BULLISH 📈 : LiquidChain Raises $526K as Bitcoin ETFs Show Resilience

- Bitcoin ETFs demonstrated resilience during a recent crash, absorbing sell pressure despite retail traders liquidating positions.

- The market dip exposed inefficiencies in fragmented liquidity, increasing interest in solutions that unify Bitcoin, Ethereum, and Solana.

- LiquidChain addresses cross-chain friction with a 'deploy-once' architecture, merging liquidity from major chains into one execution layer.

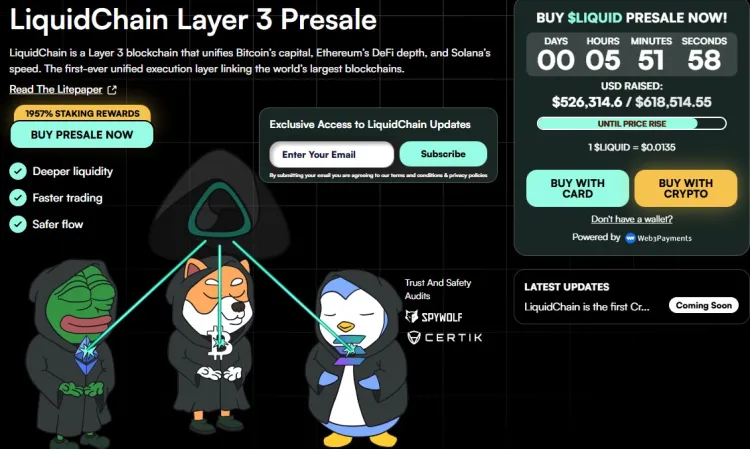

- The $LIQUID presale raised over $526k, indicating strong investor demand for infrastructure solutions, despite market volatility.

Institutional investors maintained their positions during the Bitcoin dip, treating it as a liquidity event rather than an exit signal. This highlights a shift in narrative where volatility is seen as an operational detail rather than a threat.

Fragmentation remains an issue as capital defensively moves between major cryptocurrencies, encountering high fees and security risks. LiquidChain, a Layer 3 protocol, aims to unify these liquidity islands using a Cross-Chain Virtual Machine (VM) for seamless asset movement.

This eliminates user experience hurdles and allows developers to deploy applications once, accessing deep liquidity pools from Bitcoin, Ethereum, and Solana.

The $LIQUID token functions as transaction fuel for the Cross-Chain VM and is essential for liquidity staking, with structured tokenomics rewarding network participants. The presale's success indicates a growing appetite for Layer 3 solutions ready for the next market cycle.

Investors are distinguishing between speculative price changes and the fundamental value of infrastructure projects, as evidenced by the successful $LIQUID presale.