1 0

Key Bitcoin Indicators Signal Bearish Market Shift Ahead of Jackson Hole

Key indicators suggest a potential bearish shift in the bitcoin (BTC) market as traders await remarks from Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium.

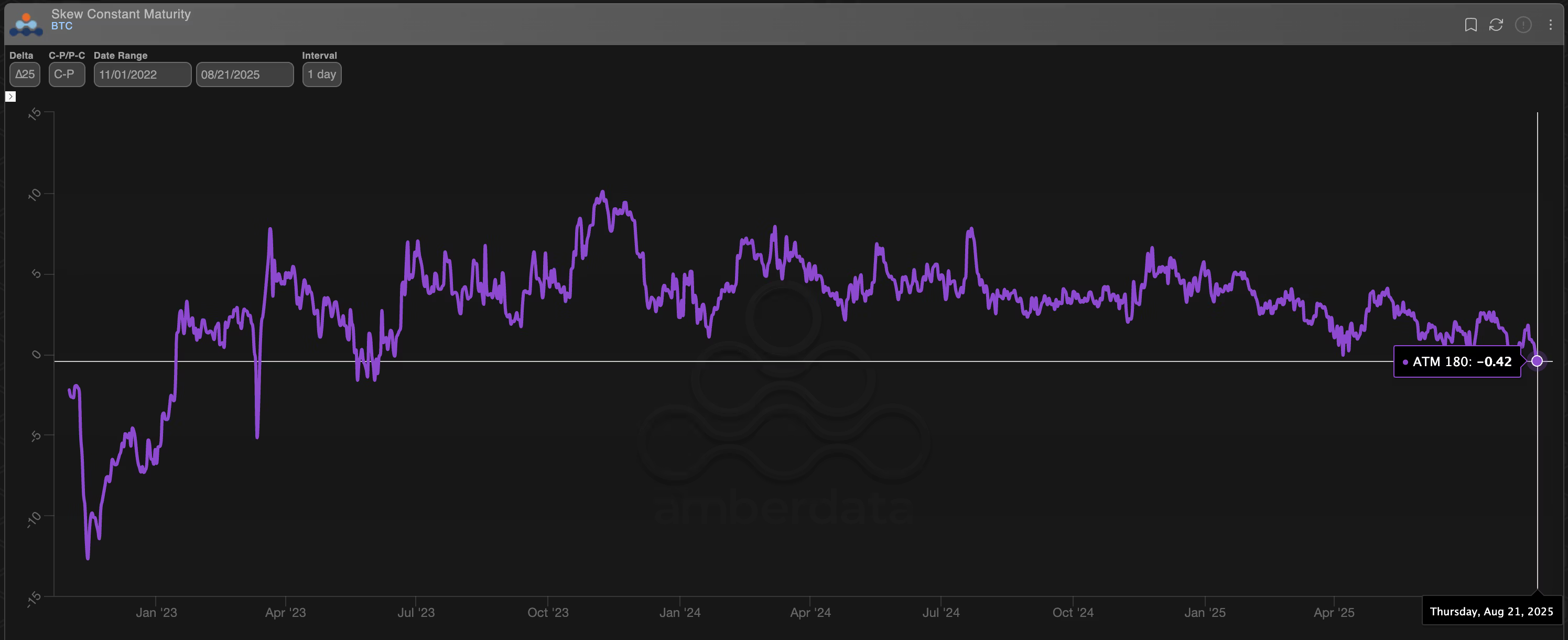

- The 180-day call-put skew on Deribit, the largest crypto options exchange, is at negative 0.42, the lowest since June 2023. This negative skew indicates increased demand for put options, signaling rising caution among traders.

- Recent price pullbacks have led to heightened demand for put options, with BTC only down about 8% from its recent high of over $124,000.

- Federal Reserve Chair Powell is expected to discuss potential rate cuts, which could influence market dynamics. Analysts predict sideways to slightly bearish action if expectations are met; however, larger cuts than anticipated may ignite bullish sentiment.

- Demand for downside protection in BTC aligns with Wall Street trends, where traders are purchasing "disaster" puts for major tech stocks.

- The Guppy multiple moving average (GMMA) indicator shows BTC's price has fallen below key moving average bands, indicating a loss of bullish momentum and potential strengthening of downside risks.