House Approves Budget Bill with $5 Trillion Debt Capacity and Tax Cuts

The House passed President Trump's budget bill on July 3, which includes:

- Tax cuts

- $5 trillion in new debt capacity

- Reductions to Medicaid and food assistance

This bill pressures the US dollar due to increased federal debt and the Federal Reserve's balance sheet reduction. Historically, such conditions favor non-sovereign assets like Bitcoin, which typically reacts quicker than equities to liquidity changes.

If the Treasury provides liquidity support for bond markets, Bitcoin may attract capital as a hedge against inflation.

Ethereum and Altcoin Perspectives

While Bitcoin may benefit from macroeconomic factors, the altcoin market is mixed:

- Infrastructure tokens like Ethereum could gain institutional interest with a potential risk-on sentiment.

- Speculative meme assets may struggle due to volatility affecting short-term confidence.

- A proposed de minimis tax exemption for small crypto transactions was excluded from the final bill, reducing incentives for US trading volume.

Impact on Bitcoin Miners

The rollback of clean energy subsidies may boost profit margins for Bitcoin miners in states like Texas and Wyoming by providing access to cheaper power, enhancing mining efficiency.

Overall, with fiscal uncertainty and liquidity imbalance, Bitcoin may gain indirectly through a shift towards monetary loosening.

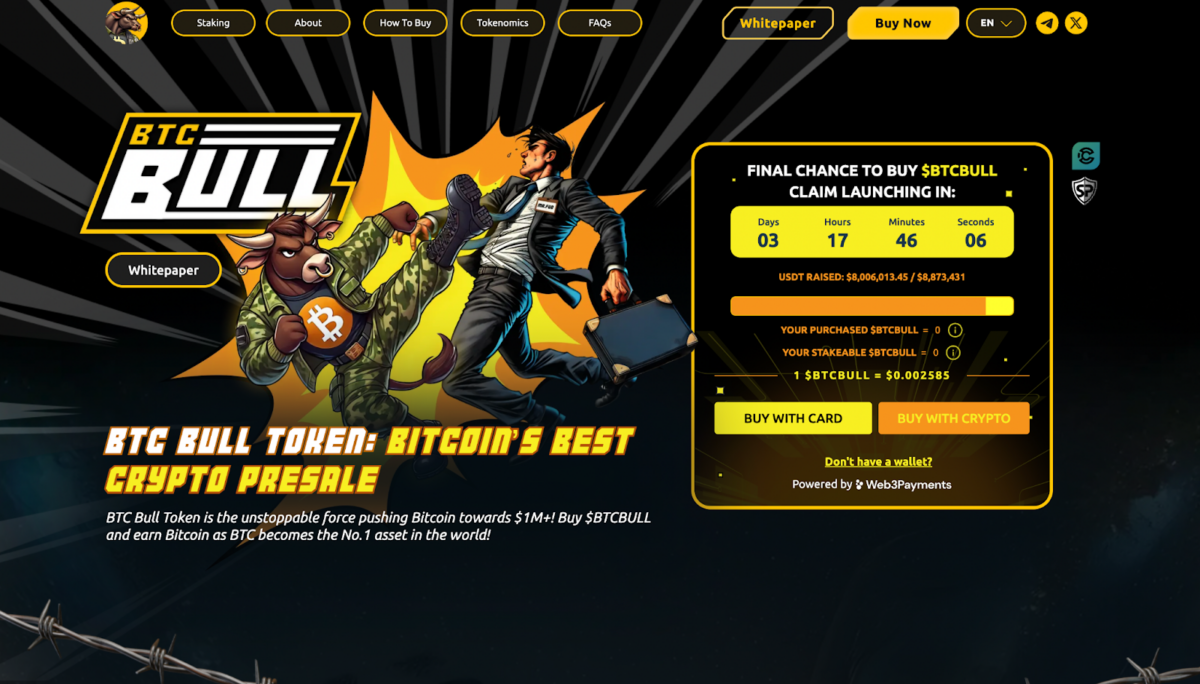

BTC Bull Token Update

BTC Bull Token is nearing the end of its presale phase with over $8 million raised out of an $8.87 million goal, priced at $0.002585.