Updated 18 December

Justin Sun Unstakes $209 Million in Ethereum from Lido Finance

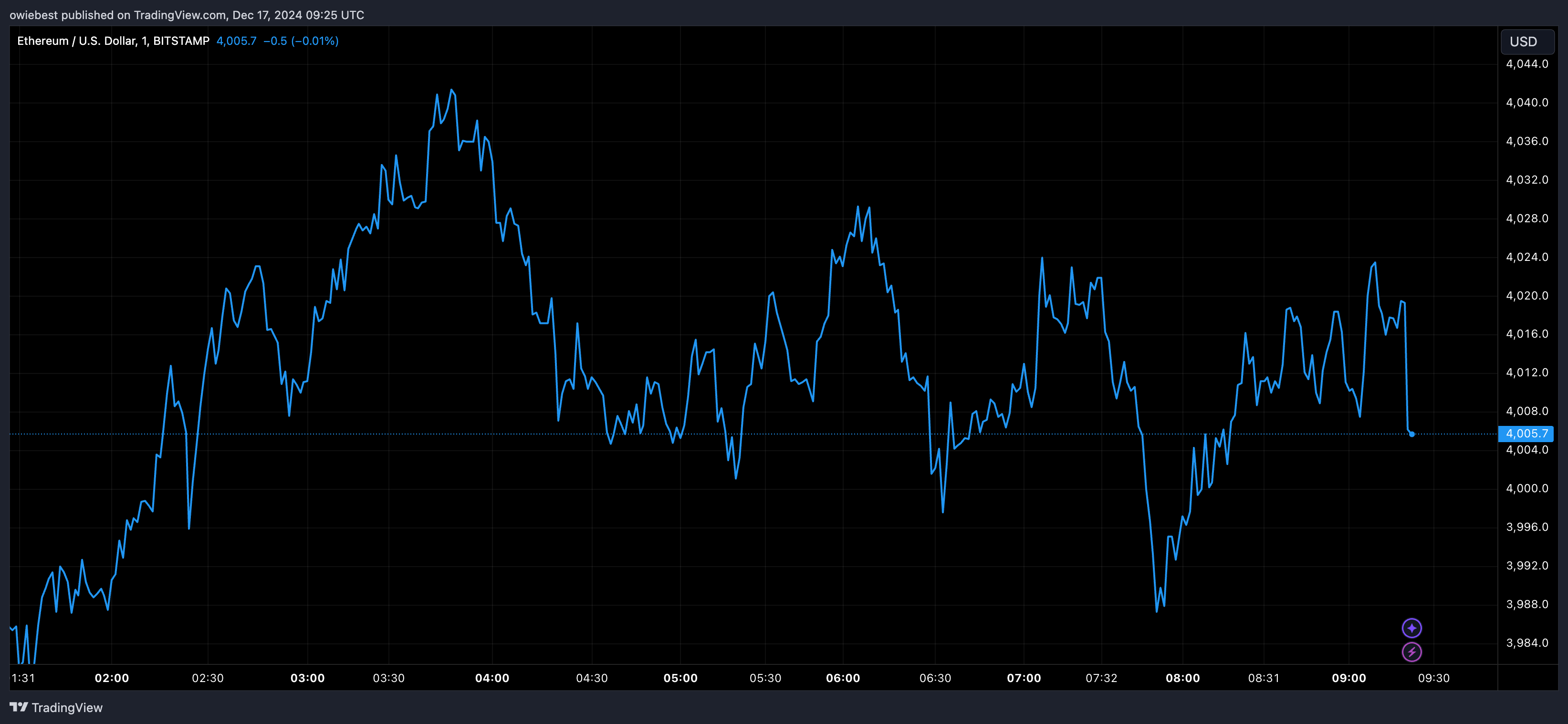

The Ethereum price may experience volatility following Justin Sun's withdrawal of $209 million from Lido Finance, an Ethereum staking platform. Compared to leading cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE), Ethereum’s performance has been subdued, peaking at $4,000 before facing consolidation challenges. Additional sell-offs could lead to a significant drop in Ethereum's price if Sun decides to liquidate more assets.

Justin Sun Dumps ETH

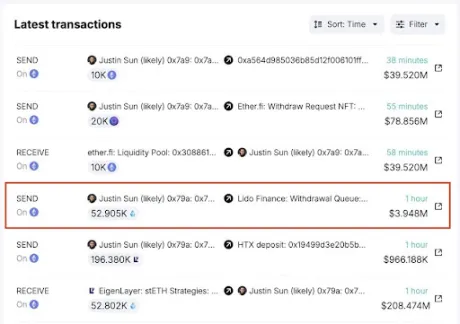

Recent reports indicate that Sun withdrew 52,905 ETH, approximately $209 million, from Lido Finance. This withdrawal is part of the 392,474 ETH tokens Sun acquired between February and August 2024, totaling around $1.19 billion at an average purchase price of $3,027. His total profit from these transactions is about $349 million, reflecting a 29% increase since acquisition.

On October 24, Sun also unstaked 80,251 ETH valued over $131 million from Lido Finance, transferring this amount to Binance shortly before a 5% decline in Ethereum's price. This action may have mitigated potential losses for Sun.

This is not the first instance of Sun liquidating Ethereum; he has previously cashed out during market rallies. In November, he deposited 19,000 ETH worth $60.83 million to HTX, followed by another transfer of 29,920 ETH valued at $119.7 million to the same exchange after Ethereum surpassed $4,000.

Given Sun’s history of significant asset movements, further sell-offs could impact the fragile Ethereum market. The question remains whether he will continue this pattern.

Ethereum Price Crash Ahead?

Sun has yet to comment on his recent large-scale withdrawals, but the volume and timing of these transactions could negatively affect Ethereum's future price trajectory. Historically, substantial ETH sell-offs have led to price declines due to heightened selling pressure.

Ethereum's price remains unstable, striving for upward movement. Recent data shows a 7% increase over the past week and a 28% rise over the last month, according to CoinMarketCap. However, additional large-scale sell-offs could intensify market volatility, particularly if other investors follow suit.