Legendary Trader Peter Brandt Projects Bitcoin Price Between $130K and $150K in 2025

Legendary trader Peter Brandt, with nearly five decades of trading experience since 1975, has shared a bullish forecast for Bitcoin's price trajectory in 2025. Brandt stated on X: “Bitcoin $BTC is now in the sweet spot of the bull market halving cycle that should top in the $130k to $150K range next Aug/Sep. I measure cycles differently than most.”

How High Can Bitcoin Go In 2025?

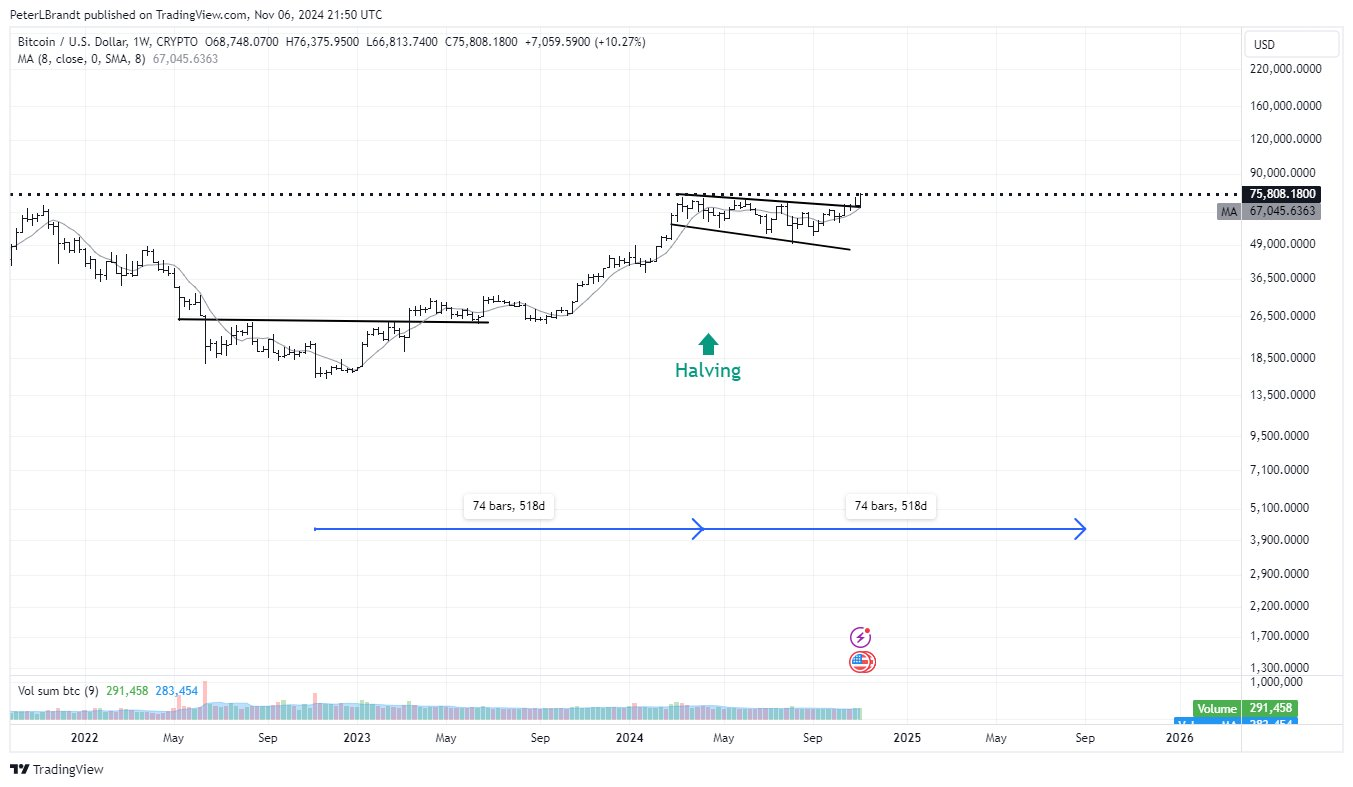

Brandt's analysis is based on historical patterns observed in Bitcoin's halving cycles. His chart, covering Bitcoin's price action from early 2022 to projections into 2026, highlights two significant periods of 518 days each, representing critical phases in Bitcoin's market behavior and its cyclical nature.

A notable technical pattern identified in his chart is the breakout from a broadening wedge formation, suggesting increasing market volatility as prices make progressively higher highs and lower lows. A successful breakout from this pattern is considered a strong bullish signal.

In a detailed blog post from June titled “The Beautiful Symmetry of Past Bitcoin Bull Market Cycles,” Brandt elaborated on the significance of halving events, noting that these dates have represented the halfway points of past bull market cycles. He observed that the time from the start of each cycle to the halving dates has been nearly equal to the time from the halving dates to subsequent bull market highs.

Based on this symmetrical pattern, Brandt posits that if the sequence continues, “the next bull market cycle high should occur in late Aug/early Sep 2025.” He suggests that the highs of past bull markets align well with an inverted parabolic curve, indicating that the high of this cycle could be in the $130,000 to $150,000 range.

Despite his optimistic projection, Brandt maintains a cautious stance, emphasizing that “no method of analysis is fool-proof” and he avoids being “dogmatic about any idea.” He acknowledges a 25% probability that Bitcoin's price has already topped for this cycle. If Bitcoin fails to reach a new all-time high and declines below $55,000, he would increase the probability of an “Exponential Decay.”

The crypto community actively engages with Brandt's analysis. Popular crypto analyst Astronomer (@astronomer_zero) agreed with Brandt's top estimation, highlighting the importance of accurately calling the market top. Astronomer noted: “I think you’re spot on with that top estimation Peter! As for calling the bottom, now it is our duty to call the top ideally in one single try. The terminal price does that very well. I have 6 other metrics in place. If they all line up, it is a sell. Location at $160,000.”

In response to an inquiry about the implications for the Bitcoin to gold (BTC/GLD) ratio, Brandt indicated that while higher prices may eventually be implied, he prefers to take a step-by-step approach without becoming too dogmatic.

At press time, BTC traded at $74,940.