Bitcoin Miner MARA Acquires 703 BTC, Total Holdings Reach 34,794 BTC

Bitcoin mining firm MARA, previously known as Marathon Digital, has acquired an additional 703 BTC, raising its total holdings to 34,794 BTC.

MARA’s Bitcoin Holdings Surge To 34,794 As CEO Shares Bullish Outlook

MARA announced its acquisition of 703 BTC at an average price of $95,395 via X. This purchase brings the company's November total to 6,474 BTC, following last week's acquisition of 5,771 BTC.

The total digital asset holdings are now valued at approximately $3.3 billion. The firm's year-to-date BTC yield per share is 36.7%. Earlier in the month, MARA raised $1 billion through 0% convertible senior notes due in 2030, allocating part of this to buy back some 2026 notes and reserving $160 million for future Bitcoin purchases if market conditions are favorable.

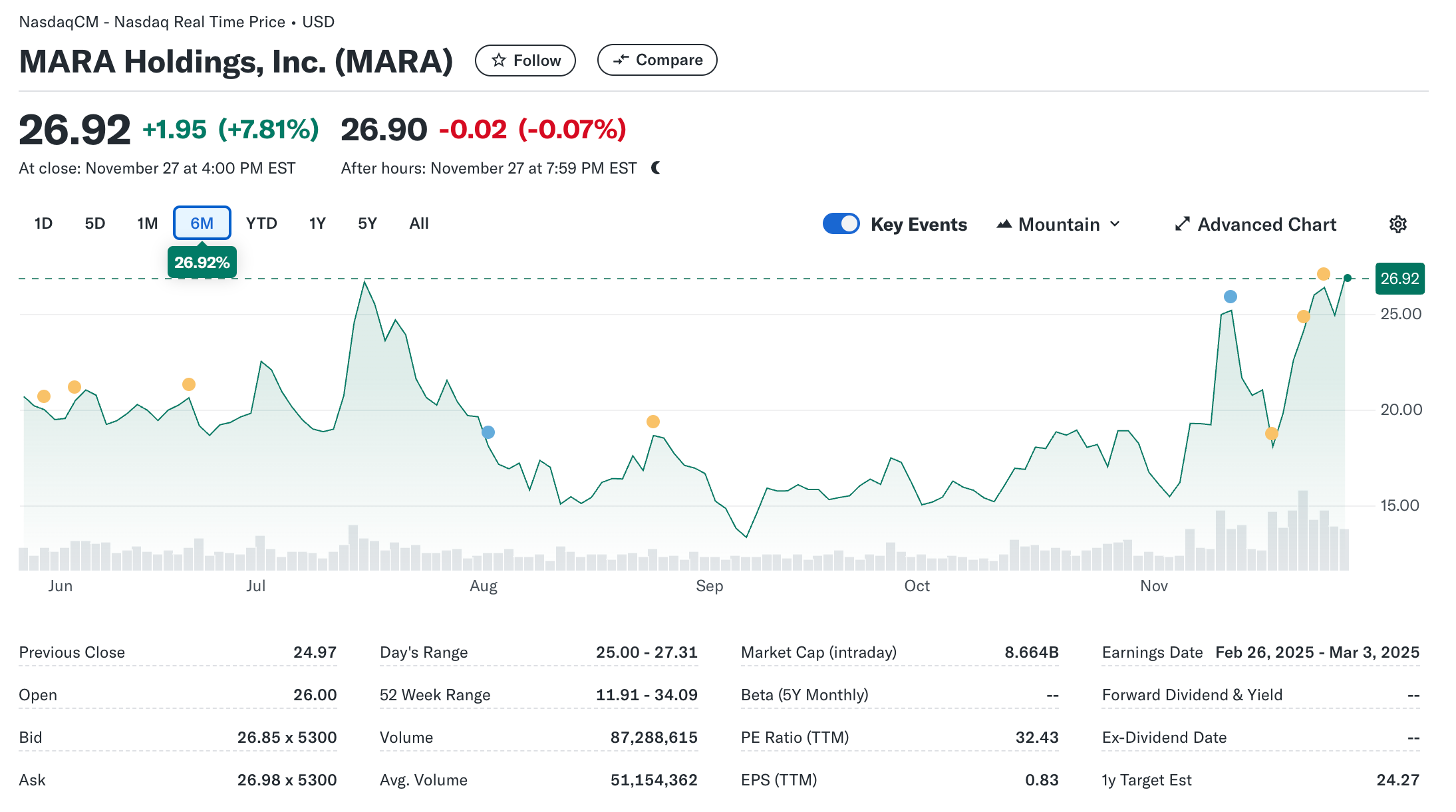

CEO Fred Thiel stated that institutional interest in BTC is rising, anticipating favorable regulations under a Trump administration. MARA stock closed at $26.92 on November 27, up 7.81% for the day, with a six-month increase of 26.92% as optimism around digital assets grows.

Corporate Moves Could Push Bitcoin Beyond $100,000

MARA's acquisition strategy is akin to MicroStrategy's, which holds the largest Bitcoin reserves globally. Under Michael Saylor, MicroStrategy has spent billions on Bitcoin, totaling $4.6 billion and $5.4 billion in consecutive weeks.

As President-elect Trump's inauguration approaches, more corporations are considering adding BTC to their balance sheets. Rumble has allocated $20 million for future BTC purchases, while Metaplanet's BTC holdings have surpassed 1,000 BTC.

The competition for accumulating BTC has led analysts to predict that the digital asset may breach the $100,000 mark early next year. Currently, BTC trades at $95,615, reflecting a 1% increase in the past 24 hours.