6 0

MicroStrategy’s Bitcoin Strategy Under Scrutiny Amid Market Volatility

Bitcoin's price volatility has spotlighted MicroStrategy ([MSTR](https://holder.io/coins/mstr/)), the largest corporate BTC holder. The company's strategy during market downturns is closely observed as an indicator of BTC's future trend.

MicroStrategy's Market Influence

- MicroStrategy holds billions in [BTC](https://holder.io/coins/btc/), influencing market dynamics.

- Analysts speculate that selling some holdings could impact BTC's price.

- JPMorgan suggests MicroStrategy can avoid forced sales if its enterprise value-to-BTC ratio stays above 1.0, currently at 1.13.

- The firm slowed its BTC purchases due to market pressure, adding 9,062 BTC last month compared to 134,480 a year ago.

- MicroStrategy's stock fell by about 42% over the past three months.

- Potential exclusion from MSCI indices may cause $8.8 billion in passive fund outflows.

- Despite challenges, it holds $1.4 billion for dividends and interest, reducing the need to sell BTC.

Institutional Impact on Bitcoin

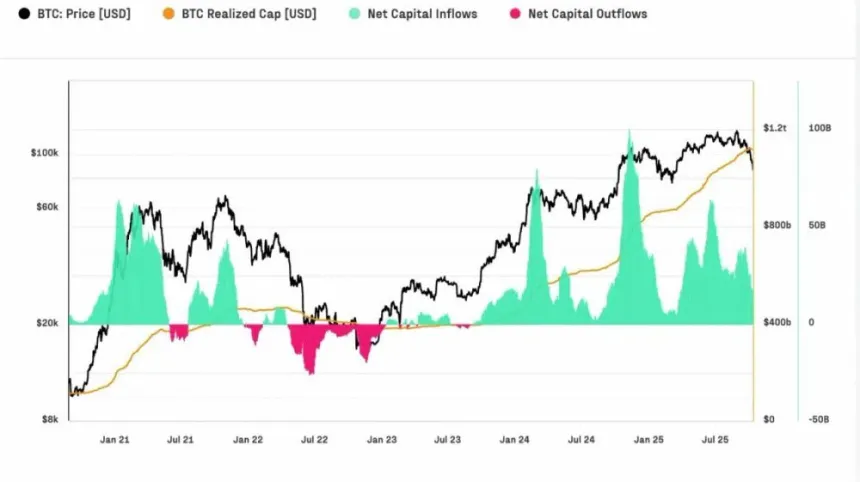

- Bitcoin is witnessing significant capital migration driven by institutional adoption.

- The current BTC cycle (2022-2025) has absorbed more new capital than previous cycles, indicating market maturity.

- Over $732 billion was introduced in this cycle, surpassing $388 billion from 2018-2022, pushing BTC's market cap to a high of $1.1 trillion.

- Total settlement volume in the decentralized BTC protocol reached $6.9 trillion in 90 days.

- Active on-chain entities reduced from 240,000 to 170,000 per day, reflecting liquidity shifts to spot ETFs.