Michael Saylor Signals Potential Bitcoin Purchases as Profits Reach $25.9 Billion

Bitcoin has consolidated within a narrow range of $117,300 to $114,400 after recent volatility in the altcoin market. The cryptocurrency experienced weak corporate demand and outflows from Bitcoin ETFs totaling $1.2 billion without any inflows.

Michael Saylor of MicroStrategy suggested potential institutional interest may rise again, stating “Bitcoin is on Sale” with evidence of his firm's BTC acquisitions. MicroStrategy's holdings now total 629,376 BTC, valued at about $72.3 billion, with profits reaching $25.9 billion.

- A renewed appetite for Bitcoin could restore confidence among retail and strategic investors.

- Short-term traders might also be incentivized to speculate on further purchases by MicroStrategy.

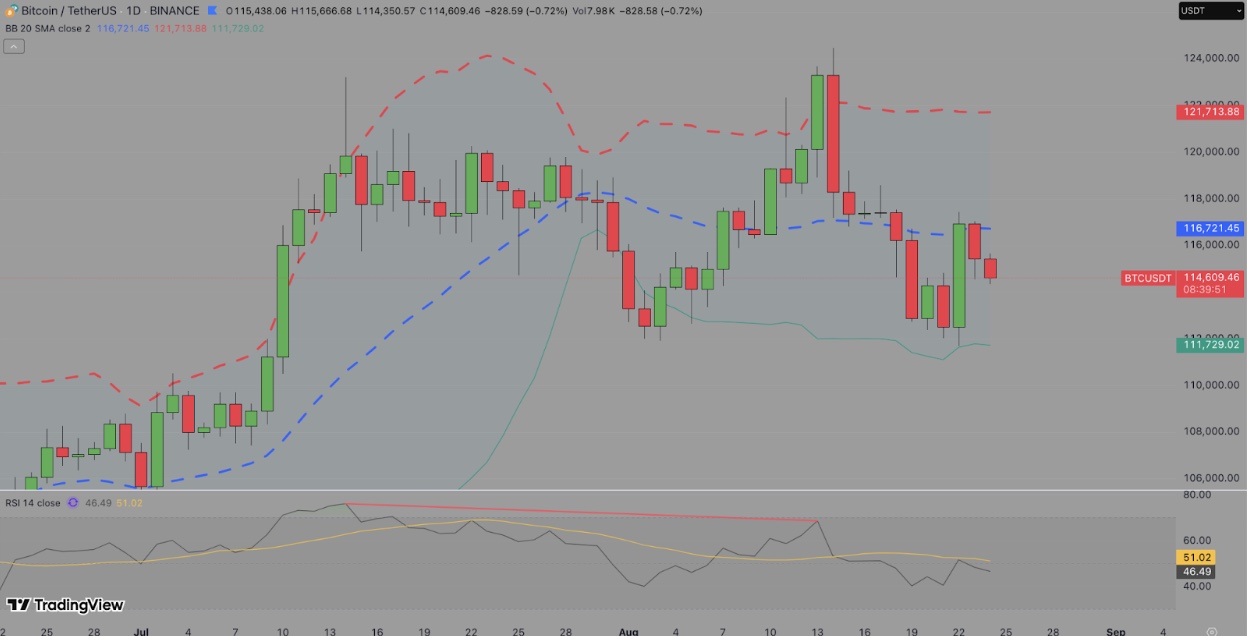

Bitcoin Price Forecast: Resistance Levels

Currently, Bitcoin trades around $114,600, under resistance near $121,713. Momentum indicators remain neutral, indicating potential for future price movement.

- A close above $117,800 could trigger positive momentum toward $121,700 or even $124,000.

- Support is noted at $111,700; a drop below this level could lead to losses down to $108,000.

In summary, Bitcoin is likely to remain between $114,000 and $118,000 without increased corporate demand.

Maxi Doge Presale Activity

With Bitcoin's stagnation, some traders are exploring speculative options like Maxi Doge (MAXIDOGE), which offers high leverage with no stop-loss. The presale has raised over $1.27 million of its $1.53 million target, priced at $0.000253 per token, with only two days left before a price increase.