Hyperliquid Launches HYPE Token with 31% Airdrop Supply

Hyperliquid, the largest perpetuals DEX by trading volume, launched its HYPE token today.

HYPE Token Airdrop

The HYPE airdrop is notable for two reasons: 31% (310 million) of the total token supply is being airdropped, significantly higher than the typical range of 5% to 15%. Additionally, Hyperliquid operates without venture backing, meaning no private investor allocations.

The airdrop is regarded as one of the most successful of the year, with HYPE currently holding a market cap of $1.7 billion and a fully diluted valuation (FDV) of $5.1 billion. For comparison, dYdX has a valuation of $1.1 billion.

Source: Hyperliquid Discord

Platform Features

Hyperliquid has established itself as the leading perps DEX of 2024 due to seamless onboarding, gas-free trading, a user-friendly interface, and rapid token listings. Originally a perps application on Arbitrum, it expanded to include a spot orderbook exchange and migrated onto a proof-of-stake layer-1 in March 2024.

The Hyperliquid L1 chain utilizes the HyperBFT consensus protocol, claiming to support around 100K TPS. Its fully onchain orderbook has earned it the nickname “onchain Binance.” In contrast, others like Aevo employ offchain or hybrid models.

HYPE is expected to facilitate L1 staking and governance, reinforcing its utility token status.

Financial Ecosystem Development

Hyperliquid aims to leverage its DEX liquidity to establish a comprehensive financial ecosystem centered around its perps product. The L1 features a parallelized EVM secured by the same consensus protocol, allowing applications to interact with liquidity pools from both perps and spot order books (currently in testnet).

To enable developers to utilize its over $2 billion in DEX liquidity, Hyperliquid introduced “builder codes,” an onchain identifier that allows liquidity lending via fee-sharing agreements.

Additionally, Hyperliquid launched its Hyperliquid Liquidity Provider (HLP) vaults, enabling users to engage in market making by depositing USDC to earn trading fees. As of November 2024, these vaults have achieved a net annualized return of 25%.

Market Position

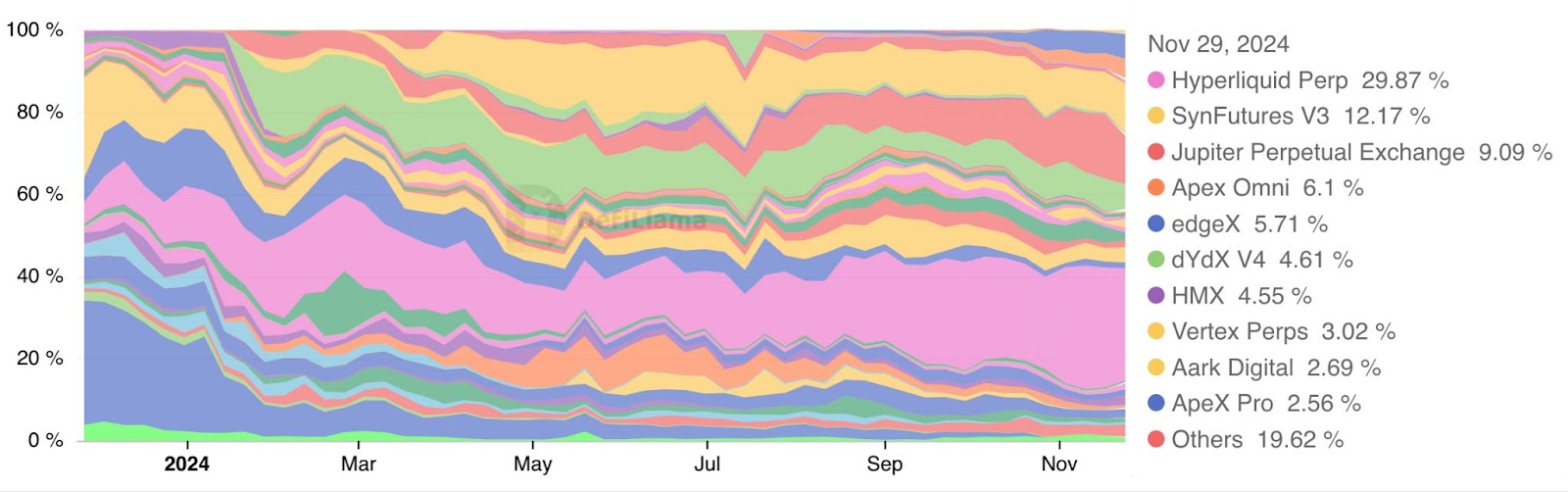

While numerous perps DEXs have emerged and faded, since dYdX's rise in 2022, Hyperliquid now commands the largest market share at under 30%. Other competitors include SynFutures V3 and Jupiter Perpetual Exchange, holding 12.17% and 9.09% respectively. Smaller players like Apex Omni and edgeX maintain shares of 6.1% and 5.71% respectively.

Some volume fluctuations can be attributed to incentives aimed at airdrop hunters. The decline in dominance of earlier players like dYdX (now at 4.61%) indicates rising competition, with new entrants like Vertex Perps capturing significant shares while "Others" consistently hold between 20-30%, reflecting ongoing fragmentation.

Despite intense competition within DeFi's crypto derivatives sector, centralized exchanges like Binance dominate, accounting for approximately 95-97% of trading volumes.