6 0

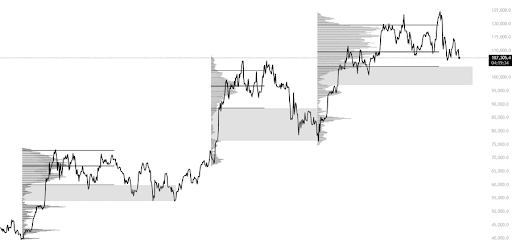

Institutional Traders Exploit Low-Volume Areas in Bitcoin Market

Institutional traders in the Bitcoin market are targeting low-volume areas, known as Low Volume Nodes (LVNs), to maximize profit by reducing slippage during large trades. This strategy aligns with basic supply and demand dynamics, indicating a potential market retracement when Bitcoin can't sustain bullish momentum.

- A major increase in volume around highs suggests a distribution phase rather than re-accumulation.

- If Bitcoin fails to reclaim the $114,000 monthly open, it might target below $100,000, potentially leading to a bear market towards the $50,000 to $60,000 range if not reclaimed.

The October market faced significant liquidations, affecting trader confidence. Despite Bitcoin's fundamentals being stable, sentiment remains cautious as the market recovers from the October leverage purge.