BULLISH 📈 : LiquidChain aims to unify cross-chain liquidity for seamless trading

- Changpeng Zhao emphasizes the importance of personal responsibility in crypto trading, urging users not to blame exchanges or influencers for their losses.

- Market fragmentation across major chains like Bitcoin, Ethereum, and Solana presents systemic risks that individual caution cannot address alone.

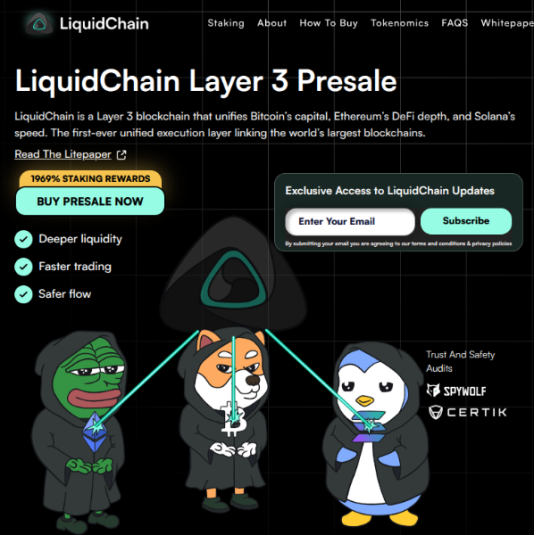

- LiquidChain aims to mitigate these risks by creating a unified Layer 3 protocol, merging liquidity from these ecosystems to facilitate seamless cross-chain transactions.

Amidst market volatility and FUD, Changpeng Zhao's message to the crypto community is clear: traders must own their risk. Bitcoin is near $69K, intensifying market reactions.

The current market faces challenges due to liquidity being trapped across separate silos on different blockchains, causing issues like slippage and reliance on risky wrapped assets.

LiquidChain addresses this by acting as a 'cross-chain liquidity layer' that integrates liquidity from Bitcoin, Ethereum, and Solana, enabling efficient single-step transactions without bridges.

This innovation reduces risk, enhances market efficiency, and provides deeper liquidity. Developers benefit from a 'Deploy-Once Architecture,' allowing them to create dApps that access assets across these platforms.

LiquidChain's presale has raised over $533K, with tokens priced at $0.0136. It's designed to fuel the ecosystem through transactions and liquidity staking rewards, addressing a significant market inefficiency.

This article serves informational purposes and does not constitute financial advice. Research is advised before participating in any presale.