MicroStrategy Holds 331,200 BTC Valued at $30.9 Billion

If the US government intends to create a strategic bitcoin reserve, it will need to compete with MicroStrategy.

MicroStrategy's Bitcoin Holdings

MicroStrategy currently holds 331,200 BTC, valued at $30.9 billion, representing 1.7% of the circulating supply. Senator Lummis has proposed a 1 million BTC target for a potential government reserve, worth $93.2 billion. The US currently holds over $608 billion in gold certificates in its strategic reserve.

Government Reserve Feasibility

No official indication exists that the US will adopt bitcoin as a fifth reserve asset, with Polymarket estimating a 36% chance. Concerns have been raised about the implications of such a move.

Market Impact of MicroStrategy's Purchases

If the US government moves forward, MicroStrategy could drive prices up by purchasing large amounts of bitcoin ahead of any government acquisition. Although exact timing for MicroStrategy's purchases is unavailable, averages suggest substantial daily spending on BTC, particularly during buying periods lasting over a month.

By March 2023, MicroStrategy's daily spending reached $80 million, increasing to $190 million in early November and surpassing $657 million for 51,780 BTC between November 11 and November 17 at an average price of $88,627. Over this period, bitcoin's price rose from $80,000 to more than $91,000.

Acquisition Methods

MicroStrategy initially purchased bitcoin on spot markets but may now use over-the-counter methods, potentially reducing immediate price impacts. However, the scale of these transactions likely influences market prices over time.

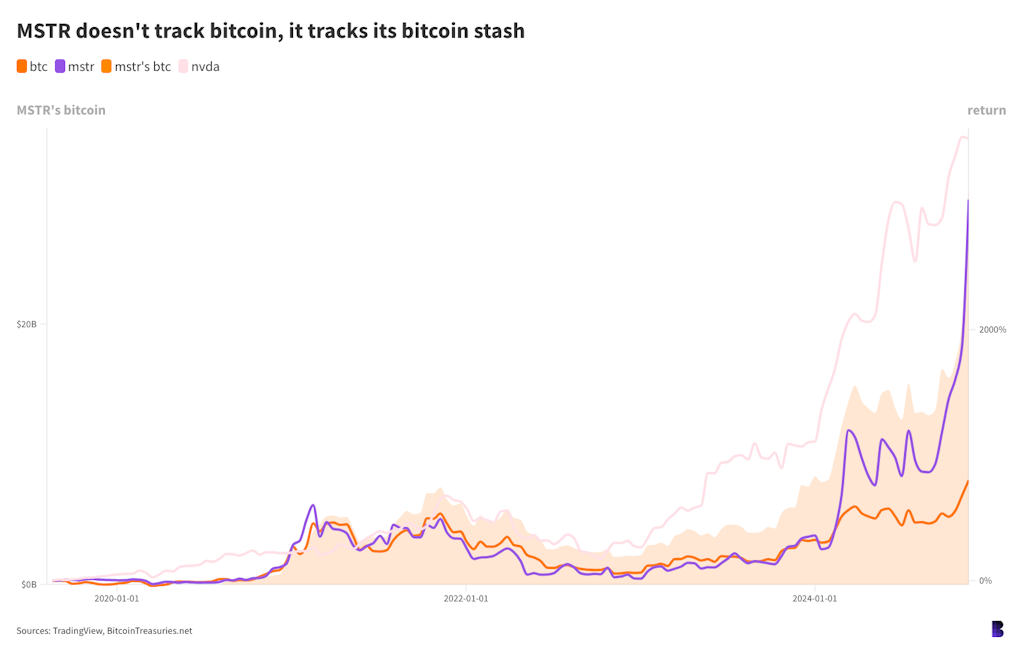

Correlation with Share Price

MicroStrategy's stock was previously affected by its bitcoin holdings, tracking closely together during bear markets. This changed in late February when the company added 3,000 BTC, leading to a 27% jump in MSTR stock within two days, followed by bitcoin reaching new all-time highs three weeks later. Since then, MSTR's share price has correlated more with its bitcoin treasury value than with bitcoin's price itself, significantly increasing its market cap.

Future Considerations

As long as MicroStrategy continues to buy dips, its share price may remain resilient against downturns in bitcoin prices. Executives and insiders have sold nearly $559 million in shares this year, with significant sales attributed to Saylor, who intends to continue purchasing bitcoin.