10 2

Strategy’s Leveraged ETFs Drop Nearly 85% Amid Cryptocurrency Slump

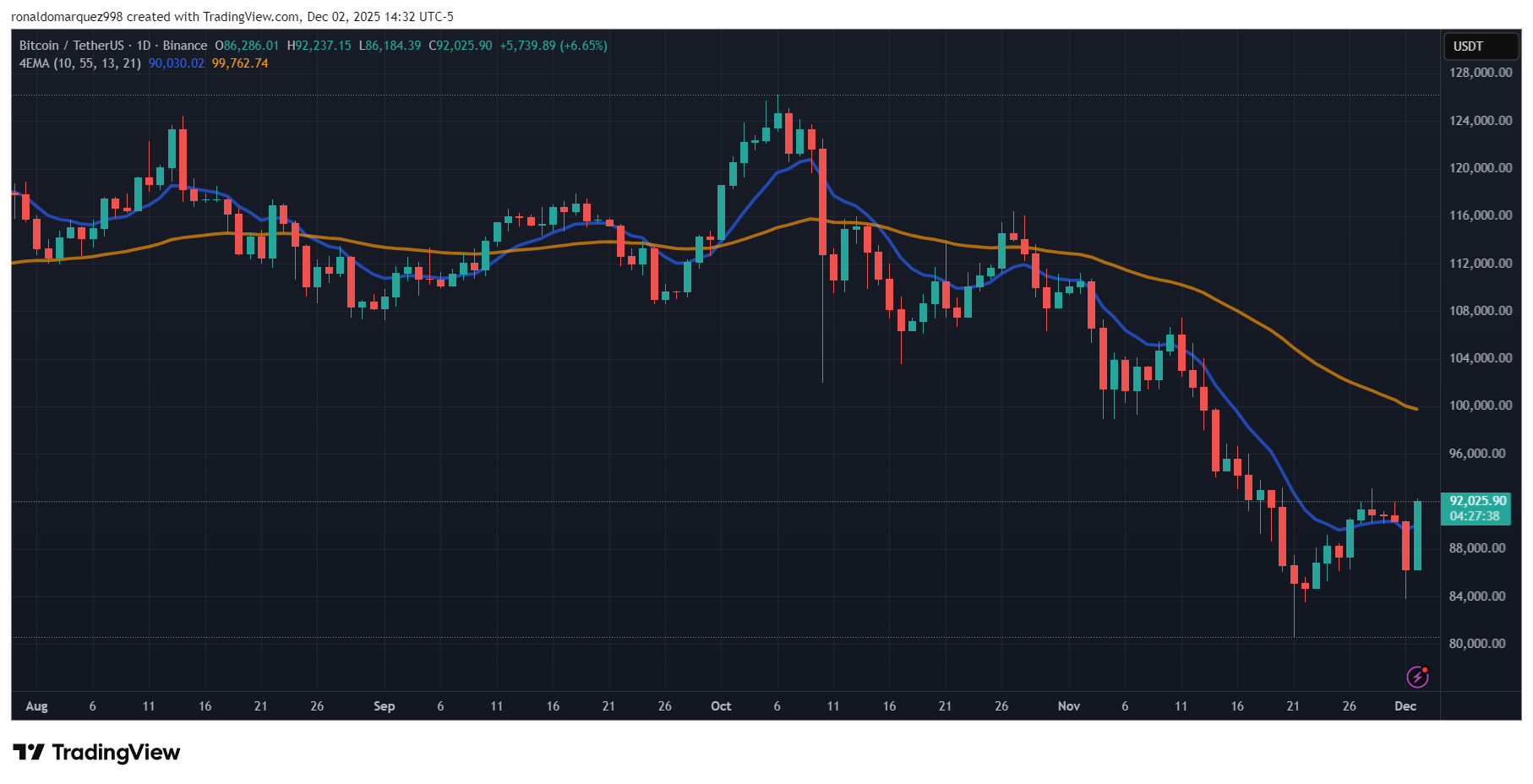

Bitcoin, despite a 9% recovery on Tuesday, has shown significant volatility, with its price dropping to $84,000 recently. This fluctuation has affected Strategy (formerly MicroStrategy), which holds the largest Bitcoin reserves at over 650,000 coins.

Strategy's ETFs Face Heavy Losses

- Strategy's CEO, Phong Le, hinted at the possibility of selling some Bitcoin holdings due to market conditions.

- The company's leveraged ETFs have suffered substantial losses, raising concerns about its financial stability.

- The T-Rex 2X Long MSTR Daily Target ETF and Defiance Daily Target 2x Long MSTR ETF have decreased by nearly 85% this year.

- The T-Rex 2X Inverse MSTR Daily Target ETF has fallen by 48% in the same period.

- Strategy's shares have plummeted over 40% this year, largely due to Bitcoin’s price drop.

Investor focus is now on Strategy’s "mNAV" metric, comparing its enterprise value to Bitcoin holdings. Concerns rose after Le mentioned potential cryptocurrency sales if mNAV falls below 1, currently estimated at around 1.1.

Mixed Analyst Perspectives

- Mike O’Rourke from JonesTrading noted that Le’s comments weaken Strategy's commitment to holding Bitcoin amid volatility.

- The company revised its full-year outlook, predicting a potential profit of $6.3 billion to a loss of $5.5 billion, down from an earlier $24 billion net profit forecast.

- Since joining the Nasdaq 100 index, Strategy’s shares have dropped over 70% from their November 2024 peak.

- Despite poor performance, analysts remain relatively optimistic; 10 out of 16 brokerages rate it a "buy," and four a "strong buy," with a median price target of $485, suggesting a potential 183% increase over the next year.

At present, Bitcoin has recovered to $92,000.