8 0

iShares Bitcoin Trust ETF Hits 52-Week Low Amid Market Volatility

The cryptocurrency market is at a crossroads, with differing opinions on the future of major assets like Bitcoin, Ethereum, and Solana.

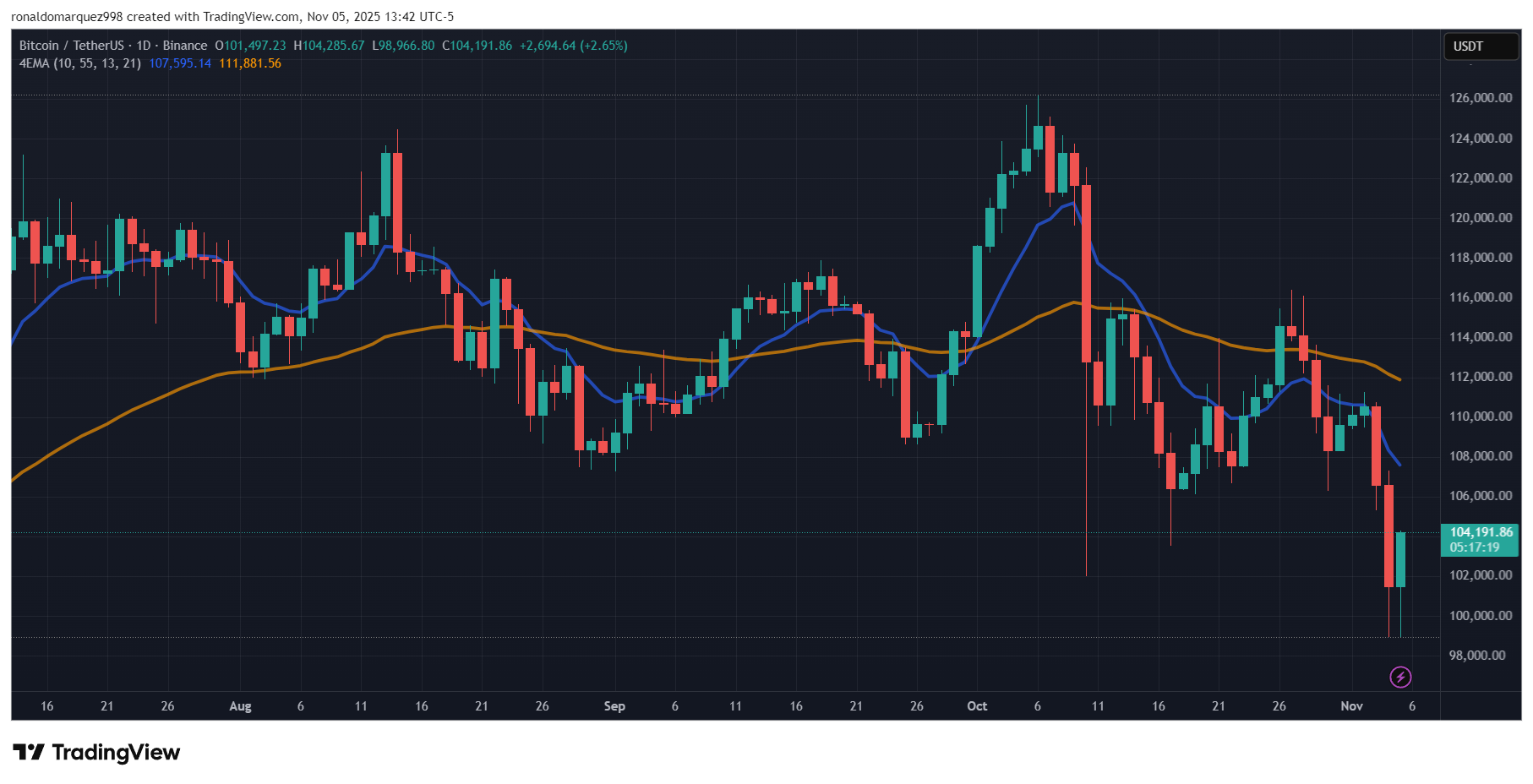

iShares Bitcoin Trust ETF Performance

- The iShares Bitcoin Trust ETF has dropped over 20% from its recent 52-week high.

- A bearish evening star pattern formed, followed by a 3% decline on October 7.

- This week saw an 8% drop, including a significant 5.5% fall, breaching the 200-day simple moving average.

- Analysts suggest maintaining current levels and reclaiming the 21-day EMA to regain investor confidence.

Grayscale Ethereum Trust ETF Decline

- The Ethereum ETF is down 34% from its annual peak, with a negative year-to-date performance of 5%.

- This week's 17% drop doubles the decline seen in the Bitcoin ETF.

- The fund has not breached its 200-day simple moving average, indicating potential stability.

Solana ETF Performance Concerns

- The Solana ETF has fallen 41% from its recent 52-week high set in September.

- A bearish island reversal pattern has formed, with significant declines recorded over the past seven weeks.

- This week alone saw a 19% drop, increasing concerns about further declines.

Overall, potential recovery in these ETFs could signal renewed bullish sentiment in the market. As of now, Bitcoin, ETH, and SOL have experienced gains of 3%, 5%, and 4%, respectively.