Hut 8 Bitcoin Holdings Exceed $1 Billion After $100 Million Purchase

Hut 8, a major North American Bitcoin (BTC) mining company, has expanded its BTC holdings with a $100 million acquisition, raising its total reserves to over 10,096 BTC, valued at more than $1 billion at current market prices.

Hut 8 Bitcoin Reserves Exceed $1 Billion

The Miami-based cryptocurrency mining firm has increased its Bitcoin reserves despite recent price surges. Hut 8 announced the purchase of approximately 990 BTC for $100 million, averaging $101,710 per Bitcoin. This acquisition brings Hut 8's total BTC holdings to over $1 billion, with an average purchase cost of $24,485 per Bitcoin. The company's strategy involves combining low-cost BTC production with strategic market purchases to maximize returns and enhance reserve assets.

Hut 8 is now among the top 10 largest corporate Bitcoin holders globally, following MicroStrategy, which holds over 250,000 BTC. CEO Asher Genoot stated that building a strategic Bitcoin reserve will strengthen the company's financial position as it pursues large-scale growth initiatives in power and digital infrastructure. The anticipated benefits of scaling operations may enable Hut 8 to grow its holdings organically at a discount to market prices.

CFO Sean Glennan noted that making BTC a reserve asset is crucial for delivering superior returns to shareholders through strategic treasury management. He indicated the company might utilize its BTC reserve to support business objectives, including upgrading its mining fleet.

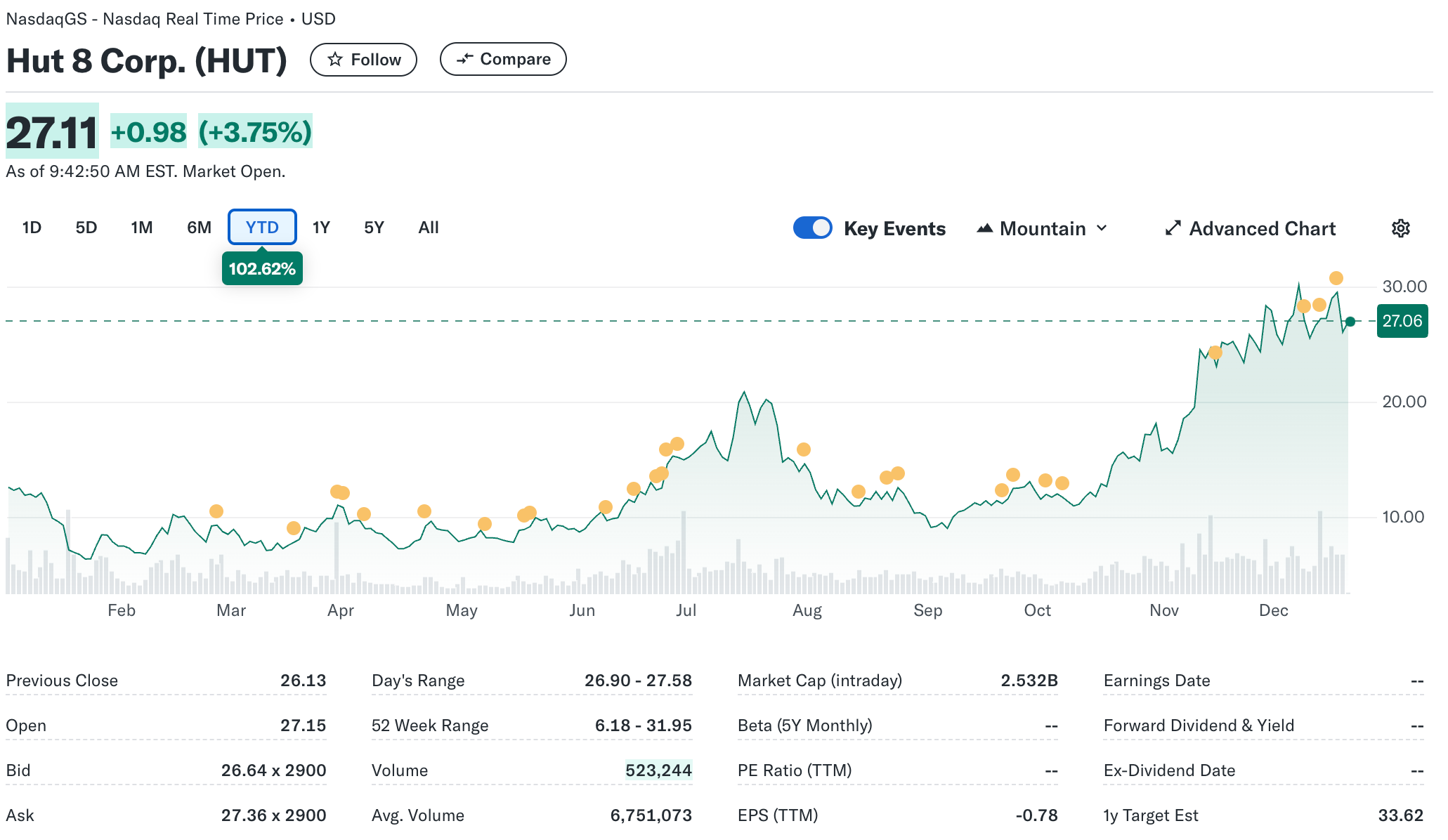

Earlier this month, Hut 8 revealed a $750 million initiative for corporate objectives, debt repayment, and enhancing its Bitcoin reserve. Year-to-date, Hut 8’s stock has risen over 102%, trading at $27.11 at the time of writing.

Mining Firms Among Top 10 Corporate BTC Holders

In addition to well-known corporate holders like MicroStrategy, Tesla, Block, and Coinbase, four Bitcoin mining firms—Marathon Digital Holdings, Hut 8, Riot Blockchain, and CleanSpark—are also among the top corporate Bitcoin holders.

Riot Blockchain reported a significant increase in its BTC holdings last year, currently holding 8,490 BTC. Marathon Digital Holdings recently purchased 703 BTC, increasing its total reserves to 34,794 BTC, aligning with the CEO's comments that institutions are eager to acquire Bitcoin.

CleanSpark CEO Zach Bradford has predicted that BTC could peak around $200,000 within the next 18 months. As of press time, BTC trades at $100,543, down 3.1% in the past 24 hours.