Metaplanet Purchases 619.7 BTC for $61 Million, Increasing Holdings

Japan-based early-stage investment firm Metaplanet has purchased 619.7 BTC for $61 million, marking its largest Bitcoin acquisition to date.

Metaplanet Increases BTC Holdings to 1,762

Despite the recent downturn in the cryptocurrency market, Metaplanet acquired 619.7 BTC at an average price of approximately $96,000, raising its total Bitcoin holdings to 1,762 BTC, which were bought at an average price of $75,600 per BTC. The company began buying BTC in May with an initial purchase of 97.9 BTC and crossed the 1,000 BTC milestone in November. This latest acquisition nearly doubles the value of its previous largest acquisition of close to $30 million in November.

Metaplanet is referred to as “Asia’s MicroStrategy” due to its aggressive Bitcoin accumulation strategy. The recent purchase follows a bond issuance that raised $60.6 million aimed at accelerating BTC purchases. Metaplanet's BTC reserves rank as the 12th-largest among publicly listed firms globally.

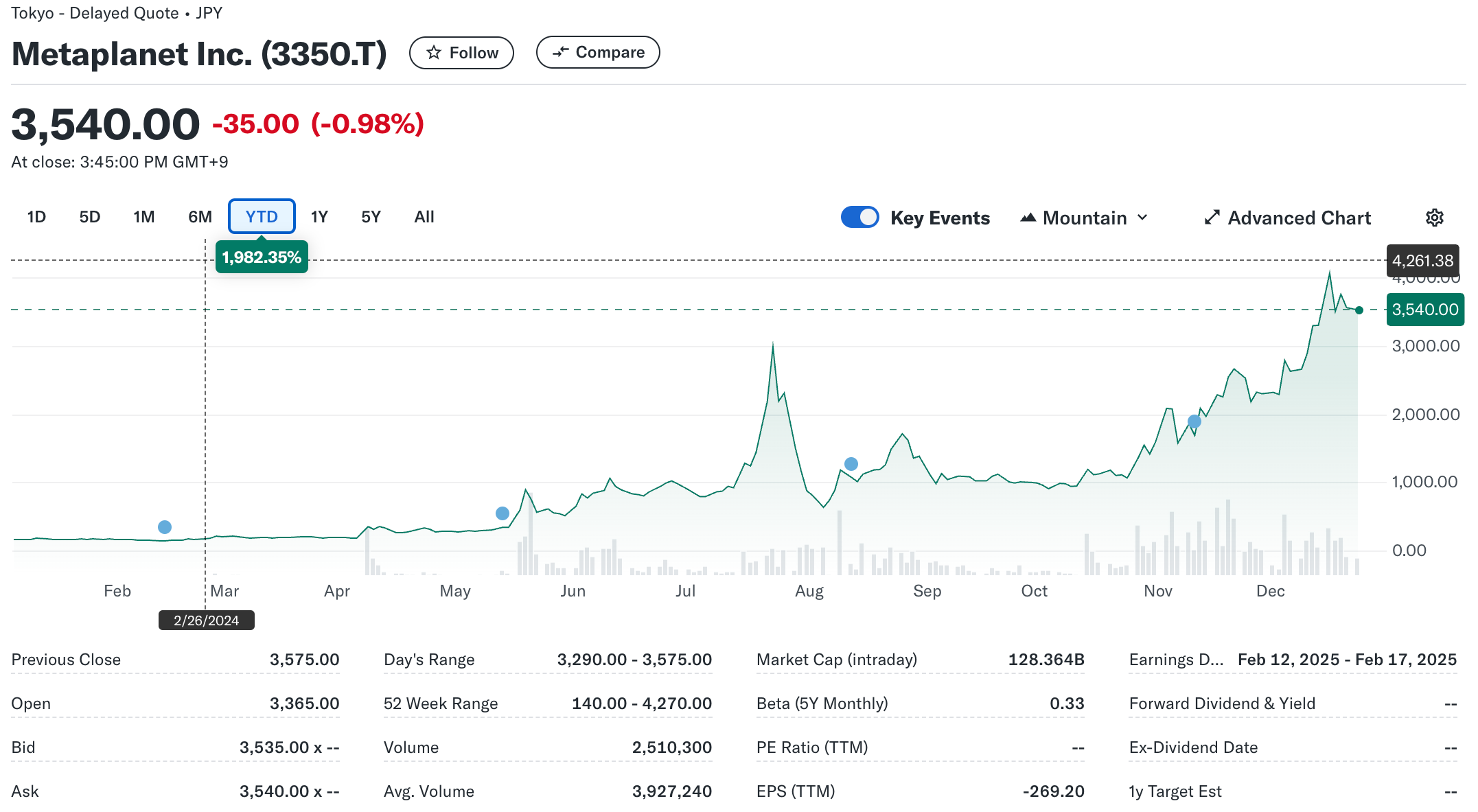

The firm's proprietary metric for measuring Bitcoin acquisition performance, BTC Yield, reached 310% from October 1 to December 23, emphasizing the strategy's benefits to shareholders. Despite this significant acquisition, Metaplanet's stock price closed at $22.5, down 0.98% for the day, although it has surged by 1,982% year-to-date.

Bitcoin Supply Crunch to Hasten Adoption?

Bitcoin's maximum supply is capped at 21 million, enhancing its reputation as an inflation-resistant asset. Recent reports indicate that BTC supply on exchanges has reached multi-year lows, suggesting that holders are withdrawing BTC, thus reducing circulating supply and potentially increasing prices.

This scarcity has led to increased competition among corporations and possibly governments to acquire Bitcoin. For instance, Hut 8 recently purchased 990 BTC for $100 million, raising its total to over 10,000 BTC. Similarly, MARA acquired 703 BTC, increasing its holdings to 34,794 BTC.

Speculation about a potential US strategic Bitcoin reserve could further support the narrative of a supply crunch, potentially accelerating Bitcoin adoption. Currently, BTC trades at $94,003, down 1.5% in the past 24 hours.