Over $500 Million Liquidated From Crypto Market Amid Bitcoin Price Fluctuations

Traders experienced significant losses this week, with over $500 million liquidated from the crypto market in the last 24 hours. This volatility is attributed to fluctuations in Bitcoin's price.

$500 Million Liquidated As Bitcoin Price Fluctuates

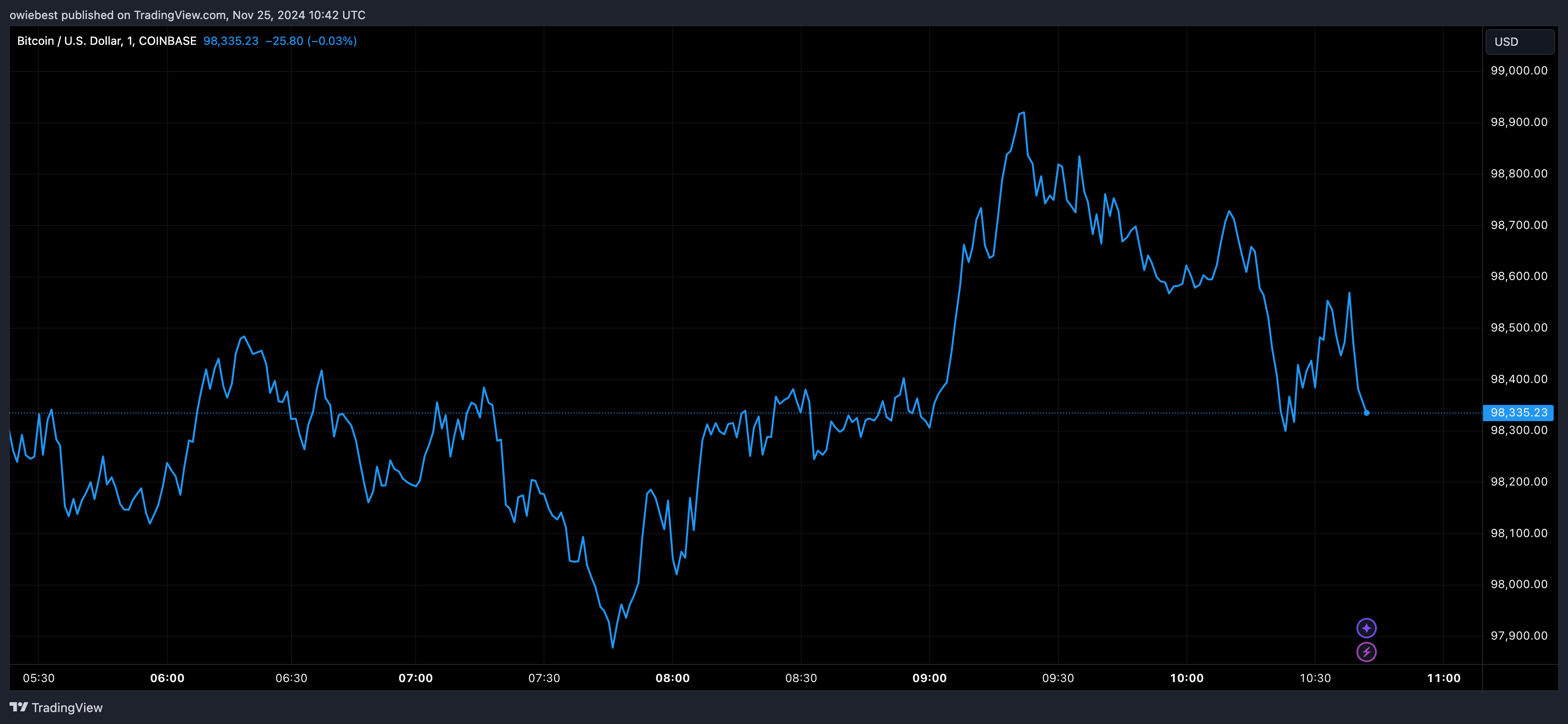

Coinglass data indicates that long traders faced the largest impact, with over $366 million in long positions liquidated, while short positions saw over $129 million liquidated. Bitcoin's price dropped from approximately $98,000 to a low of $95,500 on Sunday but has since recovered above $98,000. This volatility has been prevalent since Bitcoin approached the $100,000 milestone on November 23.

The price fluctuations have prompted mass liquidations as traders attempt to navigate the market dynamics. Pullbacks occur as investors secure profits, anticipating the psychological $100,000 level. Despite this, some whales remain active; recent purchases include $3.96 billion worth of BTC in 96 hours, with notable acquisitions such as Marathon Digital's purchase of 5,771 BTC ($572 million) at an average price of 95,554 per BTC.

Although the current Bitcoin price range may represent a local top, expectations remain for further price increases. Asset manager VanEck predicts that Bitcoin could reach as high as $180,000.

Today Could Be The Day

Crypto analyst Ali Martinez forecasts that today might be the day Bitcoin reaches the anticipated $100,000 milestone, noting a bullish signal from the SuperTrend indicator and price breakthrough past key resistance levels, including the Relative Strength Index (RSI).

Martinez suggests that $100,000 may not be the peak for this bull run, citing historical trends indicating prolonged market tops. If this trend continues, Bitcoin's peak could occur between June and September 2025, aligning with predictions from analysts like Rekt Capital.

Currently, Bitcoin is trading at around $98,300, reflecting an increase in the last 24 hours according to data from CoinMarketCap.