6 0

Long-Term Holders Sold 97,000 BTC Last Week Amid Price Drop

Long-term holders of Bitcoin increased selling activity last week as the price fell below $110,000. Key points include:

- On August 29, approximately 97,000 BTC were moved, marking the highest daily volume this year.

- 70% of the sell-off involved coins aged one to five years.

- Despite this activity, on-chain metrics indicate a strong market structure for Bitcoin, remaining below extreme levels seen in late 2024.

Institutional Buying Trends

While long-term holders sell, institutions continue to accumulate Bitcoin:

- Goobit Group AB purchased 1.0197 BTC, raising its total holdings to 11.6491 BTC, valued at $1.25 million.

- Satsuma Technology added 22.65 BTC since its last update, bringing its total to 1,148.65 BTC.

Market Stability Indicators

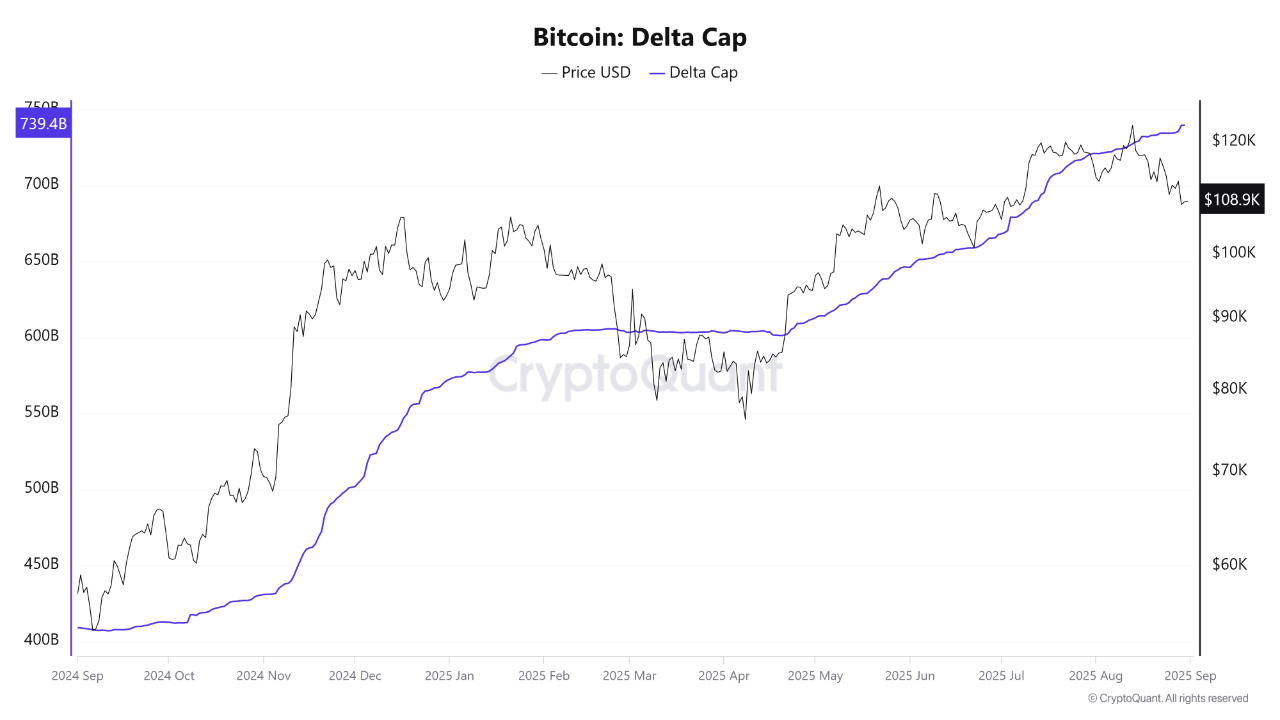

Currently, Bitcoin trades around $109,700, down 2% over the past week. The Delta Cap remains significantly below the current price, indicating stable foundations. Additional insights include:

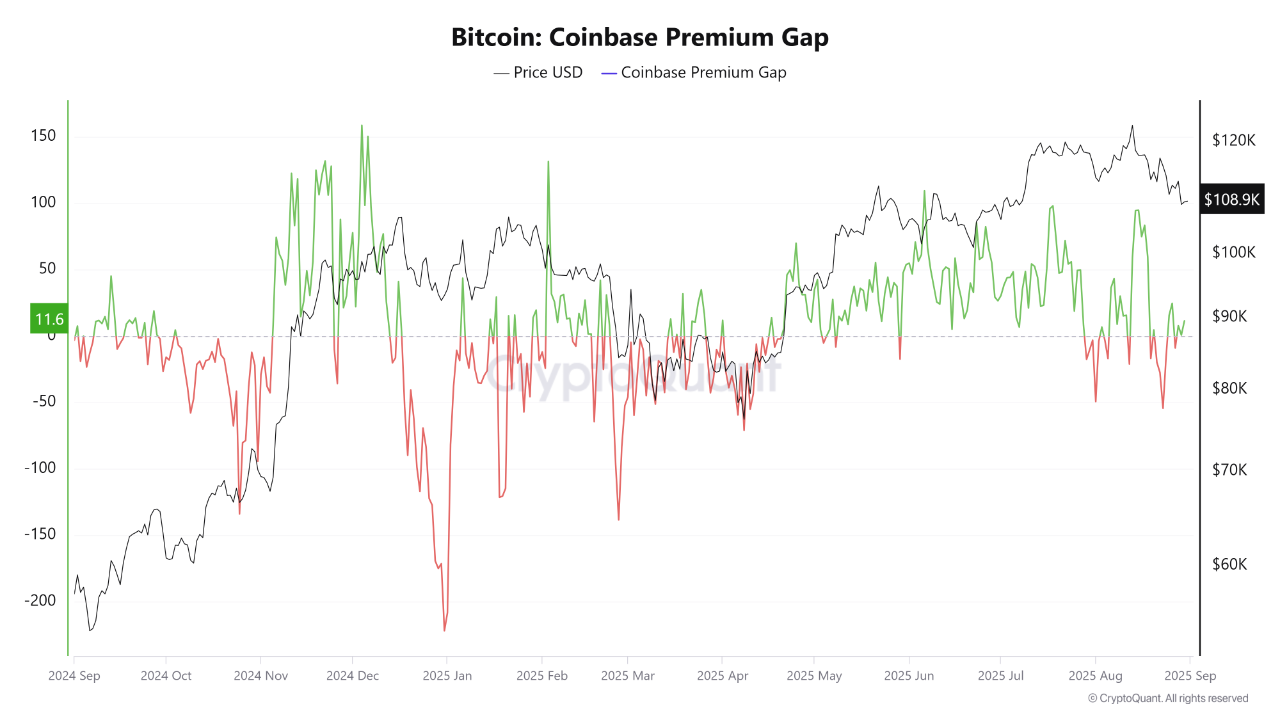

- The Coinbase Premium Gap shows U.S. institutions are paying more for Bitcoin, historically signaling potential bullish trends.

- Market corrections may present accumulation opportunities, with forecasts suggesting Bitcoin could see further gains in 2025.

- Indicators show no signs of overheating, implying that the peak price of $124,500 may not be the top for this cycle.

Bitcoin’s price compared with Delta Cap. | Source: CryptoQuant

Bitcoin Coinbase Premium Gap. | Source: CryptoQuant