13 1

JPMorgan Predicts Bitcoin Price Surge to $170,000 Despite Volatility

The recent drop in Bitcoin price below $100,000 has caused concern, but major institutions like JPMorgan remain confident. Analysts from JPMorgan predict a potential rise to $170,000 in the near future.

Key Points from JPMorgan's Analysis

- Bitcoin is viewed as significantly undervalued compared to gold.

- A 65.9% increase is expected within the next 6-12 months, targeting $170,000.

- The crypto market faced a near 20% correction due to significant liquidations, especially on October 10.

- Further liquidation events, including a $120 million exploit on Market Maker Balancer, have heightened market fears.

- Despite volatility, JPMorgan sees these events as necessary purges, clearing excessive speculation.

- Analysts believe perpetual deleveraging is ending, paving the way for stable institutional accumulation.

- Bitcoin could recover and reach new highs by October 2026.

Market Analysts' Perspectives

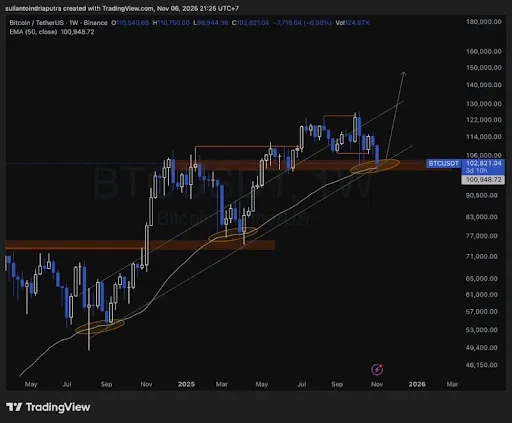

- Crypto analyst Sulianto Indria Putra supports the bullish outlook, noting Bitcoin's position above its 50-week EMA.

- Putra suggests Bitcoin is forming a higher low within an ongoing bull trend.

- Despite bearish sentiment, there's potential for a rally to $150,000 between late 2025 and early 2026.

Overall, while short-term volatility persists, long-term projections for Bitcoin remain positive according to institutional and market analysts.