BEARISH 📉 : MSTR Faces $900M Unrealized Losses from Bitcoin Holdings

MicroStrategy (MSTR) is closely tied to Bitcoin as a high-beta proxy, but the company's aggressive Bitcoin accumulation strategy has led to scrutiny over its treasury valuations. Reports indicate potential unrealized losses of $900M during local lows.

- The tight correlation between MSTR stock and spot Bitcoin prices highlights volatility issues, raising questions on capital efficiency without yield.

- The market demands that Bitcoin become more productive rather than sitting idle in cold storage.

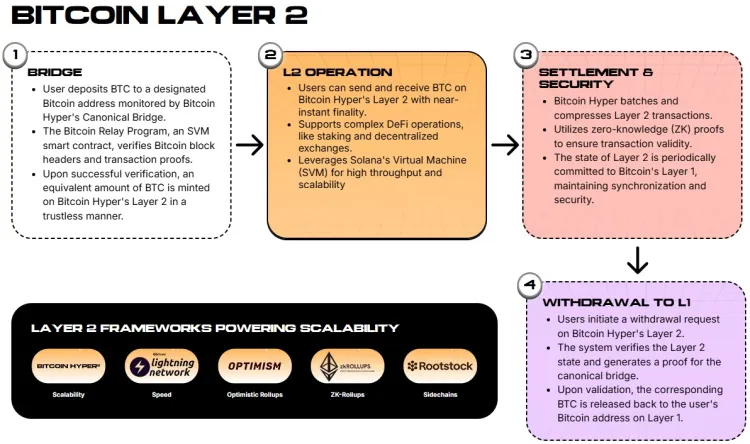

This shift is leading to increased interest in Layer 2 solutions like Bitcoin Hyper, which integrates with the Solana Virtual Machine (SVM) to enhance Bitcoin's utility without compromising its security. This allows for fast transactions with low fees, enabling use cases such as high-frequency trading and complex lending markets denominated in BTC.

- Bitcoin Hyper introduces a modular blockchain structure to increase efficiency and unlock DeFi opportunities.

- A decentralized canonical bridge facilitates trustless transfers, allowing users to stake and utilize Bitcoin effectively.

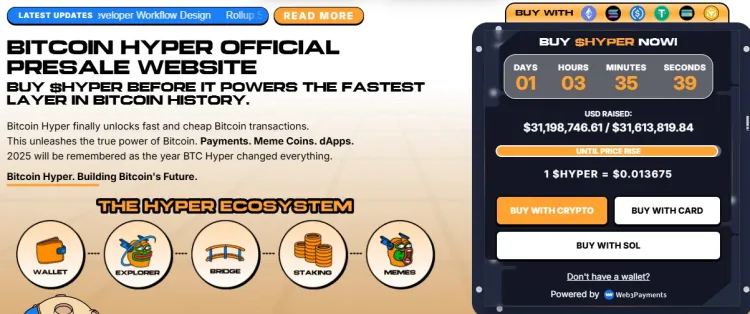

Interest in Bitcoin Hyper is growing, with over $31M raised in presale, suggesting substantial demand for infrastructure that enhances Bitcoin's programmable capabilities.

- Etherscan data shows significant investment from high-net-worth wallets, indicating strategic positioning ahead of broader market recognition.

- The $HYPER token is crucial for this ecosystem, managing gas fees and governance, with high-APY staking available after TGE.

As concerns over MicroStrategy's volatility persist, investors are considering protocols offering yield and utility as a logical hedge.