Matrixport Predicts Ethereum Price Rally to $4,617 Driven by ETF Demand

As Bitcoin price reclaimed $98,000, the total crypto market cap increased by 1.41% to $3.41 trillion. Ethereum has surpassed the $3,700 level, showing bullish momentum with an intraday gain of 2.01% after a 10% fall over two days, largely driven by increased institutional demand.

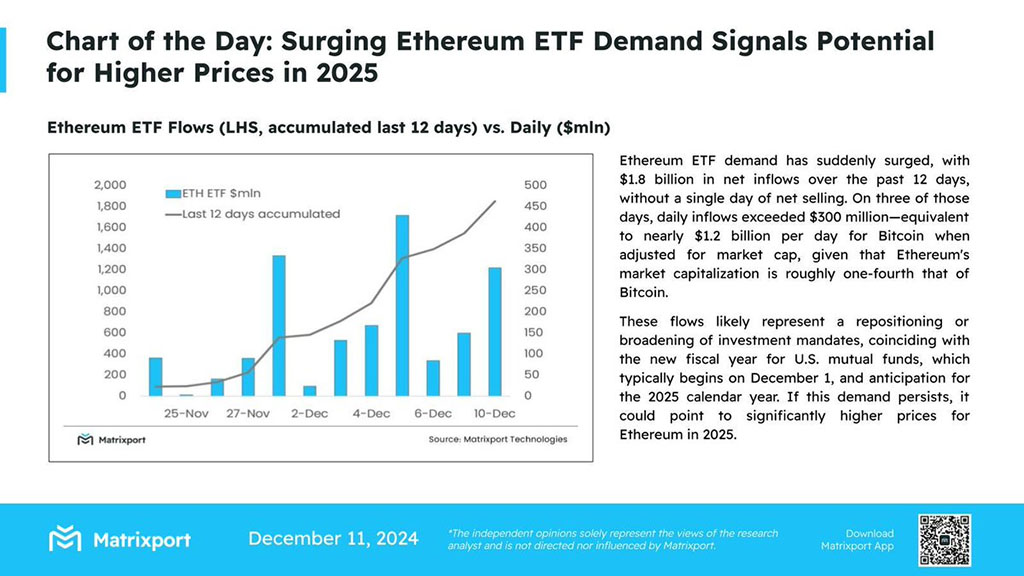

Matrixport Reports Higher Price Potential in Ethereum

A recent Matrixport report indicates that rising Ethereum ETF demand may lead to higher prices in 2025, with $1.8 billion netted over the past 12 days. Notably, there were no days of net selling during this period, and three daily net inflows exceeded $300 million.

This equates to nearly $1.2 billion daily for Bitcoin, considering Ethereum's market cap is about 25% of Bitcoin's. Increased institutional demand is linked to the Trump administration's anticipated influence in 2025 and the new fiscal year for U.S. mutual funds starting December 1, raising expectations for 2025.

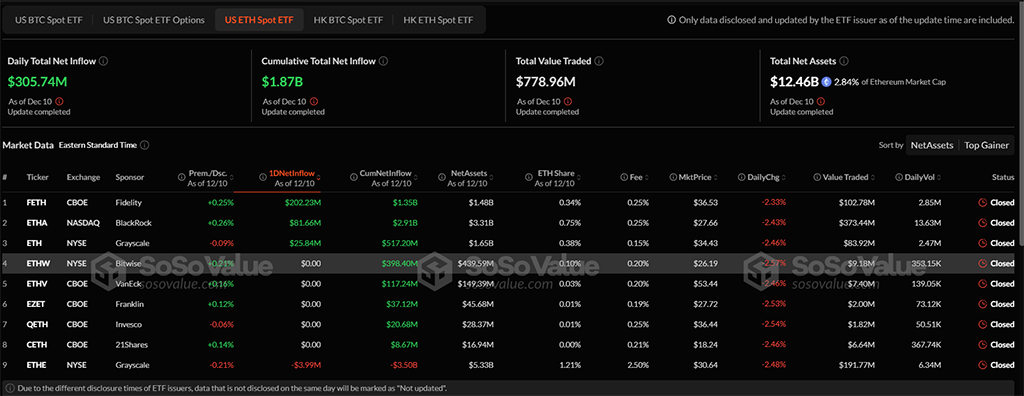

Ethereum ETFs Net $305M on December 10

The Ethereum ETFs market recorded a total daily net inflow of $305.74 million, with Fidelity's FETH leading at $202.23 million, followed by BlackRock's ETHA at $81.66 million.

The total net assets of the US Ethereum spot ETF have reached $12.46 billion, representing 2.84% of the Ethereum market cap.

Altcoin Season to Drive Ether

An independent analyst, Titan of Crypto, suggests a potential new altcoin season could support a bullish trend in Ethereum. A rising wedge pattern observed in the Bitcoin dominance price chart indicates a possible break below the support trend line, enhancing the likelihood of increased altcoin market activity.

Ethereum Price Rally Targets $4,617

Technical analysis reveals a triangle breakout rally in Ethereum's weekly chart, completing a Rounding Bottom reversal above the neckline at the 78.60% Fibonacci level of $3,817. This week’s 7.65% pullback marks a retest of the broken trendline and pattern.

Source: Tradingview

The ongoing recovery suggests a bullish crossover for the 100-week and 200-week Simple Moving Average lines. The MACD and Signal lines also show a positive trend, positioning Ethereum for a post-retest reversal targeting $4,617. With growing institutional demand and improving macro sentiments, the potential for Ethereum to reach a new all-time high has increased significantly.