Pfeffer’s Paper Revisits ETH Valuation, Suggests Overvaluation at $400 Billion

In 2017, investor John Pfeffer published “An (Institutional) Investor’s Take on Cryptoassets,” which laid foundational ideas for long-term investments in crypto tokens.

Pfeffer's thesis predicted a single dominant crypto asset as a store of value (SOV), identifying bitcoin as the likely candidate with a potential market cap between $4.7 trillion and $14.6 trillion ($260k-$800k per BTC). He argued that bitcoin has the least technological risk compared to Ethereum, which would require extensive coordination and upgrades to compete.

Pfeffer noted that participants would convert their preferred store of value at the time of payment, similar to retailers converting bank deposits to cash only when needed. He also suggested that Ethereum’s scaling solutions and transition to proof-of-stake could benefit adoption but negatively impact token value, a prediction that aligns with recent trends in ETH price appreciation.

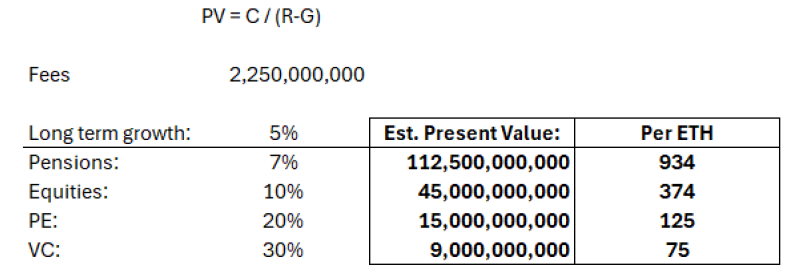

Today, Pfeffer's thesis is revisited in a paper co-authored with Triton liquid fund, concluding that while Ethereum is technologically advanced, its risk-adjusted upside is challenging to ascertain. Attempts to value ETH as a cash-flow asset face difficulties due to ongoing protocol innovations, leading to the conclusion that ETH appears overvalued at $400 billion.

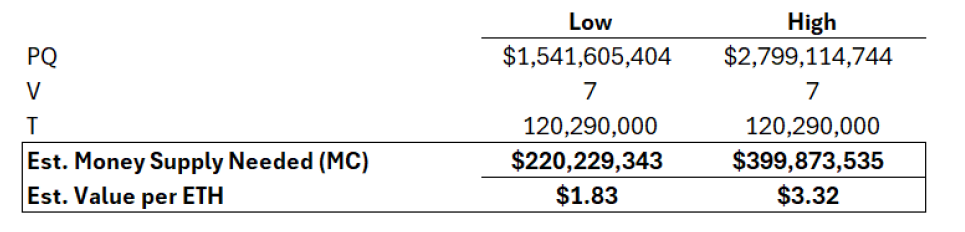

The analysis also challenges the notion of ETH as money, highlighting that it is not the primary unit of account in the Ethereum ecosystem, as seen with Base adopting USDC for gas costs. The paper estimates Ethereum’s on-chain GDP at approximately $2.8 billion, suggesting that current valuations are significantly inflated.

The strongest argument for ETH as an investment is its utility as an internet-native commodity and productive on-chain asset. However, the paper questions whether a 3% yield from staking can offset ETH's volatility. Ultimately, it concludes that at its current valuation, justifying ETH as a rational investment is difficult, while bitcoin remains a more sound risk-adjusted bet for its role as a non-sovereign store of value.