7 1

Metaplanet Acquires 5,419 BTC, Now 5th Largest Corporate Holder

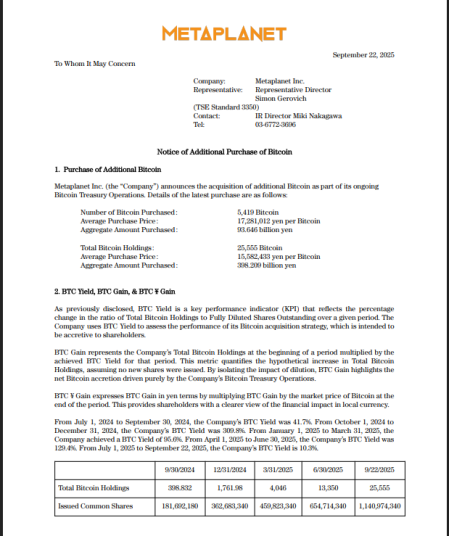

Metaplanet, a Japanese public company, has purchased 5,419 Bitcoin, raising its total holdings to 25,555 BTC. This acquisition positions the firm among the top five corporate Bitcoin holders.

Key Highlights

- The purchase cost approximately $632.5 million, with an average price of $116,724 per BTC.

- The company's average cost basis across all holdings is around $106,000 per BTC.

- Metaplanet plans to raise about $1.4 billion through share and warrant issuances for further Bitcoin accumulation.

- The target is to hold 210,000 BTC by the end of 2027, representing roughly 1% of all expected Bitcoin.

- The company achieved a year-to-date yield of 395.1% tied to Bitcoin investments.

Funding Strategy

- Equity sales fund Bitcoin purchases, shifting risk onto shareholders due to Bitcoin's volatility.

- Market response has been mixed, with stock price fluctuations following announcements.

- Analysts note the tradeoff between potential gains during Bitcoin rallies and amplified losses during declines.

Challenges and Risks

- Achieving the 210,000 BTC target by 2027 requires ongoing capital raises and market buys.

- Potential risks include Bitcoin price volatility and regulatory changes in Japan and other markets.