8 0

Options Market Indicates Higher Risk for Ether Compared to Bitcoin

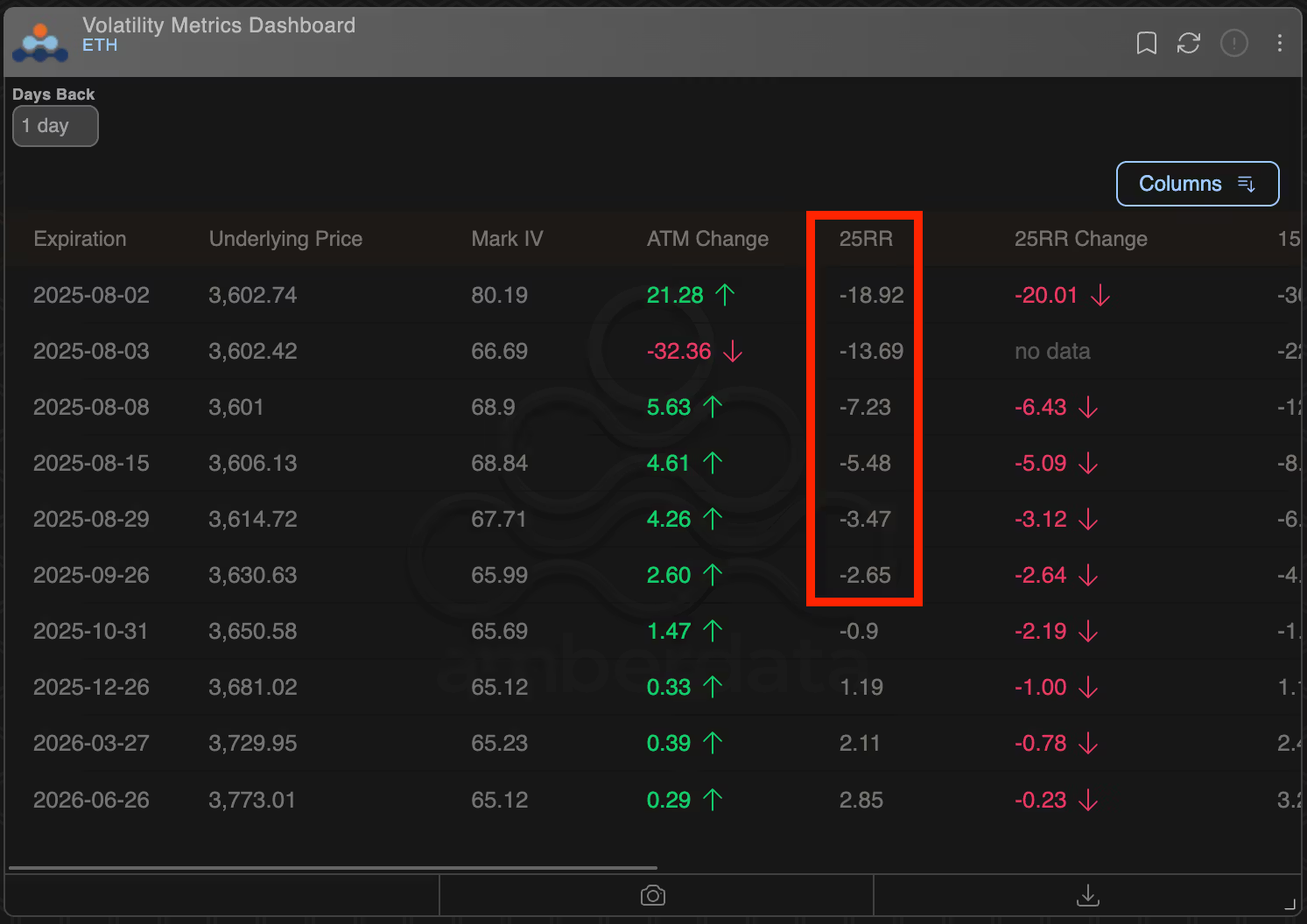

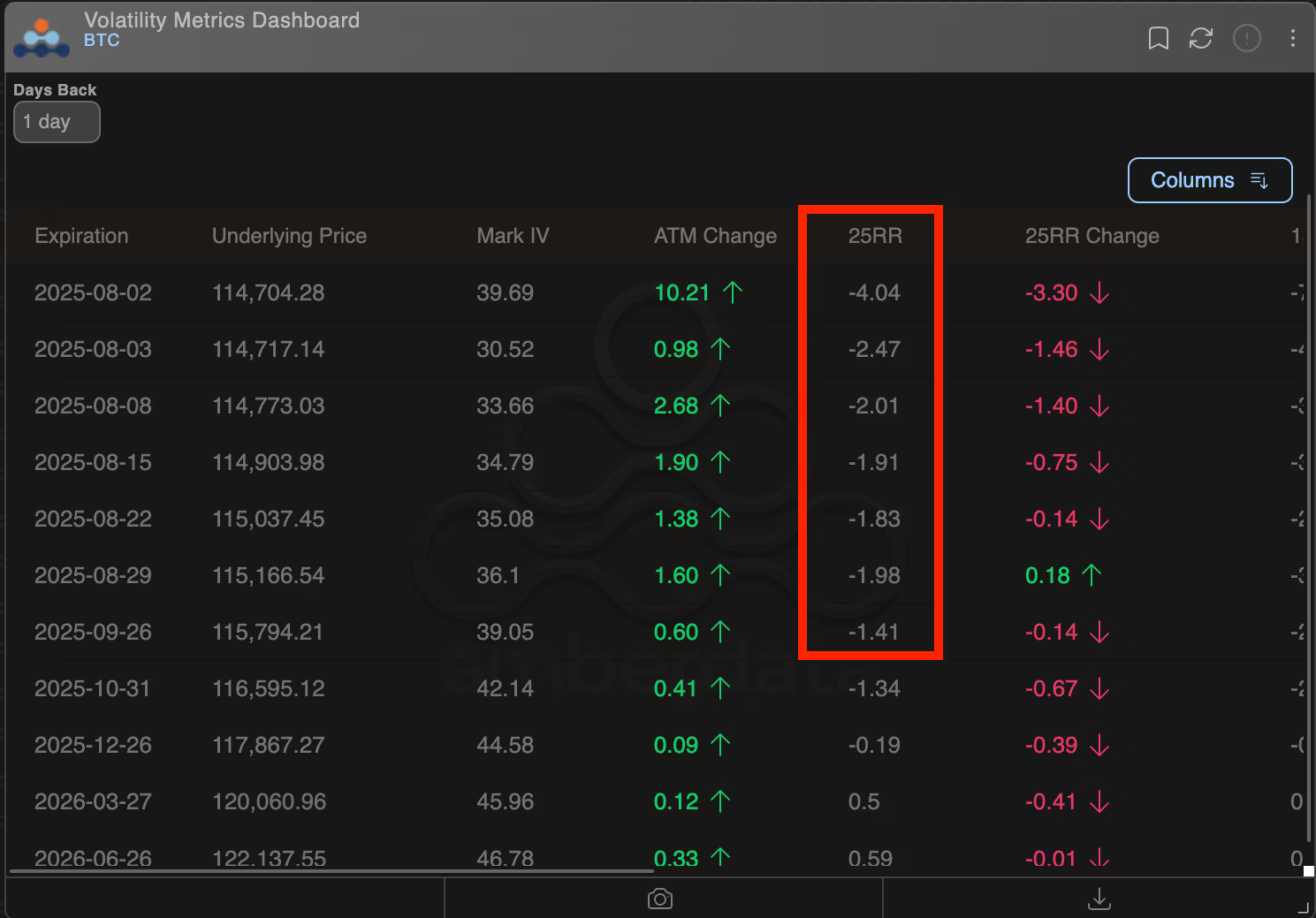

Derivatives for insuring against declines in ether are now more expensive than those for bitcoin, indicating a negative sentiment shift towards ether, according to data from Deribit.

- Big money had favored ether recently.

- Ether's 25-delta risk reversals for August and September options are trading at -2% to -7%, indicating a premium for put options over call options.

- Bitcoin's short-term put options have a premium of 1%-2.5% over calls, reflecting lesser downside fears.

- The 25-delta risk reversal is an options strategy involving a long put position and a short call option with a delta of 25%.

- Ether surged 48% in July, reaching $3,941, while bitcoin gained 8%. Ether's rally has slowed due to concerns over its sustainability.

- Current prices: Ether at $3,600 (down 6%), Bitcoin at $114,380 (down 3%).