5 0

Strategy Faces MSCI Exclusion, Potential $8.8 Billion Outflows Loom

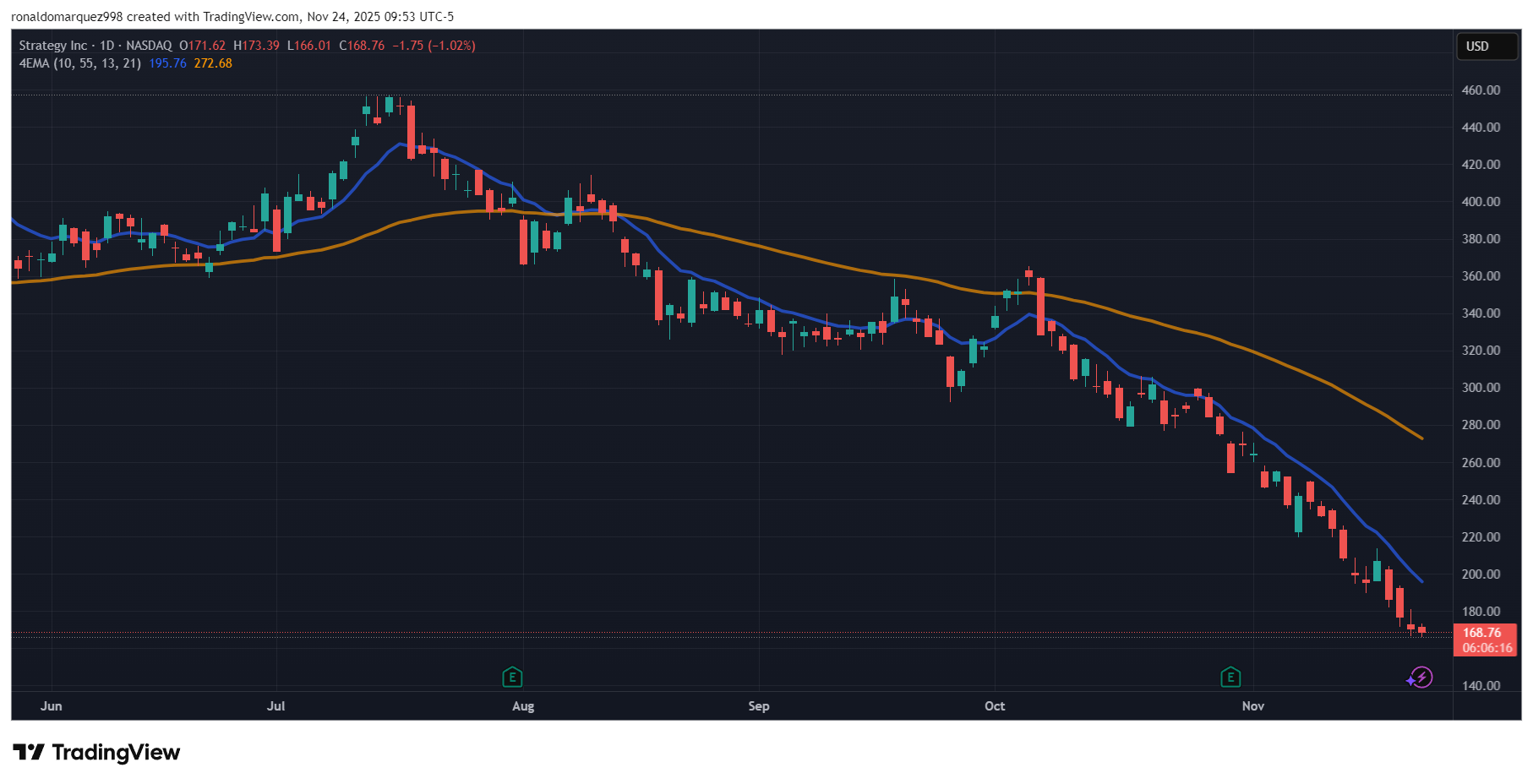

Strategy, previously MicroStrategy, a major holder of Bitcoin (BTC), faces controversy as rumors suggest JPMorgan holds a significant short position on Strategy's stock (MSTR), which has decreased by 69% from its previous high.

Potential MSCI Exclusion

- JPMorgan warned that Strategy might be removed from the MSCI USA Index due to Bitcoin's price decline and Strategy's asset allocation.

- MSCI is considering excluding companies with over 50% of assets in digital currencies from equity indices.

- Exclusion could lead to $2.8 billion in outflows, potentially rising to $8.8 billion if other indices follow suit.

The timing of JPMorgan's bearish note coincided with MSTR's decline, impacting market sentiment.

JPMorgan Account Closures

- Reports indicate an increase in share lending for MSTR, increasing short selling pressure.

- Numerous account closures at JPMorgan are reported, attributed to alleged manipulation of MSTR and Bitcoin.

There is growing concern over a potential short squeeze if Strategy’s stock rallies by 40%-50%. Michael Saylor, CEO of Strategy, emphasized the company's active financial strategy beyond Bitcoin holding, countering MSCI concerns.

The situation remains tense as MSCI's decision approaches, with JPMorgan's timing of reports adding to market uncertainty.