Hyperliquid (HYPE) Shows Strong Whale Accumulation Amid Price Pullback

The crypto market valuation stands at $3.4 trillion, with the Fear and Greed Index indicating a neutral sentiment of 57, as bullish recovery prospects arise for January 2025. Hyperliquid #HYPE is currently struggling to maintain critical levels.

Hyperliquid Price Analysis

The 4-hour chart shows HYPE forming a falling channel pattern, following a 104% price surge in December. The current pullback phase tests a crucial demand zone between $21.84 and $22.78, indicating a potential breakdown of the falling channel, evidenced by a 6.64% drop on the 4-hour candle.

Photo: TradingView

This situation increases the likelihood of a bearish crossover between the 50 and 100 EMA lines. Despite this, the 4-hour RSI indicates bullish divergence at lower levels, suggesting a possible bullish comeback as the broader market stabilizes.

A bullish recovery could target the overhead resistance trendline near the 23.60% Fibonacci level, aiming for $26.29. Additional bullish targets include $29.49 and $34.48. Long-term projections based on Fibonacci levels foresee targets of $40 and $51.30. Conversely, a breakdown below $21.00 may test the $18.52 support zone.

Whale Activity Amid Short-term Pullback

Despite the bearish short-term outlook, whale confidence in Hyperliquid remains robust. Recently, Hyperliquid briefly regained its position as the 20th largest token by market cap but has since fallen below PEPE again.

During this brief spike, multiple whales accumulated HYPE tokens. Whale 0x007 spent 3.96 million USDC to acquire 151,277 HYPE tokens at an average price of $26.19.

Whales are accumulating $HYPE as #Hyperliquid reclaims its spot as the 20th-largest token by market cap from $PEPE today!

1/ Whale “0x007” bridged and spent 3.96M $USDC to buy 151,277 $HYPE at ~$26.19, 9 hours ago.

2/ Whale “0x721” spent 2.6M $USDC to buy 99,546 $HYPE at… pic.twitter.com/tFgjF823LY

— Spot On Chain (@spotonchain) January 2, 2025

Additionally, whale 0x721 spent 2.6 million USDC to purchase 99,546 HYPE tokens at an average price of $26.14, increasing their total holdings to 107,198 HYPE tokens worth $2.76 million, yielding a $3.32 million profit on Hyperliquid. Whale 0x602 spent $911K to buy 37,017 HYPE tokens at an average price of $24.60.

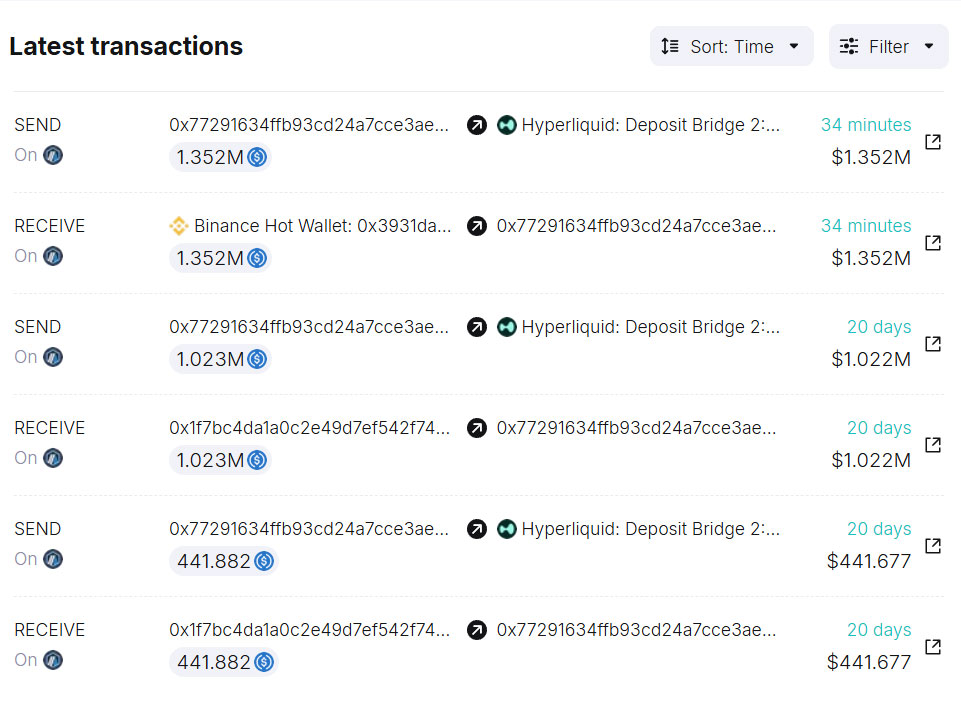

Wallet 0x772 transferred 1.352 million USDC from Binance to acquire HYPE tokens, placing orders near $22, indicating rising interest from high-net-worth individuals.

Hyperliquid Metrics Indicate Strong Fundamentals

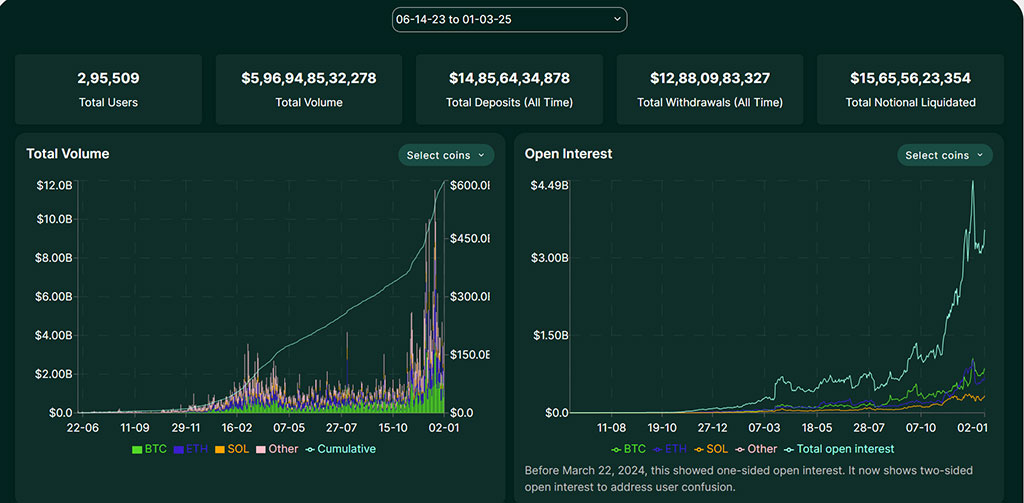

Despite the recent pullback, Hyperliquid's exchange metrics show positive trends. The user count approaches 300,000, while total volume nears $600 billion.

Total deposits approach $150 billion, with derivative open interest at $3.54 billion, indicating a V-shaped reversal. The combination of strong whale accumulation, rising user base, and impressive exchange metrics suggests a favorable long-term outlook for HYPE, highlighting potential price targets of $29.49, $34.48, and beyond in 2025.