JPMorgan Reports Bitcoin and Gold Still Key Investment Assets

By Omkar Godbole (All times ET unless indicated otherwise)

Market Overview

Bitcoin has shown an 8% recovery since late December, with JPMorgan indicating that the market forces driving Bitcoin and gold to record levels last year remain influential. The "debasement trade" strategy persists, where investors acquire assets like Bitcoin and gold to hedge against inflation and currency devaluation.

This trend contributed to Bitcoin exceeding $100,000 and gold surpassing $2,600 in 2024, driven by geopolitical uncertainty and inflation concerns. President-elect Donald Trump's pro-crypto stance led to a record $78 billion net inflow into digital assets, according to JPMorgan.

However, elevated bond yields and a strong dollar may limit short-term gains, with upcoming nonfarm payrolls data expected to test the Fed's hawkish narrative.

Current Developments

MicroStrategy's recent activities raise concerns about volatility as brokers reduce exposure alongside increased margin requirements. Additionally, crypto economist Ben Lilly notes that Ethereum's price may be suppressed due to coins locked in the DeFi protocol Ethena, which shorts ETH futures to maintain the peg of its stablecoin, USDe.

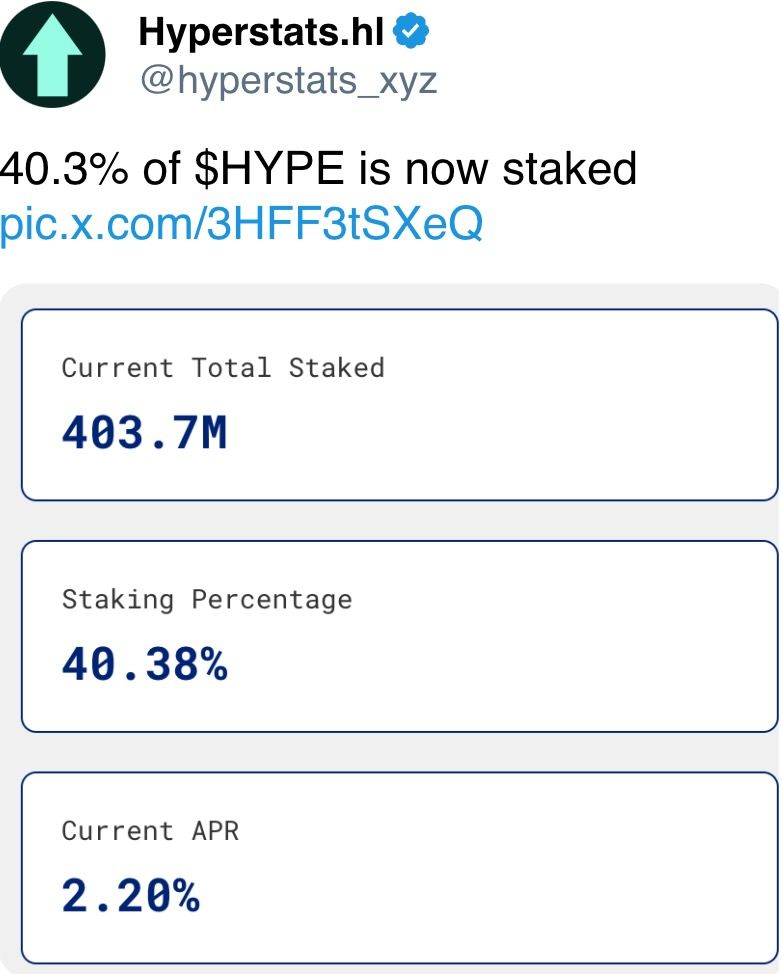

Ethena plans to launch iUSDe for institutional investors. Hyperliquid has listed SOLV, a token from Solv Protocol, while speculation grows regarding whale interest in the HYPE token.

Upcoming Events

Crypto Events:

- Jan. 6: Uniswap’s Unichain transitions to mainnet.

- Jan. 7: Dusk mainnet launch.

- Jan. 8: Bybit terminates services to French Territories residents.

- Jan. 15: Mintlayer version 1.0.0 release for cross-chain swaps.

- Jan. 16: Sonic token trading starts on Binance.

Macro Events:

- Jan. 6: Fed Governor Lisa D. Cook speaks on economic outlook.

- Jan. 7: Eurozone unemployment and inflation data released.

- Jan. 10: U.S. BLS releases December employment report.

Token Events

Cartesi is holding its first governance call of 2025. The Injective community approved a proposal to decrease INJ supply.

Market Movements

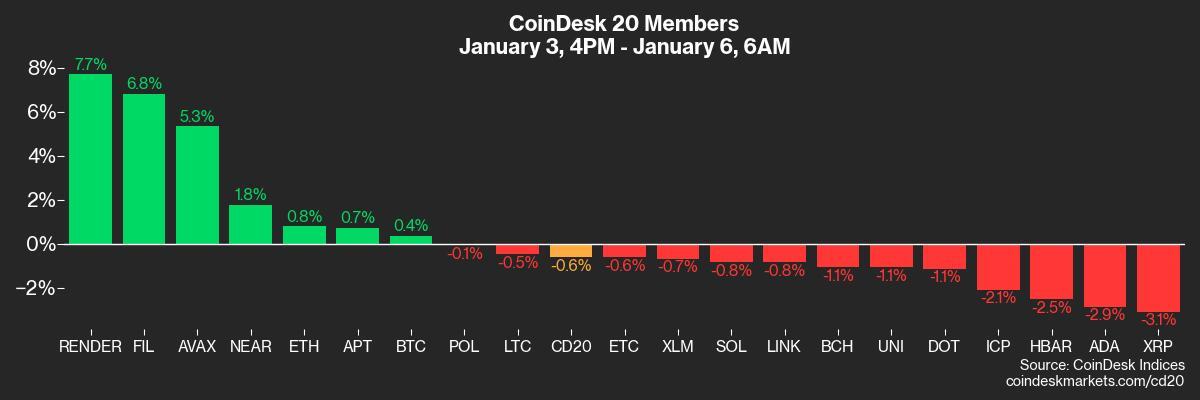

BTC is up 0.78% at $99,034.53; ETH is up 0.97% at $3,647.09. The CoinDesk 20 index is down 0.29%. BTC funding rate is 0.01% on Binance.

DXY is down 0.57% at 108.33. Gold remains unchanged at $2,641.26/oz. Silver is up 1.33% to $30.01/oz.

Bitcoin Stats

BTC Dominance: 57.25%

Ethereum to Bitcoin ratio: 0.0367

Hashrate: 814 EH/s

CME Futures Open Interest: 170,345 BTC

Technical Analysis

A potential head-and-shoulders pattern in Bitcoin suggests that a breakdown below horizontal support could lead to further price declines.

Crypto Equities

MicroStrategy closed at $339.66 (+13.22%), Coinbase at $270.65 (+5.23%). Other notable movements include Galaxy Digital Holdings at C$29.44 (+13.36%) and Riot Platforms at $12.34 (+17.97%).

ETF Flows

Spot BTC ETFs saw daily net flows of $908.1 million, totaling $35.91 billion in cumulative net flows. Spot ETH ETFs had daily net flows of $58.9 million with total holdings of approximately 3.611 million ETH.

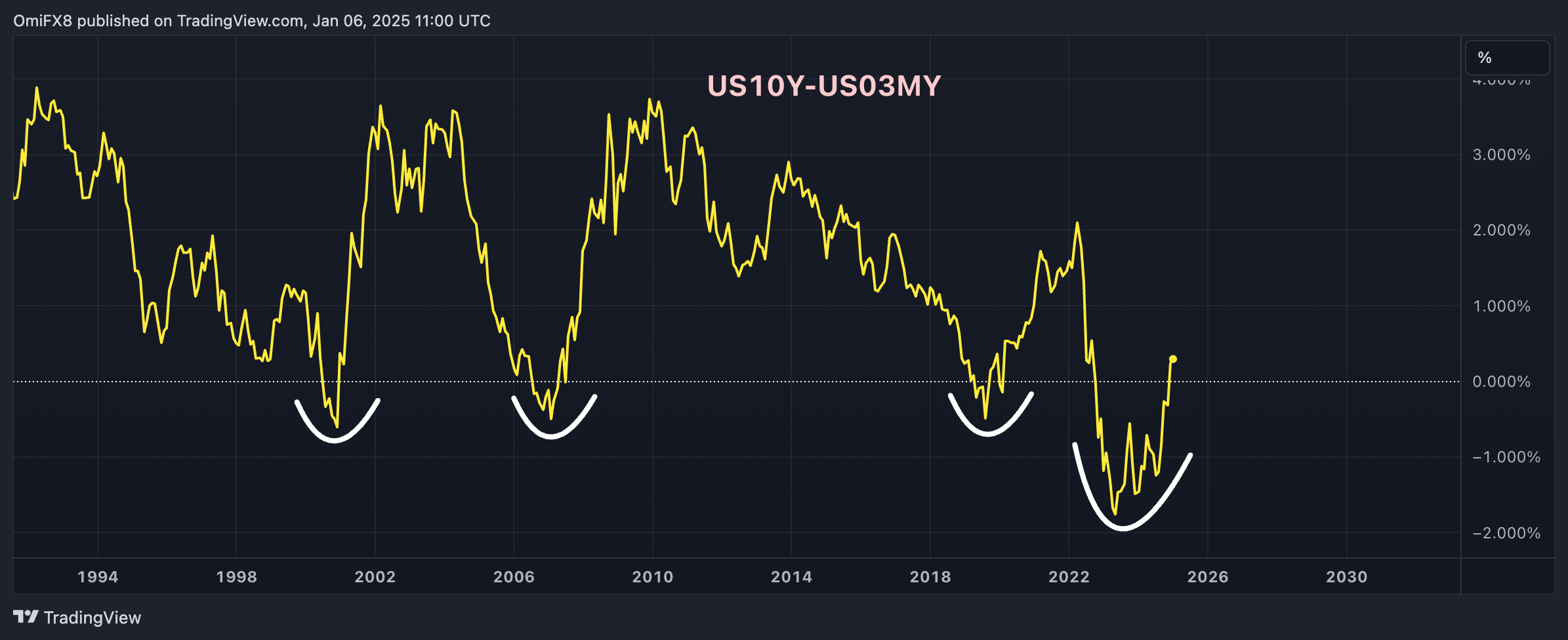

Chart of the Day

The yield curve normalization indicates a potential shift towards economic optimism.

While You Were Sleeping

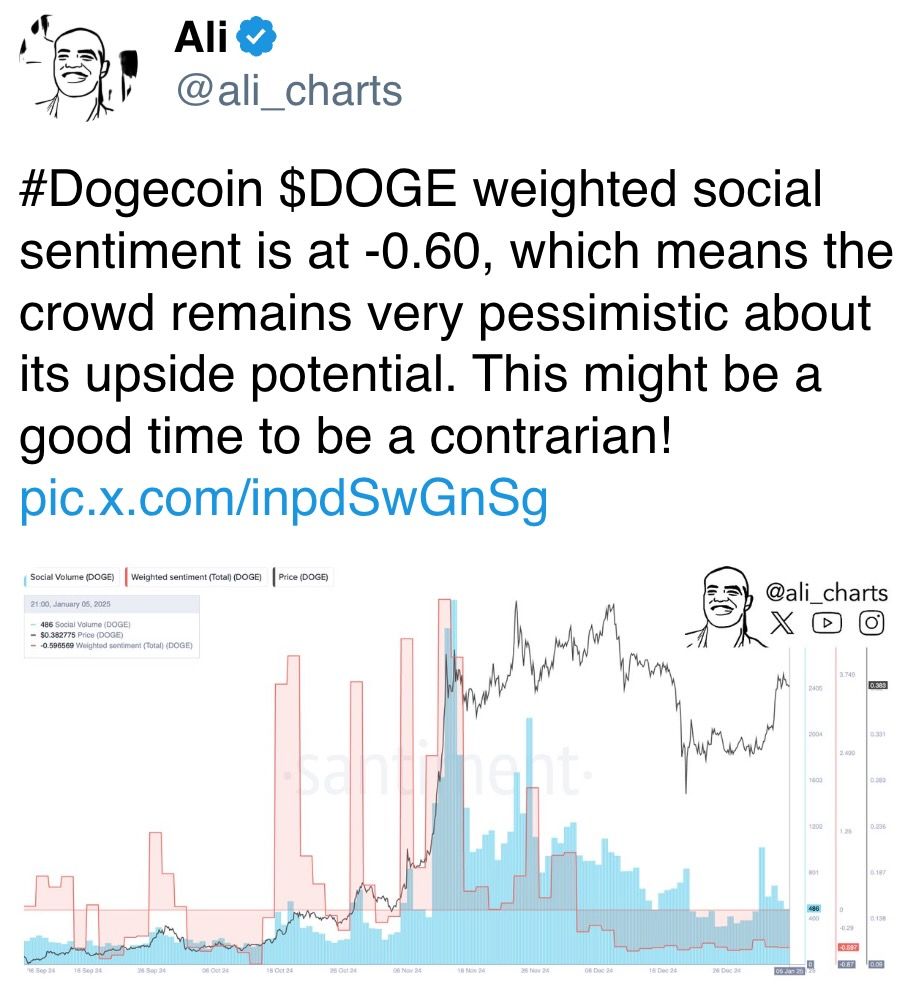

Recent articles highlight bullish expectations for Bitcoin following Trump's inauguration and MicroStrategy's plans for significant Bitcoin acquisitions. Dogecoin surged 21% due to whale activity, with forecasts predicting a potential rise to $1.

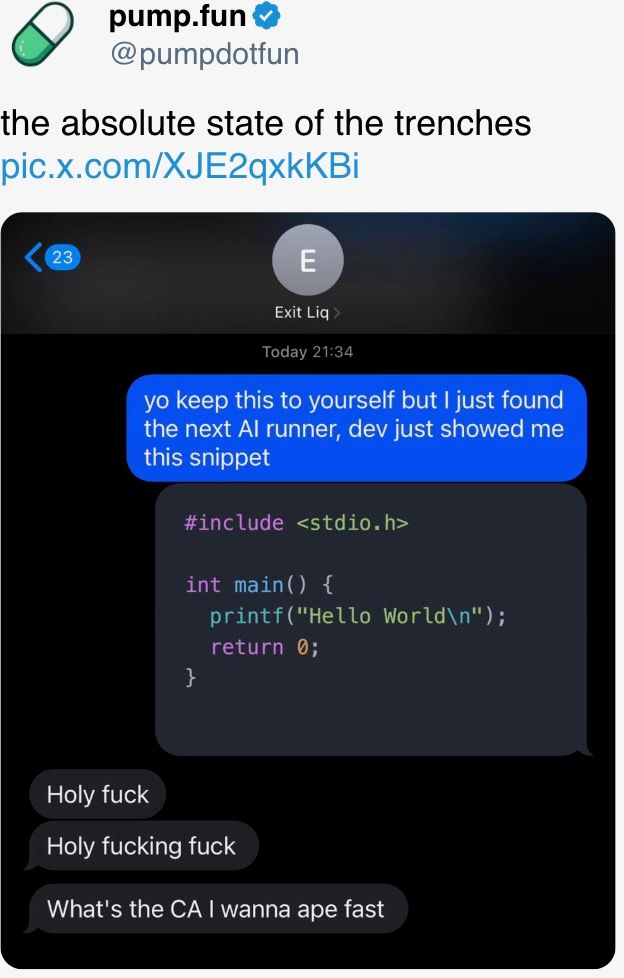

In the Ether