8 0

– Mid-Sized Bitcoin Holders Accumulate 65K BTC, Total 3.65 Million BTC – Bitcoin’s Circulating Supply Affected as Mid-Sized Holders Buy 65K BTC – Mid-Sized Bitcoin Investors Acquire $7.35 Billion Worth in One Week – Bitcoin Price Volatility Possible as “Sharks” Amass 3.65 Million BTC

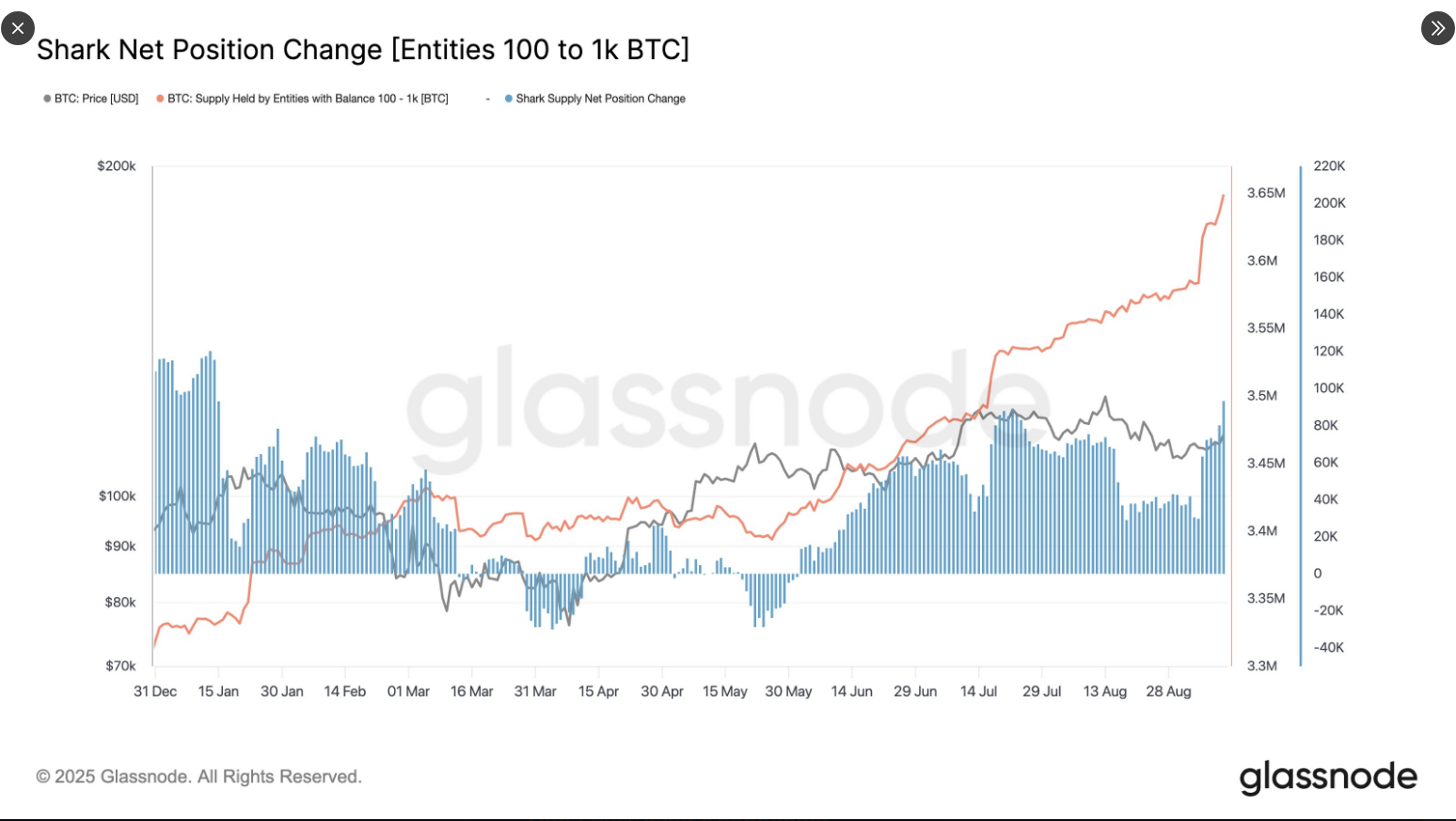

Recent data from Glassnode reveals that mid-sized Bitcoin holders, known as "sharks," have increased their holdings by approximately 65,000 BTC in the past week. This accumulation amounts to around $7.35 billion at the current spot price of $113,595 per BTC.

Sharks Expand Their Holdings

- "Sharks" now hold about 3.65 million BTC, which represents roughly 18% of Bitcoin's circulating supply of approximately 19.91 million coins.

- This acquisition reduces the available tradable supply, potentially affecting price movements.

Market Impact

- The actions of these holders can influence market balance and may lead to price increases if buying demand persists.

- Despite not being institutional whales, their activity raises short-term volatility due to concentrated holdings.

Recent Price Action

- BTC has surged about 100% over the past year, with a 23% increase year-to-date, and over 40% gain in the last six months.

- Price fluctuations include a drop to $107,000 on September 1st, followed by a recovery to over $116,000.

Forecasts and Risks

- Predictions suggest Bitcoin could reach $150,000 to $200,000 by Christmas, according to industry experts.

- Potential risks include rapid market reversals due to ETF flows, miner sell pressure, or macroeconomic changes.

- Investors should monitor wallet flows, trading volumes, and major announcements for potential impacts.

The ongoing accumulation by mid-sized Bitcoin holders tightens the available supply, correlating with significant price gains this year.