6 0

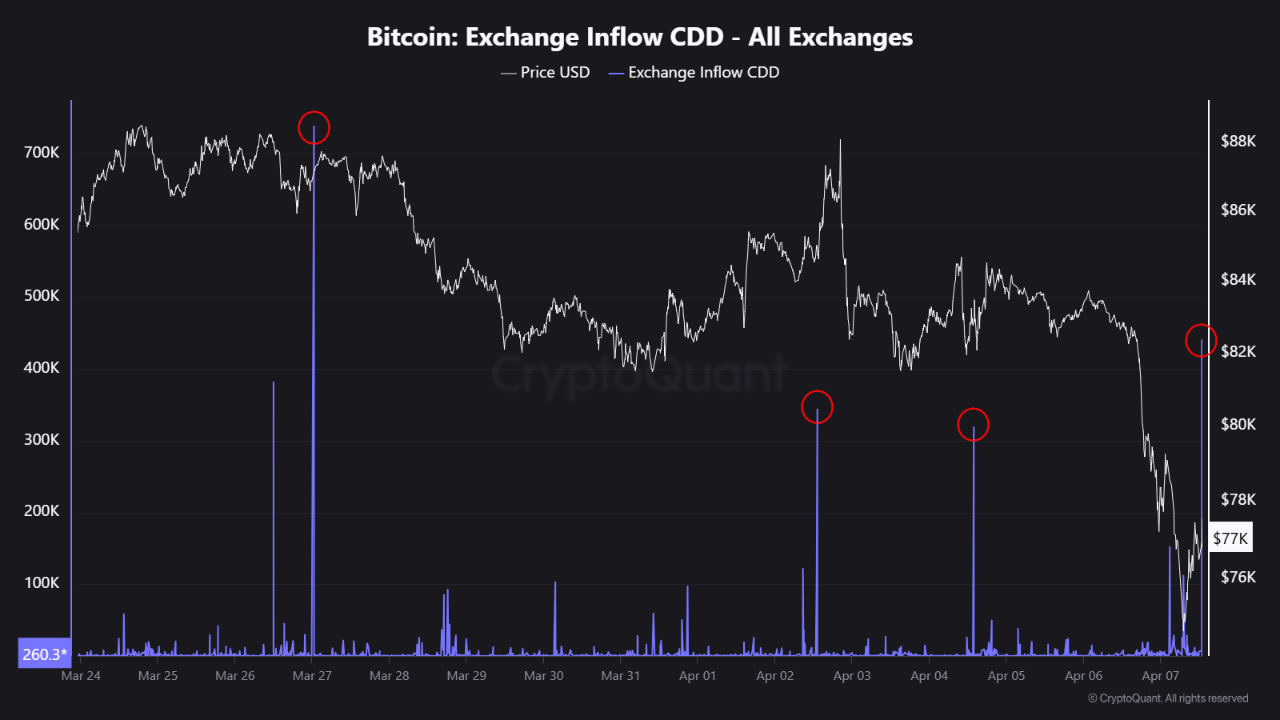

Long-Term Bitcoin Holders Transfer Coins Amid Market Uncertainty

Bitcoin's price briefly dropped to $74,604 but rebounded to above $79,000. It remains down 3.1% over the past day and nearly 30% from its January peak of over $109,000.

Old Coins Start to Move: Sell Off Ahead?

- Analysis shows a spike in Exchange Inflow Coin Days Destroyed (CDD), indicating older coins are being moved.

- This movement often suggests long-term holders may sell their assets.

- Historically, such spikes preceded significant price corrections.

- The recent surge coincided with Bitcoin’s drop from $82,000 to $76,000.

- If the trend continues, it could signal bearish market conditions as dormant coins re-enter circulation.

Bitcoin Short-Term Metrics Indicate Possible Cooling Trend

- Short-term holder behavior is analyzed through realized price data.

- Realized prices for coins held from one week to three months indicate market health.

- Current data shows downward trends in these realized prices, similar to previous peaks in April and November 2021, and March 2025.

- If losses persist among newer holders, further downside may occur.

- Past bear cycles saw these metrics mark bottom zones where prices found support and reversed.