5 0

BULLISH 📈 : LiquidChain raises $532K in presale, addressing crypto fragmentation

- China is actively working to bypass the US dollar in international trade, aiming for a financial system that doesn't rely on SWIFT. This move is increasing global financial fragmentation and highlighting the need for neutral settlement layers.

- The cryptocurrency market faces similar challenges with liquidity being isolated across various networks such as Bitcoin, Ethereum, and Solana, necessitating interoperability solutions.

- LiquidChain addresses this by integrating these ecosystems into a single Layer 3 environment, allowing developers to deploy applications once and access liquidity across multiple networks.

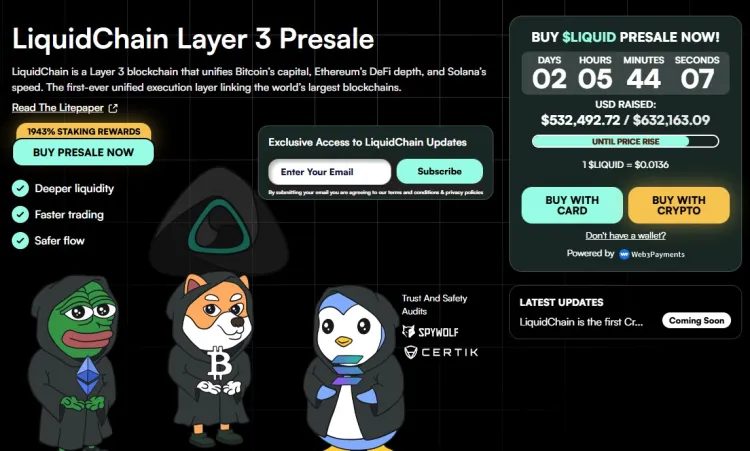

- The project has gained traction, raising over $532K during its ongoing presale phase.

Geopolitical shifts are creating a bifurcated global economy, affecting capital efficiency and liquidity distribution. The demand for a neutral, trustless settlement layer is rising as centralized control diminishes.

LiquidChain: Unifying Liquidity

- Current DeFi inefficiencies prevent seamless interaction across networks like Bitcoin and Solana without complex processes.

- LiquidChain's solution introduces a Unified Liquidity Layer, enabling native interactions among major blockchain networks.

- This architecture eliminates traditional bridge vulnerabilities and offers a 'Deploy-Once Architecture' through its Cross-Chain Virtual Machine (VM).

Presale Success Reflects Market Interest

- The LiquidChain presale has raised $532K, suggesting investor confidence in cross-chain infrastructure solutions.

- The native token ($LIQUID) serves as transaction fuel and supports liquidity staking, enhancing the user experience in DeFi applications.

- While adoption speed remains a risk, the presale data indicates strong support for LiquidChain as it aims to unify global liquidity pools amidst financial fragmentation.

Disclaimer: Cryptocurrency investments are high-risk and may result in total loss. Conduct thorough research before investing.