1 0

Iran Central Bank Buys $507M USDT to Counter Sanctions, Elliptic Finds

The Central Bank of Iran (CBI) reportedly used at least $507 million in USDT to alleviate a currency crisis, bypassing sanctions that limit access to dollars. This information comes from a report by Elliptic, a blockchain analytics firm.

- Elliptic traced the acquisition to wallets linked with the CBI, noting purchases paid in Emirati dirhams.

- The strategy involves building a dollar-linked reserve outside the traditional banking system using networks like TRON.

- Until June 2025, most USDT flowed through Nobitex, Iran's largest crypto exchange, facilitating local market stabilization by converting USDT to rials.

- Post-June 2025, funds were moved via cross-chain bridges from TRON to Ethereum and then spread across decentralized exchanges and other platforms.

- This coincided with a hack on Nobitex by a pro-Israel group, resulting in the loss of $90 million in crypto.

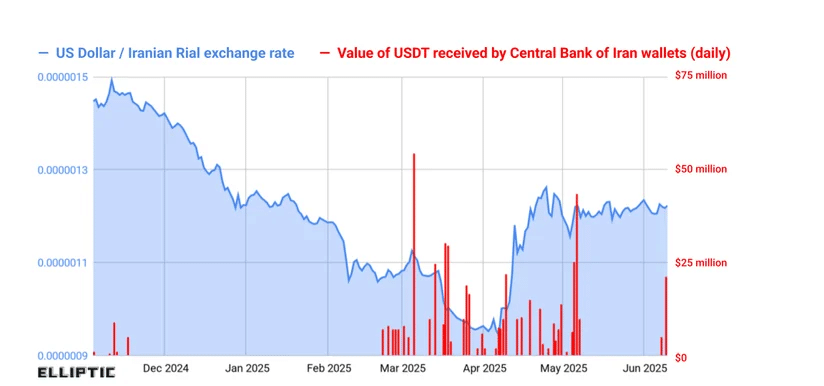

Elliptic suggests this activity reflects efforts to counteract a devalued rial and manage trade under sanctions. The rial lost about half its value against the dollar over eight months, prompting the central bank to buy rials with stablecoins.

Graphic of the US Dollar / Iranian Rial exchange rate | Source: Elliptic

Sanctions Risks and Enforcement

- Elliptic identifies this as a sanctions-resistant shadow banking layer, although stablecoin transfers on public blockchains leave traces.

- Exchanges and issuers can enforce sanctions; Tether has previously blacklisted wallets connected to the CBI.

- A separate report highlights how Iran's IRGC allegedly moved nearly $1 billion in cryptocurrency between 2023 and 2025, underscoring enforcement challenges.