0 0

BULLISH 📈 : Metaplanet Buys More $BTC Amid Rising Institutional Interest

- Metaplanet is aggressively accumulating Bitcoin, signaling a trend of corporate treasury adoption. This decreases liquid supply and raises the price floor.

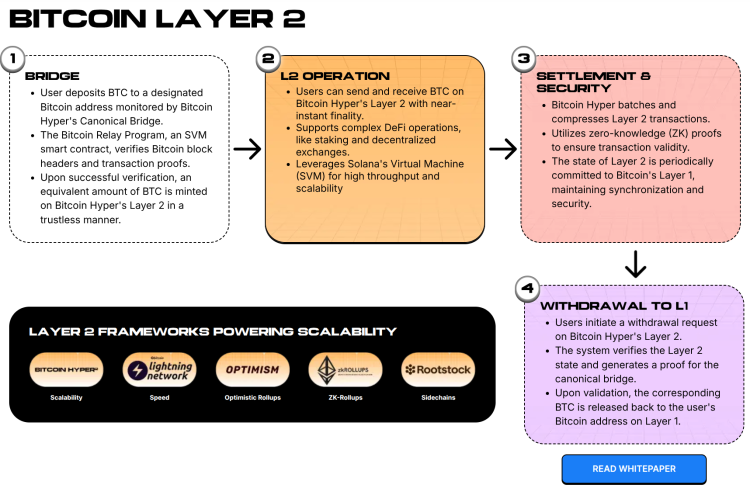

- The gap between Bitcoin's store of value and lack of utility shifts focus to Layer 2 solutions for speed and programmability.

- Bitcoin Hyper utilizes the Solana Virtual Machine (SVM) to enable high-speed smart contracts on Bitcoin, backed by over $31M in presale funding.

- Institutional infrastructure is evolving towards building ecosystems where Bitcoin can be integrated into DeFi and gaming.

Metaplanet, dubbed 'Asia’s MicroStrategy,' is expanding its Bitcoin holdings despite market conditions, reinforcing Bitcoin as a treasury reserve standard.

This accumulation strategy contributes to a supply shock, with significant liquidity being redirected into Layer 2 solutions that address scalability issues.

High-Speed Execution Meets Bitcoin Security via SVM Integration

Bitcoin Hyper integrates the SVM as a Layer 2 solution, offering sub-second finality and low costs while maintaining Bitcoin's security. Developers can use Rust for smart contracts under Bitcoin's security umbrella.

This setup allows high-frequency trading and NFT gaming with wrapped BTC, avoiding main chain gas fees and focusing on immediate scalability.

Presale Momentum Builds as Whales Deploy Capital into L2 Infrastructure

- The Bitcoin Hyper presale has raised over $31M, with tokens priced at $0.0136752, indicating investor interest in post-mainnet repricing.

- Whale investors are actively participating, with notable purchases exceeding $1M, suggesting confidence in shifting from holding to yielding BTC.

- The project's tokenomics encourage early entry with a 7-day vesting period for presale stakers and high APY rewards for governance.