Investors Can Determine Ideal Bitcoin Allocation by Answering Three Questions

Multi-asset investors can assess bitcoin's suitability for their portfolios by addressing three questions related to return expectations and target portfolio volatility.

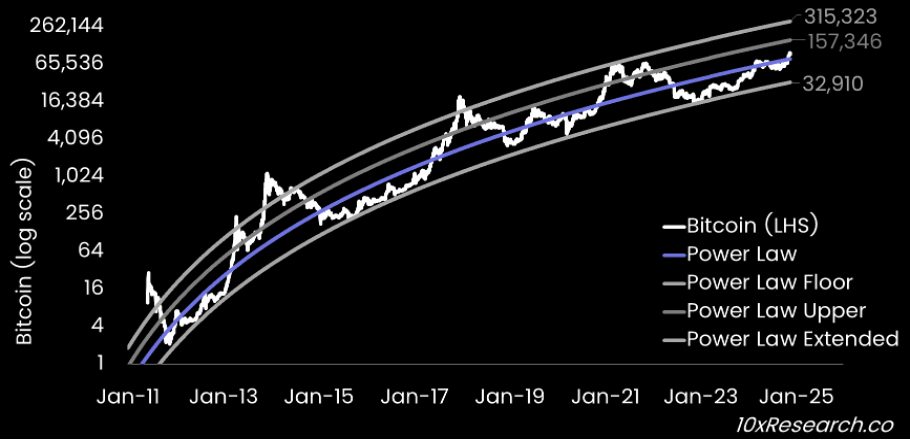

Bitcoin's Price Drivers

Bitcoin's price is mainly influenced by demand rather than mining supply. Its five bull markets have been fueled by innovations in access methods, including spot exchanges, futures, uncollateralized borrowing, spot bitcoin ETFs, and options on these ETFs. This evolution indicates bitcoin's increasing integration into traditional financial markets, supported by U.S. regulatory approvals from agencies like the CFTC and SEC, which have legitimized bitcoin-based financial products.

Scaling Debate Resolution

The decision in 2017 to maintain Bitcoin's 1-megabyte (MB) block size resolved a long-standing scaling debate within the community. The limit was designed to manage congestion while preserving decentralization, reinforcing bitcoin's identity as "digital gold."

Market Potential

This framework aids traditional finance investors in understanding bitcoin's role as digital gold, a risk mitigation tool, or an inflation hedge. Bitcoin may not disrupt the jewelry market valued at $8 trillion but could capture parts of the $10 trillion addressable market, which includes private investments ($4 trillion), central bank reserves ($3.1 trillion), and industrial use ($2.7 trillion). With a current market cap of $2 trillion, this suggests potential growth up to 5x as it establishes itself as digital gold.

Network Effects vs. Gold

Bitcoin's technological nature fosters strong network effects absent in gold. Network technologies often follow an "S-curve" adoption model, with mass adoption accelerating beyond a critical 8% threshold.

Current Market Share

With a market capitalization of $2 trillion, bitcoin constitutes 0.58% of the nearly $400 trillion global financial asset portfolio, a share expected to grow as institutional investors incorporate bitcoin into their strategies.

Strategic Integration into Portfolios

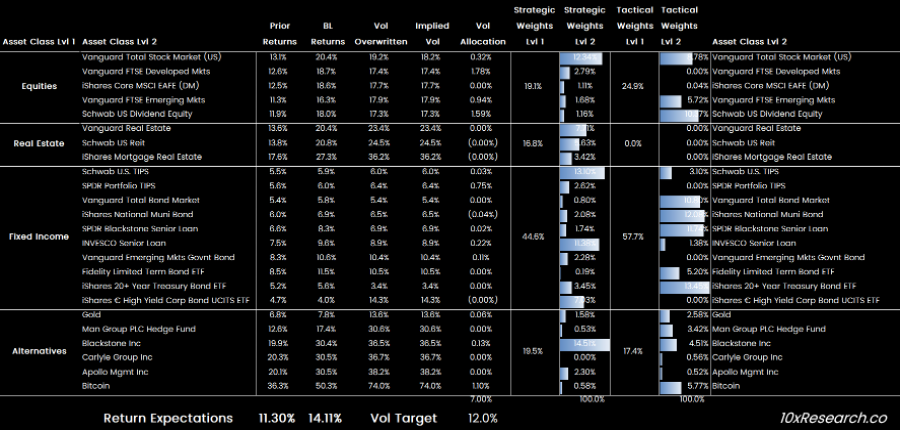

To effectively integrate bitcoin into a Markowitz-optimized portfolio, investors should consider:

- Expected performance of bitcoin relative to equities

- Performance of equities relative to bonds

- Target portfolio overall volatility

These factors inform allocation decisions within multi-asset portfolios.

Example Allocation Adjustments

If bitcoin is projected to outperform U.S. stocks by +30% in 2025, U.S. stocks outperform U.S. bonds by +15%, and the portfolio targets a 12% volatility level, several adjustments follow: equities rise from 19.1% to 24.9%, real estate decreases from 16.8% to 0%, fixed income increases from 44.6% to 57.7%, and alternatives decrease from 19.5% to 17.4%. Specifically, bitcoin's allocation rises from 0.58% to 5.77% based on its current market share.

This adjustment elevates the portfolio's expected return from 11.3% to 14.1%, utilizing a volatility-targeted Black-Litterman-optimized framework that enhances asset allocation according to investor risk tolerance and market outlook. By exploring these key questions and applying this methodology, investors can determine their optimal bitcoin allocation.