JPMorgan Reports Record High Retail Sentiment for Bitcoin

Following the US Presidential elections and Donald Trump‘s victory on November 5, Bitcoin #BTC and other altcoins experienced significant price movements. JPMorgan's retail sentiment indicator for Bitcoin indicates high market activity, suggesting potential volatility ahead.

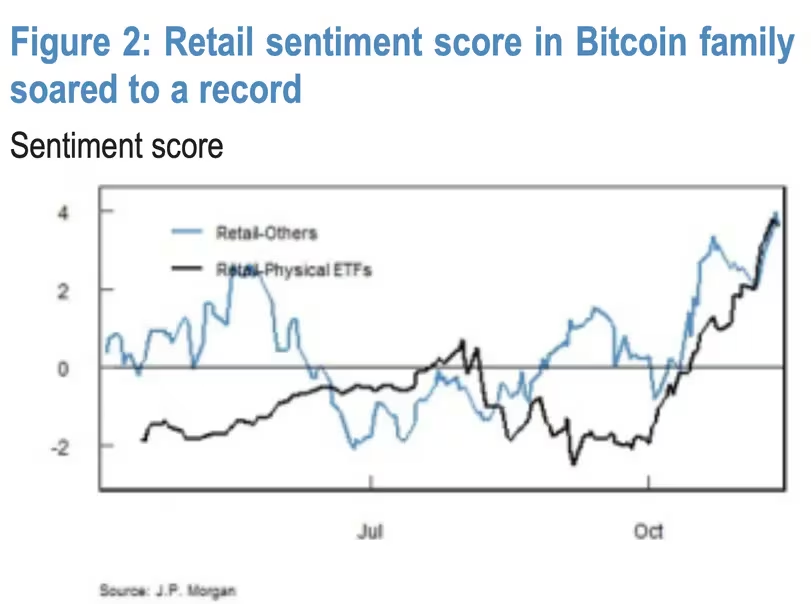

The bank's retail sentiment score for Bitcoin reached a record high of 4 as BTC surpassed its all-time high of over $93,000 last week, driven by strong inflows into US-listed spot Bitcoin ETFs. This score evaluates retail investor sentiment towards cryptocurrencies by analyzing activity in BTC-related products. JPMorgan's equity research team noted:

“Within ETF space, demand for Bitcoin ETFs was particularly strong (IBIT +3.4z) following the election results. The demand for Bitcoin was also reflected in COIN (+6z). In fact, their sentiment score for the Bitcoin family (for both physical ETFs and others) soared to a multi-sigma high.”

Courtesy: JPMorgan

In the final two days of last week, outflows from spot Bitcoin ETFs increased significantly. This, along with high selling by Bitcoin miners, caused BTC prices to drop to $87,000 before rebounding to $90,000 over the weekend, indicating ongoing tension between bullish and bearish market forces.

Bitcoin Holder MicroStrategy (MSTR) Sees Price Surge

MicroStrategy, a prominent Bitcoin holder, recently experienced a substantial rally, reaching new all-time highs. The MSTR stock has consistently traded at a premium over Bitcoin due to the company's aggressive BTC purchases.

The options market for MicroStrategy Inc (NASDAQ: MSTR), a significant Bitcoin holder, displayed notable bullish sentiment typical of market peaks. On Wednesday, the one-year 25-delta put-call skew dropped to -26.7%, indicating that call options were trading at a much higher premium than puts, which hedge against downside risks. This data, sourced from Market Chameleon, was shared by analyst Markets&Mayhem on X.

By Friday, the skew improved to -11.8%, still favoring upside bets. Call options for Bitcoin have been trading at a premium compared to puts, though the gap is narrowing.

“Call skew in MSTR is so wildly euphoric that it is hard to imagine we don’t see a more meaningful drawdown unless Bitcoin continues to move parabolically higher. For now, it appears to be cooling off just a little bit from its highs,” Markets&Mayhem stated.