9 0

MSTR Stock Recovery Likely as Institutional Investment Increases

MSTR Stock Recovery Potential

- Strategy (MSTR) increased its USD reserves to $2.19 billion.

- Institutional ownership of MSTR shares has risen from $155 million to $165 million in the past month.

- The stock is trading at a 10% premium to its net asset value, with approximately 20% effective leverage based on Bitcoin holdings.

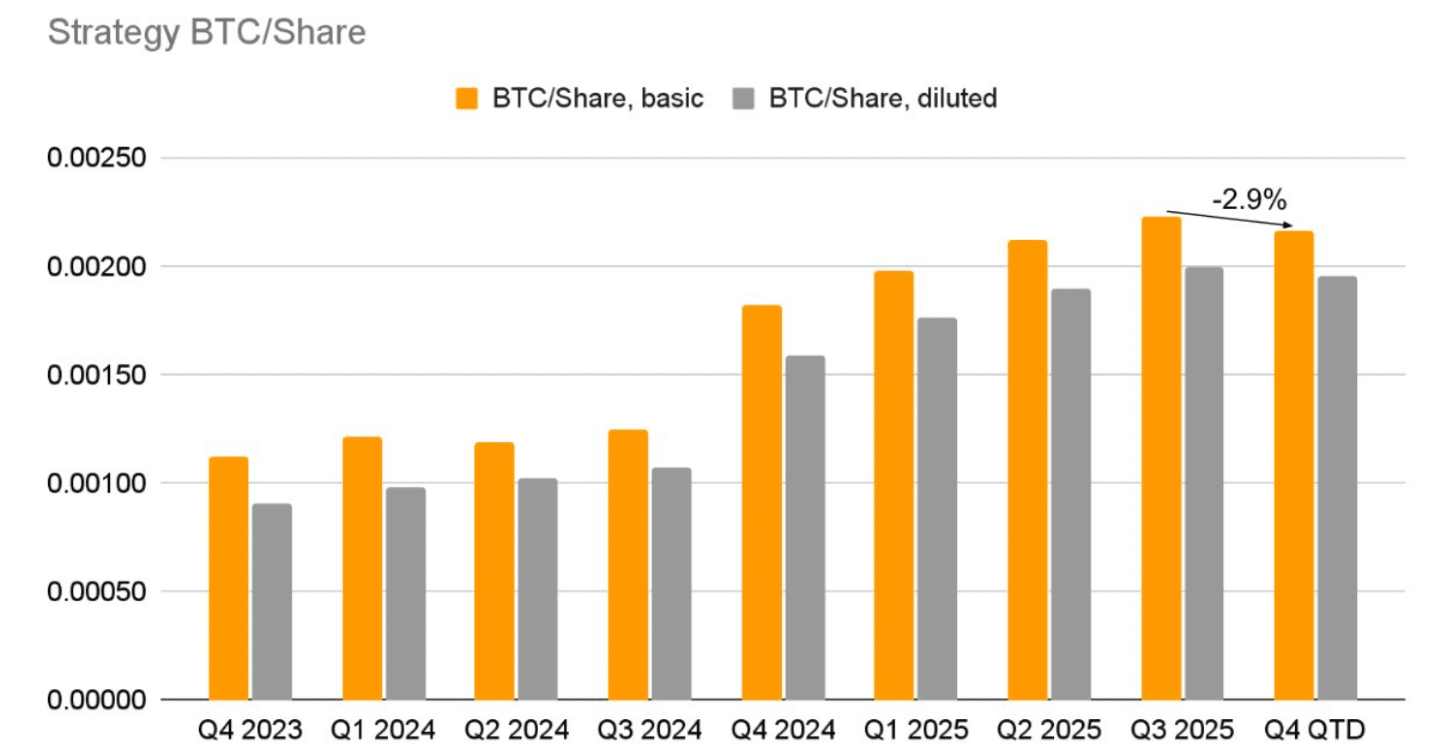

- Increased cash reserves provide financial stability and reduce Bitcoin exposure per share temporarily.

- This financial maneuvering could enhance Strategy's credit profile.

Institutional Interest and Market Sentiment

- A New Jersey public pension fund invested $16 million in MSTR shares.

- Citigroup maintains a "buy" rating but lowered the target price to $325 per share from $485.

Bitcoin price movements could significantly influence MSTR's market performance, given its substantial Bitcoin holdings.