9 1

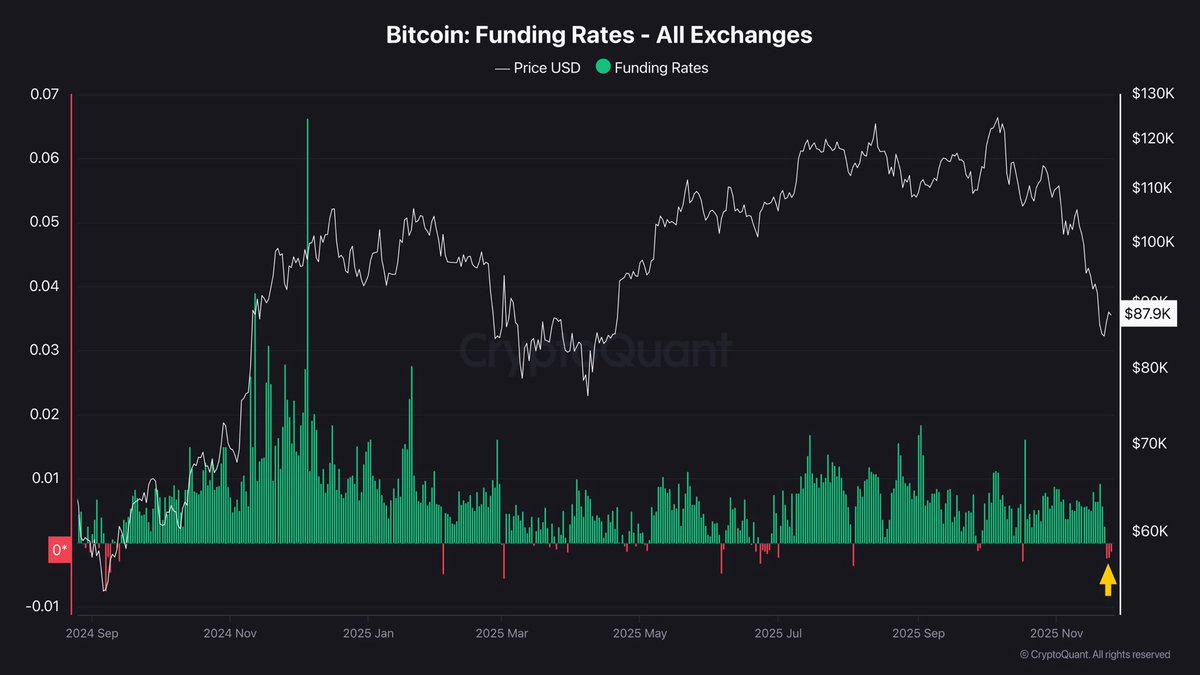

Bitcoin Funding Rates Turn Negative Amid Short Dominance and Bearish Momentum

The crypto market is witnessing significant selling pressure, with Bitcoin attempting to reclaim the $90,000 level. Analysts are divided on whether this marks the peak of the current cycle or a temporary correction.

- Bitcoin's price action indicates a shift in trader behavior, with many moving to short positions after failed long attempts during the decline.

- Funding rates have turned negative, suggesting a dominance of short positions and indicating a potential market inflection point.

- This funding behavior may signal trader capitulation, which historically aligns with late-stage bottoms in corrections.

Funding Rates and Market Sentiment

- Funding rates dropping below 0.01% suggest short-side dominance; negative rates indicate aggressive short positioning.

- Such shifts often happen deep into a correction and could precede an upside reversal if spot demand increases.

Price Testing Short-Term Supply

- Bitcoin is stabilizing around $87,000 after rebounding from a low near $80,000.

- The downtrend persists as BTC trades below key moving averages (50-day, 100-day, and 200-day) with declining slopes.

- Lack of strong volume support suggests buyers haven't returned decisively.

- Resistance levels are set at $95,000 and $100,000; failure to reclaim these could lead to renewed selling pressure.

- A sustained move above the 100-day moving average would indicate regained bullish momentum.