain analytics platform Santiment.

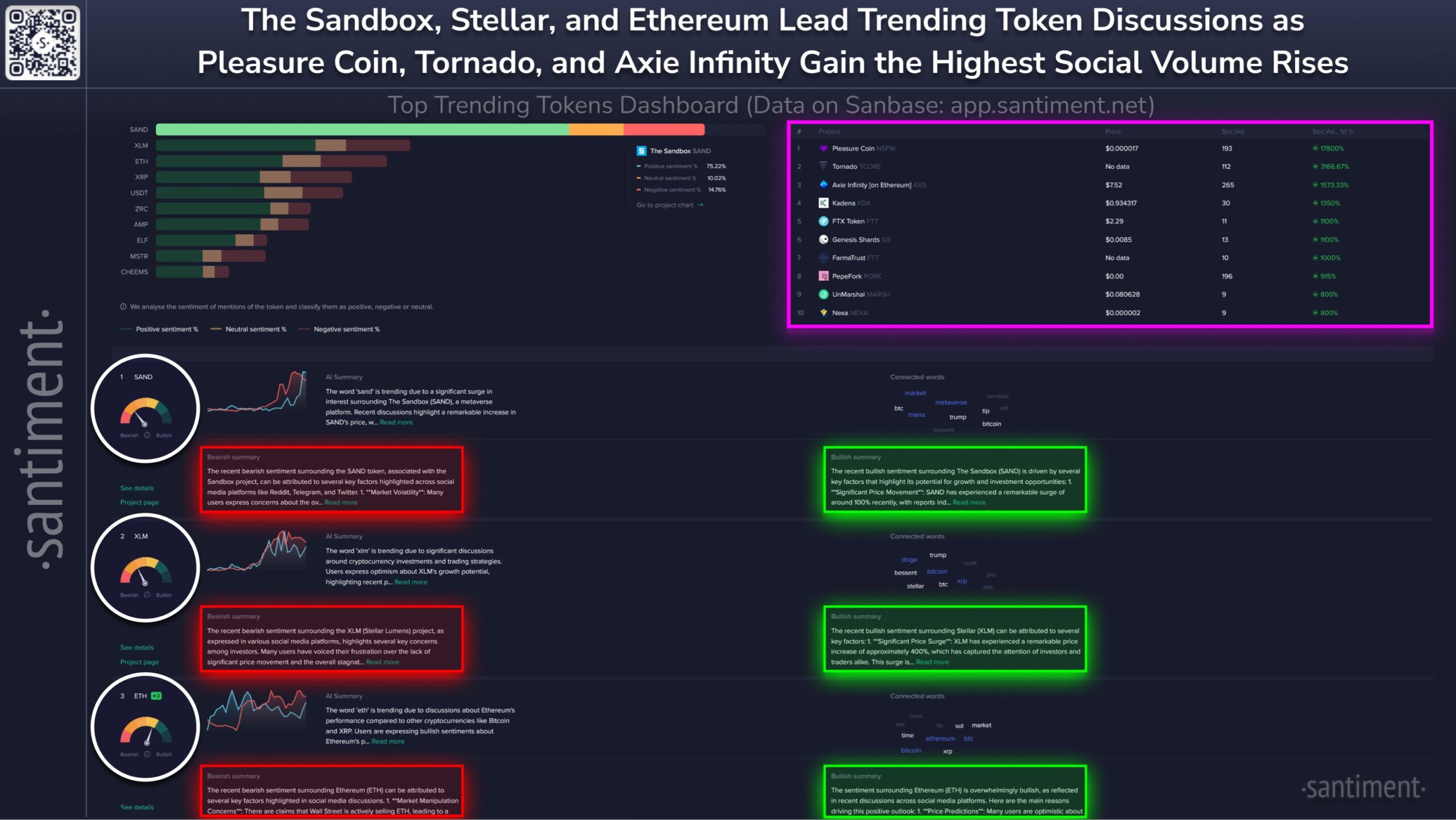

Santiment reported that as BTC fell below $93,000, traders remained focused on metaverse tokens like The Sandbox #SAND, Stellar #XLM, and Ether #ETH. The majority of discussions around these altcoins are bullish, indicating strong interest.

-

Courtesy: Santiment

Renewed interest in metaverse tokens is evident, with The Sandbox (SAND) leading due to growing investor confidence. Speculation about the reasons behind this trend is also noted by Santiment.

Stellar's native crypto XLM has gained attention from Korean investors following a recent political event, which is believed to have influenced its price surge.

Ethereum (ETH) is also among the most discussed altcoins, with users expressing optimism about its potential to outperform other large-cap cryptocurrencies under favorable market conditions.

Altcoins Face the Heat of Bitcoin Price Crash

The cryptocurrency liquidation heatmap from Coinglass shows that altcoins are feeling the impact of Bitcoin's drop below $93,000. In the past 24 hours, $573.51 million was liquidated in the crypto market, including $455.92 million in long liquidations and $115.59 million in short liquidations, with altcoins experiencing the largest wiped-out positions.

Crypto trader Moustache speculated on X that despite the dip, “Altcoins are just warming up,” suggesting that significant movements may be forthcoming. A chart shared indicated that ALT/BTC is retesting its support zone after a recent breakout.

Looks like a deviation would apply to Altcoins/BTC.D.

This month's close + December will be decisive.

I think Altcoins are just warming up here.

The real party starts soon imo. pic.twitter.com/31phuWQu68

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) November 26, 2024

Trader Eugene Ng Ah Sio mentioned on X that they are currently “watching & waiting” due to increased market unpredictability, describing it as one of the most challenging bull market altseasons experienced, noting difficulties in predicting capital flows and market movements.